🌞 Good Morning, Folks!

Stocks are flashing green again, headlines are hyping “resilient consumers,” and tech earnings are throwing just enough confetti to keep the party alive.

But if everything’s so perfect… why are defensive sectors quietly outperforming? Why are insiders selling into strength faster than they have all year? Why is real GDP growth flashing warnings under the surface?

Something’s off — and most investors are missing it.

While everyone else chases AI stocks and surface-level headlines, I’m zeroing in on a giant that’s quietly building a margin empire — without the hype.

Not the Amazon of 2020. Not the "too-big-to-move" narrative Wall Street loves.

The Amazon setting up its next supercycle — while no one's watching.

Let’s dig into the real setup. 👇

📊 Market Moves

Asset | Price | Day Change |

|---|---|---|

S&P 500 | 5,560.83 | 🟢+0.58% |

Dow Jones | 40,527.62 | 🟢+0.75% |

Nasdaq Composite | 17,461.32 | 🟢+0.55% |

Bitcoin (BTC) | $94,226.66 | 🟢+0.26% |

Tesla (TSLA) | $292.03 | 🟢+2.15% |

🔍 This Week’s Focus: Amazon (AMZN) — The Sleeping Giant About to Wake Up?

🧠 The Setup No One's Talking About

Amazon isn’t trending — and that’s exactly why it matters.

While the market chases AI tickers, Amazon’s earnings land next Wednesday, May 1st, after the close — and the setup could blindside anyone asleep at the wheel.

Here’s what’s getting overlooked:

Despite inflation, tariffs, and a brutal rate environment — Amazon’s operational engine hasn’t stalled. It’s shifted. Silently. Strategically.

If AWS growth even flattens or ticks slightly higher? The rerating could be violent — and it’ll leave latecomers scrambling.

📈 Why It Matters Now

✅ Earnings Catalyst Looming: Amazon reports Q1 2025 on May 1st after the bell. Wall Street expects $0.97 EPS on $142.7B revenue — but "whisper numbers" are creeping higher after Microsoft’s AI-driven surprise. AWS stabilizing could flip sentiment fast.

✅ Tariff Impact = Overblown:

60%+ of Amazon’s GMV now comes from non-China third-party sellers.

AWS and advertising (high-margin beasts) have zero tariff exposure.

Real margin pressure? Fulfillment — not trade wars.

✅ The Silent AWS Turnaround:

Azure just posted 20%+ growth.

AWS signed Anthropic and Databricks.

Early Q1 data shows enterprise cloud deal volume rising again.

If AWS growth snaps back to 15% YoY? Amazon's re-acceleration won't be a headline — it’ll be a rocket.

📊 Valuation & Positioning

Here’s where it gets spicy:

Forward P/E: ~39x — not dirt cheap, but normalized compared to historical 50–70x multiples during Amazon’s early cloud and e-commerce hypergrowth phases.

Price/Sales (P/S): ~2.4x — near decade-lows, only seen during market crashes or tech rotations. For a company growing high-margin segments at double digits, this is underappreciated.

Enterprise Value / EBITDA: ~19.8x — attractive versus cloud-heavy comps like Microsoft (~23x) and ad peers like Meta (~20x).

Free Cash Flow Yield: Rebounded to ~3.8% — a sharp turnaround from negative territory during 2022–2023’s CapEx surge.

AWS Implied Valuation: Estimated around $550–600 billion — meaning at today's prices, you're getting the entire retail and advertising engine thrown in nearly for free.

✅ Translation: Hidden compounding at a discount.

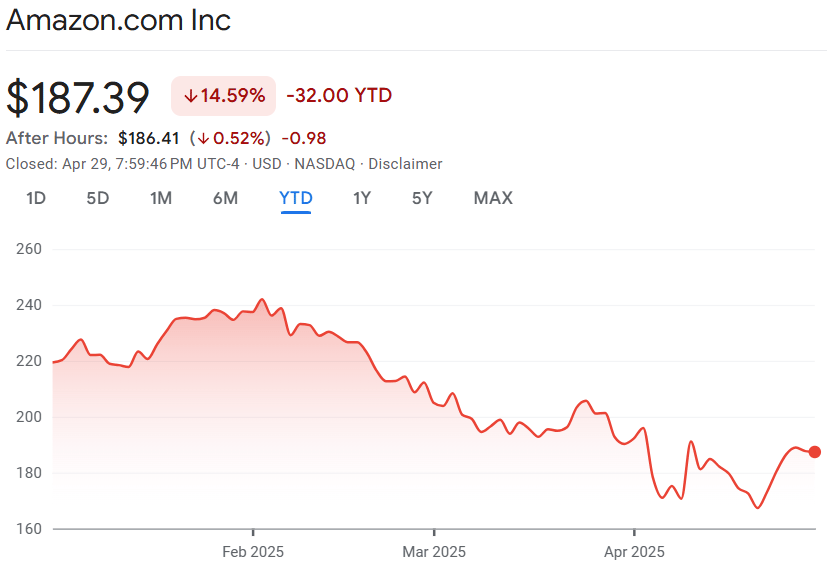

📈 Stock Performance: From February Highs to Tariff Jitters

All-Time High (Feb 2025):

Amazon hit an intraday high of $242.52 on February 4 , 2025 — fueled by enthusiasm around AWS AI integration momentum and ad market share wins.Current Price (April 29, 2025):

Amazon's stock closed at $187.39, which is approximately 22.4% below its all-time high — despite no fundamental deterioration in its cloud, ad, or Prime engines.Tariff Transparency Sparks Political Backlash:

Recent reports indicate that Amazon plans to display the impact of tariffs on product prices, aiming to provide transparency to consumers. This move has drawn criticism from the White House, labeling it a "hostile and political act." The administration questioned the timing and motives behind Amazon's decision, suggesting it may influence consumer perception of trade policies.

