🌞 Good Morning, Pragmatic Thinkers!

Wall Street spent this week chasing shadows. Every headline screamed about “the next Nvidia” or “AI’s new king,” as if one press release or one analyst upgrade could rewrite the laws of supply and demand. The market loves drama — but drama doesn’t pay bills. What pays is spotting when everyone else is looking the wrong way.

Here’s the uncomfortable truth: the noise wasn’t about fundamentals. It was about attention. Stocks were moving on headlines, not hard numbers. And when the crowd piles into the story of the week, they almost always miss the setup that really matters.

Investors got distracted by the hype cycle. But what actually mattered was risk — not growth headlines. The cracks, the constraints, the geopolitical friction nobody wants to price in. That’s where the real story was hiding.

Because markets don’t punish you for what you know. They punish you for what you ignore. And this week, while most were chasing shiny objects, the real signal was sitting in plain sight: perfection pricing in TSM, and how fragile that position really is.

So, before we head into “The Pragmatic Playbook,” I want you to pause and reset. Forget the noise, the trending tickers, the analyst soundbites. This is where we cut through the fog and ask: what actually deserves our capital, and what’s just renting our attention?

That’s the edge. And that’s why today, we go straight to the heart of it.

🔥 Market Pulse – What Actually Mattered This Week

Google just rolled out Gemini Enterprise, its new AI agent platform for business clients. That’s more than product hype — it’s a direct shot at Microsoft, OpenAI, and Anthropic in corporate AI workflows. When the major infrastructure providers begin fighting over your data and process layer, you know the architecture of power is shifting.

The minutes from the Fed’s September meeting revealed that most officials backed further rate cuts, citing worries over jobs, but division remains. That tension is the real story: markets expecting a dovish glide may be surprised if hawks push back. When your blueprint is built on consensus, cracks in consensus become your most dangerous blind spot.

While everyone’s obsessing over Nvidia dominance, this under-the-radar semiconductor is quietly outpacing it. That’s not a minor data point—it’s a warning: leadership isn’t permanent. If you’re locked into the obvious big names, you’re ignoring the divergence just taking root.

TOGETHER WITH OUR PARTNER

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

🎯 The Pragmatic Playbook: The Pragmatic Playbook: TSM Is Priced for Perfection — Will It Hold?

