🌞 Good Morning, Pragmatic Thinkers!

This week, the market panicked over the wrong thing.

While headlines screamed “Meta misses profit,” they glossed over a $51 billion revenue surge and a $7.25 adjusted EPS behind a paper tax charge. The crowd saw chaos; the context saw continuity.

What really mattered wasn’t the accounting noise — it was that a global ad machine kept humming, a data moat kept expanding, and the infrastructure for the next decade’s growth quietly widened. While traders chased drama, the real move slipped by unremarked.

In this edition’s Pragmatic Playbook, we’ll stop counting headlines and start measuring set-ups. We’ll sift signal from noise — targeting the price and the positioning that matters, not the buzz that doesn’t.

Because investing isn’t about catching every spike — it’s about choosing the moments when clarity beats hype. And this week just handed you one.

🔥 Market Pulse – What Actually Mattered This Week

According to CNBC, the summit between Donald Trump and Xi Jinping in South Korea led to a one-year pause on new rare-earth export restrictions by China and discussions on easing U.S. tariffs in exchange for cooperation on illegal drug precursor chemicals.

This matters because rare-earths and tariffs aren’t just political theatre—they form the backbone of global tech supply-chains and margin assumptions for companies like Nvidia. If you assume the U.S.–China tech/trade risk is resolved or distant, you’re missing how quickly the pivot happens and how exposed many “safe growth” names really are.

This Motley Fool piece identifies three stocks analysts believe are undervalued at the moment and could outperform if the broader market mood shifts.

The signal here is not just “cheap stocks” but that market leadership may be rotating from the obvious megacaps to overlooked names. If you’re still anchored to the “fanin-tech plus megacap dominance” story exclusively, you could miss where the next leg of returns comes from.

According to Yahoo Finance, Jerome Powell explicitly challenged the market’s assumption that the Federal Reserve will simply follow through with predictable rate cuts, emphasizing that decisions remain data-dependent and not automatic.

This matters because market valuations currently price in a “Fed easing” narrative which may not materialize. If you’re positioned under the belief that the Fed is locked into a soft landing path, you risk getting caught when the central bank backtracks or slows down.

TOGETHER WITH OUR PARTNER

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

🎯 The Pragmatic Playbook: Meta - $51B In Sales, $16B Tax Hit - What’s Really Going On

Meta made $51 billion this quarter — and still got punished.

That’s not a typo. The company just posted one of its strongest growth quarters since 2021 — 26% revenue increase, record engagement across Reels and Instagram, and a clean beat on every major metric.

And yet, the stock fell off a cliff.

It wasn’t performance that spooked investors — it was perception.

Because buried inside Meta’s stellar report was a $15.9 billion one-time tax adjustment, turning what should’ve been a brag-worthy profit into an optical nightmare.

GAAP earnings per share: $1.05.

Adjusted earnings per share: $7.25.

Same quarter. Two realities.

If you felt confused, good. You’re paying attention.

💡 The Headline Everyone Got Wrong

The narrative out there is simple — “Meta’s profit plunged 83%.”

That’s wrong. It didn’t plunge. It got distorted.

This tax adjustment isn’t cash leaving the business — it’s accounting language catching up to regulation. Meta’s real operations are not just intact — they’re thriving.

Revenue is accelerating. Ad efficiency is improving. Engagement is compounding.

The truth: the business is outperforming while the market misreads the math.

That disconnect is exactly where opportunity lives.

📊 What the Real Story Tells Us

Strip away the noise, and this is what Meta actually accomplished:

Revenue: $51.24 billion (+26% YoY)

Ad Impressions: +14%

Average Price per Ad: +10%

Users: 3.54 billion daily actives — nearly half of humanity

That’s scale most nations envy.

Reels monetization is working. WhatsApp Business is quietly scaling. Threads just passed 200 million monthly actives.

And while everyone’s distracted by that tax line, Meta quietly announced CapEx of $70–$72 billion this year.

That’s not waste. That’s a declaration: we’re building the pipes for the next decade.

