Wingstop's stock has been on a tear lately, and if you're not paying attention, you're missing out on one of the hottest growth stories in the market. Did you know that Wingstop has achieved 20 consecutive years of same-store sales growth? That kind of consistency is almost unheard of in the fast-casual dining industry. So, why is Wingstop such a standout, and what makes its stock a must-have in your portfolio?

In this post, we'll dive into the jaw-dropping financial performance that has investors buzzing, explore the strategic moves fueling Wingstop's aggressive expansion, and uncover the secret sauce behind its loyal customer base and market dominance. By the end, you'll understand why Wingstop isn't just another restaurant stock—it's a growth powerhouse that could supercharge your investment portfolio. Buckle up, because the Wingstop story is nothing short of dramatic!

1. Impressive Financial Performance

Wingstop's financial performance has been nothing short of stellar. The company reported a significant increase in its fiscal first quarter of 2024, with total revenue rising to $145.8 million, up from $108.7 million in the same period last year. This growth was driven by a 21.6% increase in domestic same-store sales, a clear indicator of Wingstop's robust business model and strong consumer demand.

Revenue and Earnings Growth: Wingstop's revenue growth has been consistent and impressive. The total revenue for fiscal year 2023 increased to $460.1 million from $357.5 million in the prior fiscal year. This surge was primarily driven by domestic same-store sales growth of 18.3% and net new franchise development. Moreover, the company reported $74.1 million in adjusted net income for 2023, up from $54.5 million in 2022, reflecting a robust 36% increase.

The earnings per share (EPS) also exceeded expectations. In the first quarter of 2024, Wingstop posted $0.975 per share against the anticipated $0.76. This remarkable earnings growth is a testament to the company's efficient cost management and strong revenue streams.

Profit Margins and Cost Management: Wingstop has demonstrated exceptional cost management capabilities. The cost of sales was $70.6 million in fiscal 2023, down from $63.4 million in the prior year. As a percentage of company-owned restaurant sales, cost of sales decreased to 73.7% from 79.3%, primarily driven by a 27.1% decrease in the cost of bone-in chicken wings. This reduction in costs, coupled with increased sales, significantly boosted profit margins.

Dividend and Share Repurchase Program: Wingstop has also been returning value to its shareholders through dividends and share repurchases. In the first quarter of 2024, the company declared a quarterly dividend of $0.22 per share, resulting in a total dividend payout of approximately $6.5 million. Additionally, Wingstop's board of directors approved a share repurchase program with authorization to purchase up to $250 million of its outstanding shares.

2. Strategic Growth and Expansion

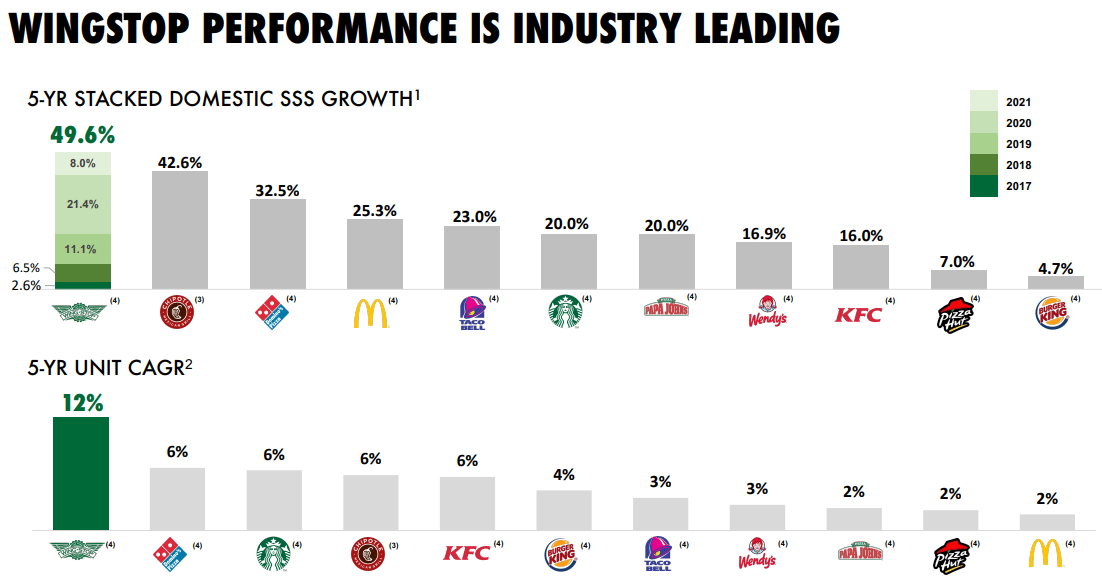

Source: Wingstop Investor Day 2022

Wingstop's strategic growth and expansion have been pivotal to its success, setting it apart as a dynamic player in the fast-casual dining industry. The company's aggressive and well-executed expansion strategy has significantly increased its market footprint and continues to drive its robust financial performance.

Domestic and International Expansion: Wingstop's expansion strategy has been nothing short of aggressive. In the first quarter of 2024 alone, the company reported a 14.2% increase in unit growth. As of December 30, 2023, Wingstop operated 2,214 locations globally, with 1,926 in the United States and 288 in international markets. This expansion included a substantial increase in domestic franchise restaurants, which grew from 1,678 at the end of 2022 to 1,877 by the end of 2023.