The real story? Macro-driven fear knocked the stock — not company-specific weakness.

🧠 In one line:

Amazon is fundamentally stronger than it was in February, yet you can now buy it cheaper because the crowd is fixated on headlines instead of balance sheets.

🔍 My Clarity Filter on AMZN

Criteria | Amazon’s Performance | Pass/Flag |

|---|---|---|

Understandable Business | Dominates U.S. ecommerce, cloud services (AWS), and growing ad business | ✅ |

Revenue Growth | Estimated 8–10% YoY Q1 2025, driven by AWS and ad strength | ✅ |

Profitability | Margins expanding via AWS, Ads, and Logistics optimization | ✅ |

Free Cash Flow | Turned positive again in late 2024 after CapEx pullbacks | ✅ |

Healthy Debt | Manageable; net debt position improving | ✅ |

Institutional Ownership | Heavy — Vanguard, BlackRock, and State Street anchor positions | ✅ |

Riding a Megatrend | Cloud, AI infrastructure, digital commerce | ✅ |

Strong Leadership | Andy Jassy executing operationally while Bezos stays a strategic force | ✅ |

Moat | Prime membership lock-in, AWS market dominance, advertising reach | ✅ |

5+ Year Hold? | 100%. Infrastructure players compound over decades, not months | ✅ |

🧠 Score: 10/10 Clarity

(Only ding? Regulatory noise is always lingering — but operational execution trumps politics long-term.)

🧠 What the Crowd Is Missing

Most investors think Amazon is “too big to move.”

They said the same thing about Microsoft before it ran 60% in 2023.

Amazon’s ad business is now a $50 billion a year juggernaut.

AWS is still the largest global cloud player by a mile.

Retail margins are expanding because of logistics and buy-with-Prime partnerships.

Meanwhile? The stock still trades like a beaten-down ecommerce site.

This isn’t a momentum chase. This is buying world-changing infrastructure before the next profit cycle kicks in.

🔭 Setup or Sentiment Shift to Watch

AWS YoY Growth: If cloud growth stabilizes or re-accelerates to 15%+, it’s game on.

Ad Revenue Momentum: Watch Amazon’s ad segment — it's the hidden profit driver few model correctly.

Tariff and Fulfillment Updates: Listen carefully to management commentary on macro pressure and pricing power.

Margin Expansion: Any update on improving North American logistics efficiency = major multiple expansion trigger.

Most missed Microsoft’s turn before it ran. I’m not making that mistake again with Amazon.

👉 Missed last week's clarity pick?

I broke down why Taiwan Semiconductor (TSMC) — the 60% profit surge nobody’s talking about — could be the real infrastructure king behind AI. If you want to understand the machine powering Nvidia (and everyone else), you’ll want to catch this.

📥 Want My Stock Scoring System?

🧠 Want to score stocks like this yourself? Download my 10-point screener — free for long-term investors who want clarity before conviction.

Over 1,600 readers have grabbed this already — don’t miss out

🌐 From Around The Web

🏛️ The U.S. Economy May Have Just Stalled — Quietly

The GDP whisper numbers are flashing warnings

Early estimates suggest the U.S. economy barely grew in Q1 2025 — with some models hinting at just 0.5% annualized growth. While headlines scream about tech rallies, the real economy is slowing under the surface, and earnings season may expose cracks no one’s ready for.

🧠 Nvidia's Stock Slides Amid U.S.-China Trade Tensions

Nvidia Faces Headwinds as U.S.-China Trade Disputes Intensify Nvidia's stock declined following reports that China's Huawei Technologies is developing an AI chip to rival Nvidia's high-performance products. This development adds to the challenges Nvidia faces amid escalating U.S.-China trade tensions, which have already impacted its ability to sell certain chips in China. Investors are concerned about the potential loss of market share and revenue in one of Nvidia's key markets. The situation underscores the broader risks that geopolitical disputes pose to global tech companies.

📉 Don’t Be Fooled: The Market’s Rally Looks Suspicious

Beneath the surface, leadership is cracking

Stocks posted a strong bounce on Monday — but CNN warns the rally is narrow and fragile, driven by a few mega caps while broader market participation weakens. This is classic late-stage behavior, and investors chasing strength here could be walking straight into a trap.

🧠 What did you think of today's newsletter?

📤 Catch Up on Monday’s Newsletter

While everyone’s cheering AI breakthroughs and stock splits, something bigger (and riskier) is cracking under the surface.

On Monday, I broke down what the headlines are distracting you from — and why real portfolio risk isn’t in tech hype, it’s in the blind spots nobody's talking about.

🧠 Final Word

It’s a noisy market. Tariffs, tech rallies, inflation panic — it’s a headline battlefield.

But clarity isn’t about louder signals. It’s about sharper filters.

When everything’s screaming, I lean harder into process:

Tight screens.

Strong balance sheets.

Unloved setups with compounding power.

Amazon isn’t boring. It’s the margin expansion machine hiding in plain sight — and boring is where wealth hides while the crowd chases noise.

🧠 Real investing isn’t about chasing everything — it’s about anchoring where it actually matters.

Want more signal and less noise in your investing?

The Pragmatic Investor delivers clear setups, smarter positioning, and deep dives that keep you ahead — no hype, no distractions.

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.