But Wall Street doesn’t reward long-term builds — it rewards short-term predictability.

And right now, Meta’s spending scares people who can’t see past a quarter.

⚙️ Why The Market Really Flinched

This selloff wasn’t about profit. It was about comfort.

Meta’s transitioning from being a “cash printer” to a “builder.” And builders spend.

Wall Street wanted a clean, tight balance sheet. Meta gave them ambition instead.

Investors don’t hate growth — they hate waiting for it to pay off.

Meta’s AI buildout, data center expansion, and custom chip program are exactly what future dominance looks like — just not what short-term traders want to see.

When sentiment flips from “great quarter” to “too much spending,” that’s not bad news.

That’s the sound of conviction being tested.

🔍 What Everyone Missed

Three things under the hood matter more than the EPS headline:

1️⃣ AI Is Now a Revenue Engine, Not a Buzzword

Meta’s AI ad tools are increasing click-through rates and return on ad spend across billions of impressions. It’s quiet, invisible efficiency — but that’s how compounders win.

2️⃣ Reels Is Turning Into a Money Machine

Ad load is up, monetization per minute is rising, and user retention is breaking records. For years, Reels was a drag on margins — now it’s one of Meta’s top growth levers.

3️⃣ WhatsApp Business Is the Sleeping Giant

Over 200 million businesses now use WhatsApp to sell, invoice, and service customers. It’s the most underappreciated profit driver in global e-commerce.

Put together, this is not a company in decline.

It’s a company entering its “infrastructure era” — the hardest and most misunderstood phase of any tech empire.

⚖️ The Real Trade-Off

Let’s be honest: Meta’s next act won’t be easy to hold through.

Costs are rising. CapEx is ballooning.

But those are the costs of building moats — not vanity projects.

You either believe Meta’s AI and infrastructure spending is reckless…

Or you see it as the price of staying relevant in the next decade of compute.

You can’t have both.

Growth without discomfort is just adrenaline.

And right now, Meta’s doing what investors say they want — reinvesting into the future — until they realize it costs money.

🎯 The Pragmatic Playbook

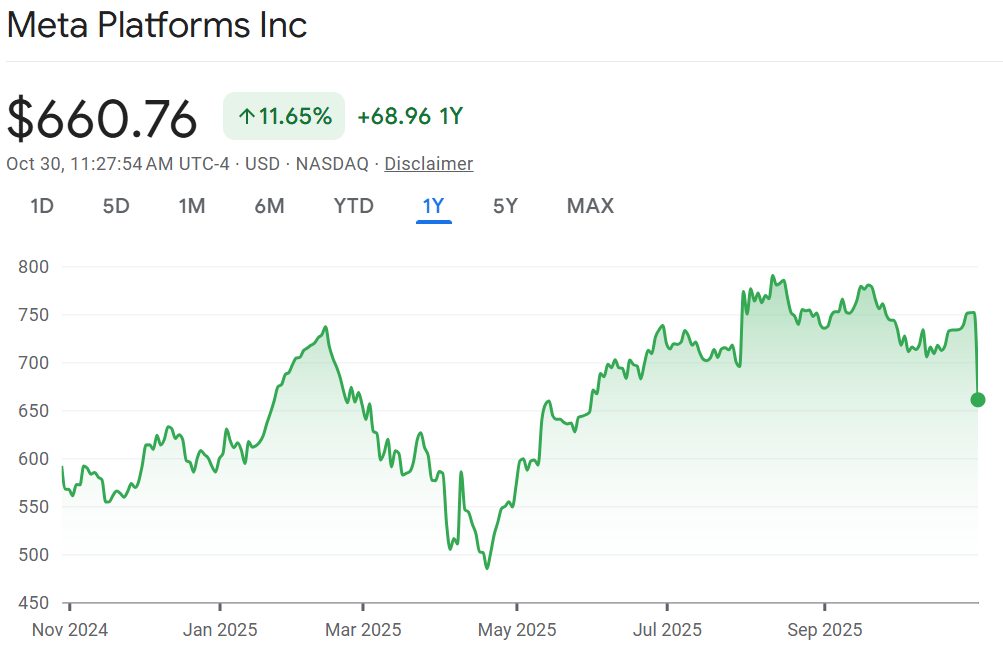

Meta opened around $669 today — down roughly 9% from pre-earnings levels. The move looks harsh, but this isn’t panic; it’s positioning.

