🌞Good Monday Morning, Folks!

🎭 This market? It’s a circus of false signals.

Big Tech beats earnings. The indexes cheer. CNBC rolls out the confetti.

Under the hood? Google’s ripping apart its AI leadership team — and the smart money is already moving where no one’s looking. If you're still trading the headlines this week, you're exactly where they want you.

Today, I’m breaking down why Google’s “victory lap” feels more like a smokescreen — and where the real positioning windows are forming before the crowd wakes up. In a market built on noise, clarity isn’t just an edge this week — it’s survival.

📊 Markets Moves

Asset | Price (USD) | Daily Change |

|---|

S&P 500 | 5,525.21 | 🟢 +0.7% |

Dow Jones | 40,113.50 | 🟢 +0.1% |

Nasdaq Composite | 17,382.94 | 🟢 +1.3% |

Bitcoin (BTC) | 94,720.50 | 🟢 +0.8% |

Tesla (TSLA) | 284.95 | 🟢 +9.8% |

💡One Big Idea: Why Everyone’s Looking at Google Wrong This Week

When a giant moves, most people stare at the price.

I stare at what’s happening under the surface.

Last week, GOOG dropped earnings that looked strong on paper: revenue beat, cloud growth accelerating again, $70 billion buyback. The headlines? Glowing. Wall Street? Cheering. Retail traders? Piling in.

And yet — while everyone’s busy high-fiving each other — something huge, something almost invisible to the headlines, is happening inside Google. And it’s the part no one wants to talk about.

Because you don’t tear up your AI division structure and rebuild it from scratch — after a win.

You do it when you know you're losing the war.

🧨 Sundar Pichai just announced a full-blown leadership restructure inside Google’s AI core.

DeepMind and Google Brain — two of the most important AI teams on the planet — are being merged under a single unit. Reporting lines have been cut. Strategy has been reshuffled.

And they’re not trying to hide it. The memo practically screamed urgency.

Meanwhile, while Google reorganizes under the hood, Palantir (PLTR) is playing chess on the side of the board no one's watching.

Palantir just inked a new multi-year, multi-million-dollar deal with Google Cloud — embedding itself right into Google's infrastructure play for enterprise AI.

And that, my friends, is not coincidence.

It’s positioning.

Because while Google tries to figure out its internal AI story, PLTR is becoming the story — by locking itself into the very pipes Google is counting on to stay relevant in the next phase of enterprise tech.

⚡ Here’s how I’m thinking about it this week:

If Google’s reorg gains real traction fast, it buys them time. Investors will stay distracted by revenue beats.

If Palantir quietly grows inside Google's infrastructure? It becomes a leverage play without carrying the platform risk of Big Tech regulation or PR headaches.

If the enterprise AI war shifts from flashy demos to pragmatic execution? Palantir's stock could quietly reprice while GOOG fights its internal battles.

Most investors will miss this.

They’ll see the earnings beat.

They’ll see the chart breakout.

They’ll think: “Crisis averted. Big Tech’s back, baby.”

But they won’t see the scramble.

Because leadership changes tell you everything earnings don't.

They tell you who's winning — and who knows, deep down, they're losing ground.

You don't reshuffle generals when you're winning the war.

You reshuffle when you're trying to survive the next phase.

🧠 My Playbook Right Now:

I’m not rushing into GOOG long just because of a beat. I want to see insider sentiment — are execs buying shares post-earnings? Are hiring freezes lifting? Is retention improving?

I’m watching Palantir’s behavior — especially cloud contract expansion. Enterprise wins mean real cash flow leverage without platform risk.

I’m tracking sentiment shifts: when the media moves from “Google beats earnings!” to “Google faces existential AI competition” — that’s when reality starts to reprice.

🔮 The Bottom Line

This isn’t about hating Google. It’s still one of the most powerful companies on the planet.

But power hides weakness better than anything — until the market gets tired of pretending it’s not there.

I’m not looking at this quarter’s beat.

I’m looking at the cracks forming underneath the floorboards.

And right now, the smart money is setting up not for this earnings cycle — but for the inflection point 3–6 months out.

Patience now is positioning later.

Most traders will celebrate this week's headlines like it's 2021 again.

But those of us who actually study the pressure building beneath?

We’ll be the ones ready when the next phase explodes out of nowhere.

Stay sharp.

Because by the time everyone sees the real shift, the best seats will already be taken.

⚡ Quick Hits: 3 Moves the Smart Money Is Watching This Week

🧠 Ray Dalio’s Warning: The “Beautiful Rebalancing” Won’t Last Forever

Ray Dalio says the U.S. and China are entering a “beautiful rebalancing” — but he’s also quietly hinting at what happens when it breaks. The world’s two biggest economies are pulling back from confrontation without solving the underlying tensions. Smart money isn't betting on a new golden age — they're watching for when this temporary calm flips back to volatility. If you miss the signs, you’ll be chasing risk at exactly the wrong time.

📉 Americans Are Bracing for a Downturn — But Here’s the Real Timing Signal

Consumer sentiment is sliding fast — but the actual slowdown hasn’t shown up in the numbers yet. Historically, when sentiment drops sharply before data cracks, it’s a leading signal that conditions will flip months later — not immediately. The real risk? Getting lulled by “resilient” data just as the cliff edge gets closer. Smart investors are positioning now — not waiting for backward-looking headlines to tell them it’s too late.

