🌞 Good Morning, Pragmatic Thinkers!

The market didn’t implode. Nothing dramatic broke. And yet, something important still slipped through the cracks — not because it lacked impact, but because it lacked noise.

While headlines orbited Nvidia and short-term AI hype cycles, the real tell this week came from the quiet operators — the ones who don’t make splashy announcements but get the orders, ship the goods, and build the future. No drama, just demand.

That’s where the edge is right now. Not in momentum trades, but in positioning before recognition. The big opportunity isn’t what’s trending — it’s what’s structurally embedded in everything trending. That’s why this week, I’m revisiting a stock I once underestimated — and the setup that I won’t miss twice.

Let’s get into The Pragmatic Playbook.

🔥 Market Pulse – What Actually Mattered This Week

Most investors missed the biggest signal of the week because they were too busy watching Nvidia’s stock price — instead of listening to what Nvidia’s CEO actually said. Meanwhile, Meta is fighting a battle that will define the boundaries of AI misuse, and the average retiree is learning—too late—that $1M might not even be enough. The lesson? The world is accelerating, AI is scaling, and financial independence isn’t a luxury—it’s a defense mechanism.

While most traders celebrated the $NVDA bounce, Jensen Huang just dropped a seismic truth bomb: the next big wave isn’t chips — it’s robots. Nvidia is positioning itself at the center of autonomous factories, vehicles, and AI-powered everything. If you’re still thinking of Nvidia as “just a GPU company,” you’re five years behind. This is a platform pivot—one that could make GPUs feel like the warm-up act.

Forget harmless filters — Meta is dragging a deepfake company to court for weaponizing AI to generate explicit content. This isn’t just about lawsuits. It’s the first real test of how the public, platforms, and regulators will respond when generative AI goes off the rails. Investors betting on open-source AI proliferation should pay attention: the regulatory clampdown is coming, and only the most defensible models will survive.

The average retiree now needs $60,000–$70,000 annually just to maintain a basic standard of living. Most aren’t even close. This isn’t a retirement crisis — it’s a planning failure. What mattered this week is the stark realization that financial security is becoming non-optional. Inflation didn’t just raise prices — it raised the stakes for everyone still playing defense with outdated assumptions.

🧭 The Real Takeaway

What actually mattered this week wasn’t the price moves — it was the positioning shifts. Nvidia isn’t just riding the AI wave; it’s shaping the next industrial cycle. Meta’s lawsuit signals the start of the AI accountability era. And the retirement math? It’s a gut punch reminder that wealth is no longer about comfort — it’s about survival. Don’t chase noise. Focus on where the puck is going: robotics, AI defensibility, and personal capital resilience.

TOGETHER WITH OUR PARTNER

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

🎯 The Pragmatic Playbook: I Missed $50K on TSM - I’m Not Missing This One

The Train That Left Me Behind…..

April 2022 still haunts me. TSM plunged 15% in a single week on tariff fears — and I froze. I watched $50,000 in gains slip through my fingers like sand in a storm. I panicked. I thought China trade wars would crush the stock. Instead, TSM rebounded 30% by December, riding a wave of AI chip demand I didn’t see coming.

Now? I’m not watching from the sidelines.

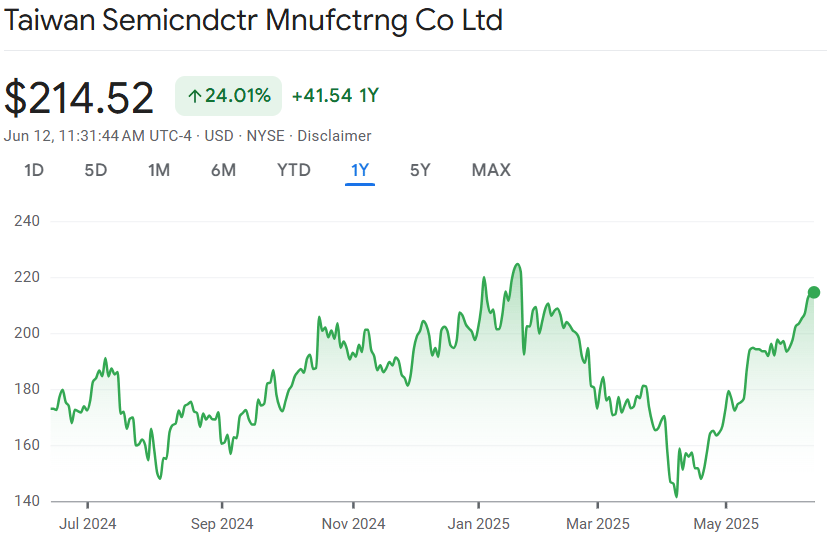

TSM just reported a 40% revenue explosion in May, and the stock sits around $215, up 4.5% on the week. This isn’t another chip rally. This is the heart of AI’s hardware engine, and the signals are getting louder. I’ve learned my lesson. And this time, I’m tracking the setup like a sniper.