Here’s how I’m reading it 👇

⚡ For Short-Term Traders (1–2 Months)

Meta needs to hold above $650 to confirm stability.

If it cracks below $630, that’s where fear overrides fundamentals — I’d look for a bounce setup there.

A reclaim of $700–710 with volume means momentum is back — that’s a tactical long toward $740–750.

Bottom line: trade the reaction, not the headline. This volatility is emotional, not structural.

💼 For Medium-Term Investors (6–12 Months)

If Meta keeps ad revenue above 20% and reins in cost growth, fair value sits around $850–900.

My move: accumulate between $630–680, trim near $900, and reload on any reset.

Watch three signals:

AI monetization conversion rate

Expense discipline

CapEx clarity for 2026

If those line up, Meta will re-rate faster than consensus can rewrite its models.

🏗️ For Long-Term Builders (3–5 Years)

This is the conviction play.

Meta’s valuation at ~19x forward earnings (ex-tax) is a discount to both Google and Microsoft — despite controlling more user time, more data, and more ad surface.

They’re building the infrastructure layer of the social web and the compute layer for AI simultaneously. That’s not reckless — that’s rare.

If execution holds, I see $1,100–1,200 by 2028.

The trade isn’t in timing the bottom.

It’s in owning the transformation while others argue about expenses.

🧩 Strategy Snapshot

Investor Type | Zone | Bias | Key Signal |

|---|---|---|---|

Short-Term Trader | $630–650 | Accumulate on bounce | Watch $700 breakout |

Mid-Term Investor | $680–750 | Hold/Add | CapEx clarity + margin stabilization |

Long-Term Builder | $630–700 | Compound | AI ROI + structural growth |

🧠 The Mindset Shift

Everyone wants exposure to the AI future — until they realize how expensive the future is.

Patience isn’t passive here. It’s positioning.

Meta’s doing what Amazon did with AWS: spending through doubt, building while the market second-guesses every dollar.

This is what leadership looks like before it’s recognized as genius.

And in markets like this, confusion isn’t a red flag — it’s a buy signal wearing a disguise.

TOGETHER WITH OUR PARTNER

Crash Expert: “This Looks Like 1929” → 70,000 Hedging Here

Mark Spitznagel, who made $1B in a single day during the 2015 flash crash, warns markets are mimicking 1929. Yeah, just another oracle spouting gloom and doom, right?

Vanguard and Goldman Sachs forecast just 5% and 3% annual S&P returns respectively for the next decade (2024-2034).

Bonds? Not much better.

Enough warning signals—what’s something investors can actually do to diversify this week?

Almost no one knows this, but postwar and contemporary art appreciated 11.2% annually with near-zero correlation to equities from 1995–2024, according to Masterworks Data.

And sure… billionaires like Bezos and Gates can make headlines at auction, but what about the rest of us?

Masterworks makes it possible to invest in legendary artworks by Banksy, Basquiat, Picasso, and more – without spending millions.

23 exits. Net annualized returns like 17.6%, 17.8%, and 21.5%. $1.2 billion invested.

Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

🧠 What did you think of today's newsletter?

🧘The Friday Reset

The irony of this week is poetic.

Meta grew 26%, expanded engagement, and improved ad returns — and the market sold it off for a tax line no one will remember by next quarter.

That’s not failure. That’s fatigue.

When markets are this impatient, I slow down. Because the trade isn’t in catching the reaction — it’s in owning the realization that follows it.

Meta didn’t break. It evolved.

And that’s the part most investors won’t see until it’s 30% higher.

So I’ll leave you with this:

When everyone’s chasing the next shiny thing, I’m betting on the company quietly building the foundation beneath it.

Because chaos is where compounding hides.

Stay Sharp,

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.