🛡️ Markets Are Shrugging Off Tariffs — But the Damage Is Still Spreading

Stocks clawed back most of their tariff-driven losses in April, but don’t mistake the bounce for immunity. Earnings guidance is quietly softening, especially in industrials and exporters, even as prices rebound. Wall Street wants you to believe the worst is over — but under the surface, the margins are bleeding. The danger now isn’t visible — it’s underestimated headwinds that could crush latecomers when optimism peaks.

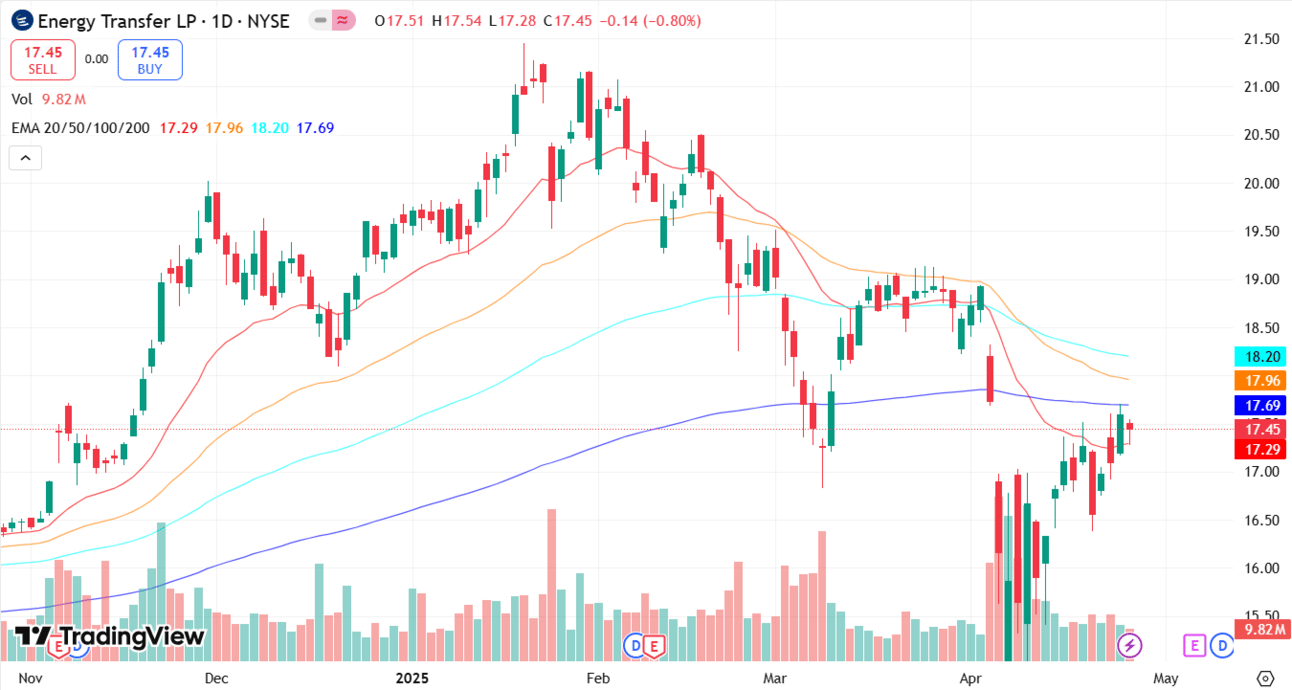

🔍 Market Setup: The Stock Everyone Forgot — But Smart Money’s Quietly Loading

You want to find trades the crowd isn’t ready for?

Start by looking where they’ve already stopped caring.

Energy Transfer (ET) is one of the cleanest mispriced setups on my screen right now — a $59.72 billion cash machine hiding in plain sight. No AI hype. No media buzz. No sexy earnings call headlines. Just $13 billion in annual revenue, fat margins, and a stock price stuck in the mud.

At around 8x forward earnings, a dividend yield over 7.5%, and steady YoY cash flow growth, this isn’t a story about explosive growth — it’s about being paid stupidly well to sit still while everyone else chases tech momentum.

The setup matters because compression is building:

Insiders have been steadily buying, the stock just quietly reclaimed its 20-day moving average, and energy sector inflows are quietly ticking higher while everyone’s obsessed with semiconductors.

I’m not calling an explosion — I’m stalking a slow, high-conviction grind higher with asymmetric upside if energy stays sticky and yield-hunters wake up.

🔧 Tool I’m Using: TradingView

Ever felt like your charts were holding you back?

I switched to TradingView — and haven’t looked back. Real-time alerts, AI pattern detection, clean visuals, and backtesting that doesn’t suck.

If you're still using clunky broker charts, this is your upgrade.

💸 We both get $15 when you sign up here ➜ Try TradingView

🧠 Final Thought: Where the Real Moves Happen

Markets love to tell simple stories. "Big Tech beats expectations." "Energy is boring." "Volatility is gone." But the real edge doesn’t come from reacting to stories. It comes from seeing the contradictions inside them — like a tech giant scrambling behind the scenes even as it prints a beat, or a quiet pipeline stock firming up while everyone else chases hype. The deeper you train yourself to spot these fractures, the less tempting it becomes to trade noise — and the more dangerous your patience becomes.

The real work this week isn’t chasing breakouts. It’s reading pressure. Watching where leadership wobbles under the surface. Paying attention to the names that aren’t moving yet — but will, when nobody’s looking. The difference between amateurs and serious investors isn’t who reads the news faster. It’s who can sit still long enough for the cracks to widen and the setups to get stupid obvious. That’s when real positioning happens. Everything else? Just noise with better branding.

🧠 What did you think of today's newsletter?

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.