Good Monday Morning, Folks!

🚨 Markets Just Had Their Biggest Single-Day Rally Since 2022 — But Here’s Why I’m Not Celebrating.

On Friday, the S&P 500 spiked 1.8%, the Nasdaq jumped 2%, and traders cheered what looked like a soft-landing signal. But zoom out — the S&P is still down nearly 9% YTD, and bond yields are climbing.

This isn’t a bottom. It’s a bull trap.

The question now isn’t “should you buy the dip?” — it’s “are you sure you’re not the dip?”

👉 Let’s break down what’s really going on — and how I’m positioning for this week.

📊 Market Pulse: Index & Asset Overview

🟢 S&P 500 | 5,363.36 | +5.7% |

🟢 Dow Jones | 40,212.71 | +5.0% |

🟢 Nasdaq Composite | 16,724.46 | +7.3% |

🟢 Bitcoin (BTC) | 85,104.00 | +3.4% |

🟢 NVIDIA (NVDA) | 110.93 | +17.6% |

💡 One Big Idea: Why I’m Not Buying Stocks — I’m Buying Time

Look, I get the excitement.

NVIDIA ripped 17% last week. The Nasdaq had its best run in months. Every finance influencer is suddenly back on the AI hype train. Feels good, right?

That’s exactly why I’m not buying stocks right now. Not yet. I’ve seen this movie before. The bounce always looks the strongest right before the weak hands get wiped out again.

Here’s the deal — I’m not chasing anything. I’m stalking.

When setups like NVDA show up, they’re not a green light to dive in. They’re a signal that something is moving. That smart money is shifting. That the window for a high-conviction move is opening.

But instead of dumping $10,000 into shares, I’m doing what I’ve done for years: I’m buying time.

That means I’m watching for the moment when the story, the technicals, and the sentiment all line up. I’m loading up on call options only when the trade makes sense — when I can cap my downside, stretch my upside, and let the market come to me. Not the other way around.

You think I'm going to chase a 17% move? Hell no. That’s for TikTok traders. I’m sitting in the weeds with a loaded playbook, waiting for a pullback, waiting for volatility to cool, waiting for the crowd to look the other way — then I strike.

This isn’t about gambling. It’s not about FOMO. It’s about precision. When I buy call options, it’s because I see a calculated edge. I don’t need to be early. I just need to be right.

So what’s next?

I’ve got my eyes on a few sectors that no one’s talking about right now. Energy. Fintech. A couple of sleeper semis. The setups are forming. The tape is talking. And I’ll be ready — with calls, not shares — when the conditions are finally too good to ignore.

Stick around for Wednesday. I’ll show you which names I’m circling and why they might be next in line for a breakout move.

You don’t need to chase the market. You just need to know where it’s going next — and have the guts to wait for it.

⚡ Quick Hits

President Trump just spared electronics — including iPhones, GPUs, and laptops — from the latest wave of tariffs on Chinese imports. On the surface, it looks like a win for Apple, Nvidia, and consumers. But don’t get too comfortable. Analysts say this exemption is more about delaying political pain than any real economic strategy. The tech sector is still one unpredictable headline away from a reset.

Forget exchange rates. What’s happening to the U.S. dollar right now is about something deeper — reputation. As the greenback hits a 3-year low, global investors aren’t just moving capital… they’re moving confidence. The real story isn’t a weak dollar. It’s a weakening U.S. brand — and that could have ripple effects far beyond forex charts.

Think you’ve got it handled? Maybe you do — until you suddenly don’t. Whether it’s a retirement decision, inheritance, or a career shakeup, the truth is: the stakes get higher fast. A financial advisor isn’t for people who don’t know money — it’s for people who know what they can’t afford to screw up.

🔍 Market Setup: The Sleeper Stock That’s Quietly Outperforming

Last Friday, I teased a stock trading at just 8x earnings, growing faster than the market, and somehow flying under Wall Street’s radar. It’s not flashy. It’s not AI. But it’s printing cash like it’s 2021 again.

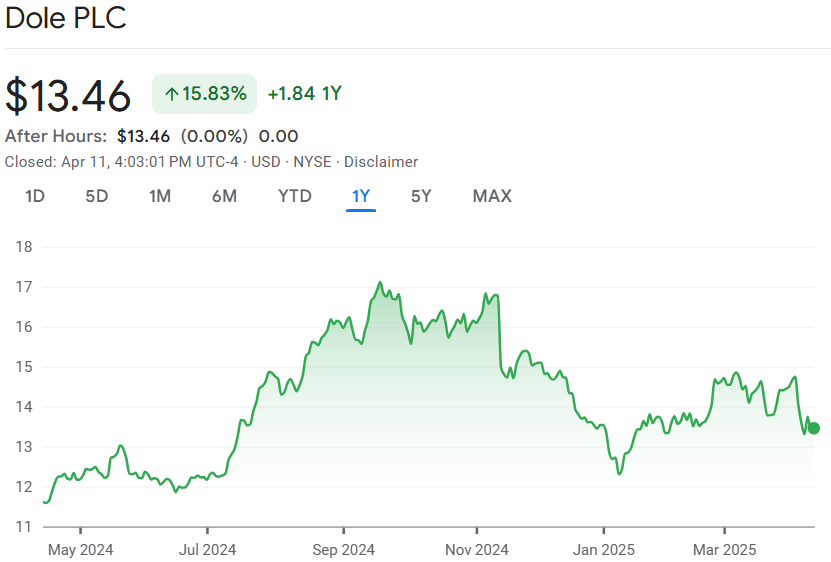

That stock? Dole plc (NYSE: DOLE).

You know Dole for bananas. What you might not know is that it quietly dominates the global fresh produce market — and it’s doing it with efficiency and cash discipline that would put some tech names to shame.

Here’s why I’m circling this one hard:

P/E Ratio: ~8.3x

EPS (TTM): $1.62

Free Cash Flow: ~$130M

Dividend Yield: ~2.3%

Return on Equity: ~12%

Media Coverage: Basically zero — and that’s where the edge lies

While everyone’s distracted by NVIDIA or chasing crypto rebounds, Dole is steadily executing. This isn’t a hype trade — it’s a classic underfollowed compounder. And if this gets picked up by any major fund or makes a surprise earnings beat, this rerates fast.

I’m not in yet — but I’m watching volume, insider activity, and sector rotation closely. If this starts to break out with institutional flows, I’ll move fast.

🧠 Final Thought

Markets are noisy right now. AI hype here, recession fears there, and now tariffs throwing curveballs at every sector. But in all that chaos, I’ve found that clarity comes from one thing: discipline.

I’m not rushing into anything this week. I’m watching my levels. I’m letting others overreact. And when the dust settles — I’ll be ready to strike.

👉 Want Wednesday’s stock pick before the breakout? Make sure you’re subscribed.

This week is about preparation, not prediction.

Until then — stay clear, stay patient, and stay dangerous.

🧠 What did you think of today's newsletter?

AK

The Pragmatic Investor

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.