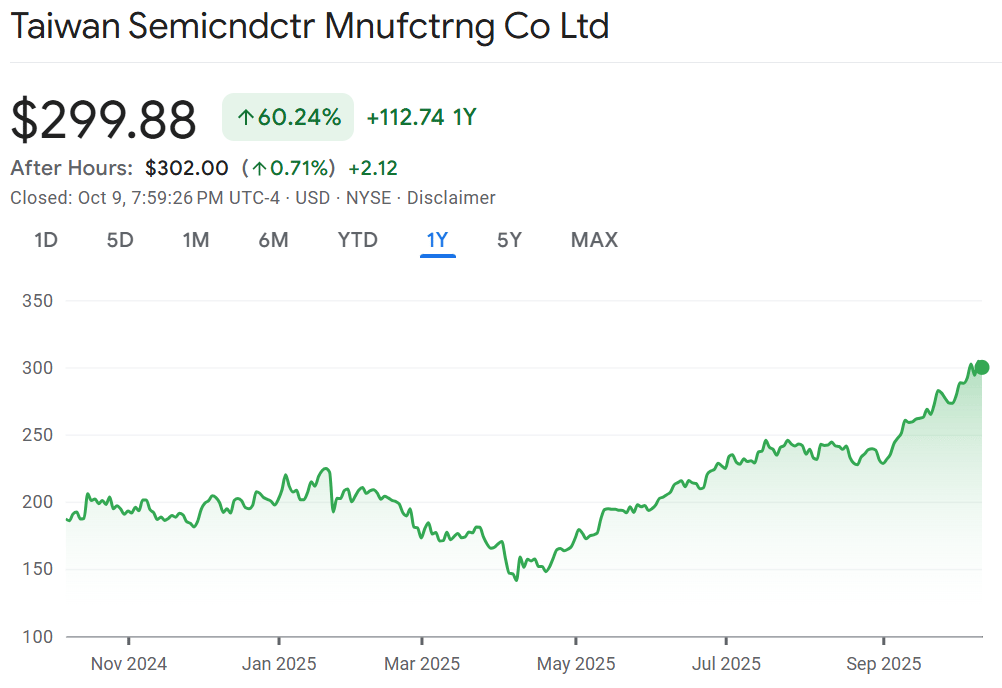

TSMC (NYSE: TSM) is Wall Street’s golden child right now. September revenue jumped 31.4% year-on-year, a jaw-dropping number that puts it squarely in the driver’s seat of the AI boom. The stock has surged, analysts are hiking targets, and retail traders are piling in.

But let’s get brutally honest: you’re not just buying growth anymore — you’re buying the belief that TSM can’t miss.

That’s when I get nervous. Because the market has a nasty habit: the moment everyone agrees a stock is untouchable, it punishes the latecomers.

🚀 Why Bulls Think TSM Can Do No Wrong

There’s plenty of evidence fueling the optimism. I’ll lay it out straight:

Revenue momentum:

September sales hit NT$331 billion (~$10B USD), up 31.4% YoY. Q3 revenue totaled NT$981.5 billion (~$31.5B USD), up 30% YoY and ahead of estimates. Numbers like this silence doubters fast.AI demand:

Every major AI workload — from Nvidia’s H100s to Apple’s M-series chips — flows through TSM’s fabs. Their 3nm process is sold out, and the N2 node pipeline is locked down by key customers. TSM isn’t just another foundry; it’s the foundry.Guidance upgrades:

Management now expects 2025 revenue to grow ~30% in USD terms. That’s not cautious optimism — that’s confidence backed by backlog.Analyst cheerleading:

Needham lifted its target to $270. Bernstein went higher, pushing toward $290. The sell-side chorus is loud: buy, buy, buy.Global expansion:

The $100B U.S. fab program is underway. The Arizona site is already producing 4nm chips, and new fabs in Taiwan’s Kaohsiung region show they’re hedging geographic risk without abandoning home base.

The bull case is clear. TSMC is printing money in a once-in-a-generation AI supercycle.

But investing isn’t about what everyone sees. It’s about what they don’t.

💰 The Valuation Question: Rich or Justified?

Let’s strip away the hype and look at what you’re actually paying for.

Forward P/E: ~25x earnings.

EV/EBIT: ~16.7x.

PEG ratio: ~0.7 (implying growth still outpaces valuation).

Margins: ~40%+, though cracks may appear as capex and U.S. expansion costs rise.

On paper, it doesn’t look insane. Nvidia trades north of 30x forward earnings. Big Tech peers trade at 25–30x.

But here’s the raw truth: this isn’t SaaS. It’s a foundry. Capital-intensive, cyclical, execution-heavy. A 25x multiple in this industry is the market saying: “TSM can’t screw up. Not once.”

That’s not valuation. That’s faith. And faith breaks fast.

⚠️ Where the Cracks Could Show

Everyone knows the upside story. Let’s talk about what keeps me awake at night.

Geopolitical tripwires

The U.S. just revoked TSM’s “validated end-user” status for its Nanjing fab. Now every advanced tool shipment needs special approval. It’s a canary in the coal mine. If restrictions tighten, it cuts straight into TSM’s China operations.

And let’s not sugarcoat Taiwan risk. One weekend headline could knock 20% off this stock overnight.Fab execution

Building in Arizona isn’t the same as Taiwan. Delays, cost overruns, labor shortages — any hiccup there, and the market questions the whole “global diversification” narrative.Margin pressure

Materials cost more. Engineers cost more. ASML’s EUV machines aren’t getting cheaper. Guidance looks rosy, but the street is already whispering about margin compression in Q3 and Q4.Overcrowded trade

When everyone’s bullish, upside fades and downside sharpens. I’ve seen it with Apple, with Tesla, with Nvidia. The crowd stops seeing risk… and that’s when it shows up.Customer cycles

Cloud giants — Nvidia, AMD, Apple — drive TSM’s growth. If AI capex cools even temporarily, orders slip, and TSM feels it instantly.