The company's international presence is also growing rapidly. Wingstop has been focusing on key international markets, including Europe, Asia, and the Middle East, leveraging its strong brand recognition and replicable business model. The addition of 50 new international franchise locations in 2023 highlights the company's commitment to global expansion.

Innovative Marketing and Product Strategies: Wingstop's innovative marketing strategies have played a crucial role in its growth. The company's ability to engage customers through unique and limited-time product offerings has kept the brand fresh and appealing. For example, Wingstop's introduction of the "Hot Honey Rub" and other unique flavors has driven significant customer interest and repeat business. These limited-time offerings create a sense of urgency and excitement, driving both sales and brand loyalty.

Additionally, Wingstop's marketing efforts have capitalized on cultural trends, such as the rise in popularity of live sports. By positioning its products as the perfect accompaniment to sports events, Wingstop has tapped into a lucrative market segment. This strategy has been particularly effective in driving same-store sales growth, which reached an impressive 21.6% in the first quarter of 2024.

Franchise Model and Operational Efficiency: Wingstop's franchise model has been a cornerstone of its expansion strategy. The company leverages its franchise partners to accelerate growth while maintaining operational efficiency and brand consistency. In 2023, Wingstop's domestic average unit volume (AUV) increased to $1.827 million, up from $1.606 million in 2022. This growth in AUV underscores the effectiveness of the franchise model in driving profitability and operational efficiency across the system.

Technological Advancements and Digital Transformation: Embracing technology has been another critical component of Wingstop's growth strategy. The company has invested heavily in its digital capabilities, enhancing its online ordering platform and mobile app. In 2023, digital sales accounted for over 60% of Wingstop's total sales, demonstrating the success of its digital transformation initiatives. These investments have not only improved customer convenience but also increased order accuracy and operational efficiency.

Future Expansion Plans: Looking ahead, Wingstop has ambitious plans for continued expansion. The company aims to add approximately 270 new units globally in 2024, further solidifying its position as a leader in the fast-casual dining industry. This planned growth includes both new domestic and international locations, reflecting Wingstop's ongoing commitment to broadening its market reach.

3. Strong Market Position and Brand Loyalty

Source: Wingstop Investor Day 2022

Wingstop has successfully carved out a strong market position and cultivated a loyal customer base, setting it apart in the highly competitive fast-casual dining industry. This success is attributed to several key factors, including its distinctive product offerings, consistent brand experience, and strategic marketing initiatives.

Consistent Same-Store Sales Growth: One of the most striking indicators of Wingstop's strong market position is its consistent same-store sales growth. Wingstop has achieved 20 consecutive years of same-store sales growth, a remarkable feat in the restaurant industry. This consistent performance is a testament to the company's ability to maintain customer loyalty and attract new patrons year after year.

Brand Loyalty and Customer Engagement: Wingstop has built a fiercely loyal customer base through its focus on high-quality, flavorful offerings. The company's signature chicken wings, available in a variety of unique flavors, have become a favorite among consumers. Wingstop's commitment to quality and flavor consistency ensures that customers return frequently, fostering strong brand loyalty. Additionally, Wingstop's active engagement with its customer base through social media and targeted marketing campaigns has strengthened its brand presence and customer connection.

Strategic Marketing Initiatives: Wingstop's strategic marketing initiatives have played a crucial role in enhancing its market position. The company's marketing campaigns often leverage cultural trends and events to resonate with a broader audience. For example, Wingstop's campaigns around live sports events have been particularly successful, positioning its products as the go-to choice for game-day snacks. This strategy has not only driven sales but also reinforced Wingstop's association with enjoyable, social experiences.

Comparison with Competitors: Wingstop's market position is further highlighted by its comparison with competitors. Unlike many fast-casual dining brands that struggled during the COVID-19 pandemic, Wingstop demonstrated resilience and continued to grow. The company's focus on takeout and delivery, supported by its strong digital infrastructure, allowed it to thrive even when dine-in options were limited. This adaptability and forward-thinking approach have enabled Wingstop to outperform many of its peers in the industry.

Conclusion

Wingstop's impressive financial performance, strategic growth and expansion, and strong market position with brand loyalty underscore why this stock is a compelling choice for investors. The company's robust revenue and earnings growth, driven by effective cost management and a strategic franchise model, highlight its financial health and potential for sustained success. Wingstop's aggressive domestic and international expansion, coupled with innovative marketing and technological advancements, position it well for future growth. Moreover, its strong market position and loyal customer base reflect its consistent ability to meet consumer demands and adapt to market trends.

While Wingstop's growth trajectory is promising, investors should also consider potential risks, such as market volatility and operational challenges. However, with its strategic initiatives and solid foundation, Wingstop appears well-equipped to navigate these challenges and capitalize on future opportunities.

As Wingstop continues to expand and innovate, it raises an intriguing question: Can Wingstop maintain its rapid growth and market leadership in an increasingly competitive industry? The answer will unfold in the coming years, but current indicators suggest a bright future for this dynamic company.

Found these insights valuable? Elevate your investing game by subscribing to our blog for more in-depth analysis, strategies, and market trends. Stay ahead with expert tips and refine your portfolio. Share this post with friends interested in the stock market and let's build a smarter investing community together!

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.