📅 What to Watch Next

Q3 earnings (Oct 16): Street expects ~$32B revenue, EPS ~$1.60. If they miss or guide lower, the punishment will be quick and brutal.

Export policy updates: New U.S. restrictions could be announced any month. Watch the Commerce Department wires.

Fab ramp headlines: Arizona yield rates, Kaohsiung progress — execution here is critical.

Customer deals: Renewed contracts with Nvidia or Apple? Bullish. Silence? Worrisome.

Macro tone: If AI spending slows or markets rotate, semis are first to bleed.

This isn’t noise — these are the levers that decide whether TSM keeps its premium.

🧠 Neuromarketing Truth Bombs

Let me anchor this with what matters most for you, the investor:

Loss Aversion: If you think TSM can’t fall, remember the traders who bought Nvidia at $900. Great company, brutal entry point.

Scarcity: Every bleeding-edge AI chip is made at TSM. That monopoly is real… but monopolies attract regulators and rivals.

Authority Bias: Analysts love it. But remember: Needham doesn’t lose money if their $270 target is wrong. You do.

Curiosity Gap: Oct 16 earnings aren’t “just another quarter.” It’s the moment the market finds out whether TSM deserves perfection pricing — or whether the air leaks out.

🧐 My Playbook

Here’s how I’m thinking about it, no sugarcoating:

If you’re new to TSM: Don’t chase. Build a starter position and wait for volatility. Pullbacks will come — they always do.

If you’re already holding: Protect your gains. Trim 10–20% or set a trailing stop. This isn’t cowardice. It’s discipline.

If you’re long-term: TSM is a backbone of AI. Over 5–10 years, I’d bet on it every time. But short-term, it’s priced like it can’t miss — and that’s when pain comes fastest.

My call? Hold, with an eye to buy more on weakness. I want to own this long-term, but I refuse to overpay for perfection.

🧭 The Final Word

TSM is great. Nobody doubts that. But greatness doesn’t protect you from drawdowns.

This stock is priced like failure is impossible. And if there’s one thing the market loves, it’s proving us wrong.

I’ve been burned enough times to know: when a stock feels “safe,” that’s when it’s most dangerous. Oct 16 is the gut check. If TSM smashes numbers, it stays king. If it even hints at slowing, the selloff will be swift and unforgiving.

That’s the real playbook: respect the upside, but never forget the downside.

TOGETHER WITH OUR PARTNER

Buying Cannabis Online Is Now Legal, And Incredibly Convenient

For years, buying cannabis meant taking a trip to a dispensary, dealing with long lines, limited selection, and inconsistent pricing. But thanks to changing laws and innovative online retailers, buying high-quality THC products is now 100% federally legal—and more convenient than ever.

And when it comes to quality and reliability, Mood is leading the way…

Because they’ve completely flipped the script on cannabis shopping. Instead of memorizing hundreds of confusing strain names – like “Gorilla Glue” and "Purple Monkey Breath" – you simply choose how you want to feel: Creative, Social, Focused, Relaxed, Happy, Aroused, and more.

Each gummy is formulated with the perfect blend of Delta-9 THC and botanicals to deliver the perfect mood.

Want a great night’s sleep? Try the Sleepytime gummies. Need laser focus Mind Magic gummies have you covered. Hotter sex? Try the Sexual Euphoria gummies.

It's cannabis shopping that actually makes sense for “normal” people.

🧠 What did you think of today's newsletter?

🧘The Friday Reset

Everywhere you look right now, the noise around TSM feels like it’s turned into a referendum on the entire AI cycle. That’s the fatigue talking — the same headlines recycled, the same analysts scrambling to prove they “called it first.” When a stock is priced for perfection, the chatter gets louder, not clearer. That’s usually when discipline erodes and investors start confusing urgency with opportunity.

Here’s the reset: my edge has never come from predicting the next print. It comes from having a process that keeps me sane when others chase. If it feels like you’re behind, you’re not — you’re just early. Stillness is underrated; clarity often comes in the pause, not the push. Hype won’t outlast setups, but setups reward patience every time.

Stay Sharp,

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.