📉 What Just Happened

TSM’s May revenue hit $10.7 billion, up 40% year-over-year — following a 48% spike in April. The market barely flinched at first… until the institutions started buying.

The stock rose 3.4% this week, easily outpacing the S&P 500’s 0.55%. Bernstein just raised their target to $251, citing revenue “way ahead” of Q2 expectations. And the whispers on X are relentless: Apple, Nvidia, AMD, Qualcomm, and Broadcom have locked down TSM’s Arizona fab capacity through 2025.

Everyone’s chasing Nvidia. But Nvidia doesn’t manufacture chips. TSM does — and they’re booked solid.

This isn’t a sideshow. It’s the main engine no one’s watching.

🧠 What This Triggered In Me

This rally pulled me right back to 2022 — that moment where fear drowned out facts. We’ve all had it: a trade that was right, but emotion overrode execution.

But here’s what’s different now.

TSM isn’t just a chipmaker. It’s the foundry that manufactures over 90% of the world’s most advanced semiconductors. It’s the bloodstream of AI, data centers, and 5G.

In 2020, it rallied 60% when cloud demand exploded. Today feels even bigger — and tighter. A PEG ratio of 1.08 and EPS growth forecast of 54.7% for Q2? That’s high-octane growth trading at a discount.

The scar from 2022 still aches. But now, it’s my edge. I’m not chasing hype — I’m recognizing a giant when it’s still underpriced.

📊 The Setup I’m Tracking

This isn’t just a 3% pop — it’s a tectonic demand shift in AI infrastructure, and TSMC is at the core.

🔥 Demand Spike

Q1 2025 revenue soared 35.3%, and Q2 is projected to come in at 37%–41%.

May’s 40% leap confirms demand is outpacing supply.

Arizona fabs are locked down by five of the biggest tech firms. This isn’t speculative — it’s real, booked business.

💸 Valuation Edge

Forward P/E: 22.5 — in line with peers.

But 54.7% EPS growth crushes everyone else.

PEG at 1.08 = rare value for this kind of explosive growth.

Bernstein’s $251 price target = ~18% upside. Average analyst target sits at $219.43. Smart money is loading up.

🌍 Geopolitical Hedge

U.S., Japan, and UAE fabs reduce Taiwan-centric risk.

Arizona’s $165 billion third fab isn’t just expansion — it’s strategic insulation.

CEO C.C. Wei reaffirmed mid-20% sales growth for 2025, unfazed by trade headlines.

📈 Technical Tell

On June 10, TSM smashed through its 50-week moving average with a 20% spike in volume.

That’s not retail noise — that’s institutional flow.

Momentum is real. But it’s still early.

🚨 What I’ll Do — And What Would Stop Me

I’m not diving in blind. Discipline is the edge I didn’t have in 2022.

✅ Entry Conditions:

Earnings (July 2025): If revenue clears $29.66B or guidance gets raised above mid-20%? That locks my conviction.

Price Action: A breakout above $220 on 15%+ volume is my trigger. I want to see the big money move in.

Geopolitics: Reports of thawing U.S.-China talks (like the June 5 Trump-Xi coverage) reduce macro risk. But even if not — UAE and Arizona help hedge.

❌ Exit Conditions:

Huawei Risk: If China’s Ascend 910D chip starts to eat into Nvidia’s TAM — and reduces its dependency on TSMC — I’ll be on alert.

Tariff Shock: A 25%+ U.S. semiconductor tariff? That would squeeze margins hard. I’ll reassess.

Demand Drop: If wafer orders slow or Apple/Nvidia cut guidance, I’ll exit. AI hype doesn’t pay the bills — real orders do.

Technical Breakdown: A close below $200 with heavy volume? That’s distribution. I’ll wait for support to reestablish.

🧱 My Move

If TSM holds above $210 next week with strong volume, I’m scaling in. Slowly. Deliberately. Targeting 5% of my portfolio over time.

I’ll move on strength — not emotion.

And if the setup breaks? I’m out. Fast. No ego, no excuses.

Here’s my edge, and yours too:

✅ Watch for revenue surprises

✅ Track volume surges

✅ Follow analyst upgrades

✅ Anchor to real positioning, not social media hype

💥 The Raw Truth

This isn’t about missing another $50,000.

It’s about refusing to be paralyzed by the past. I see a company thriving despite geopolitical tension, expanding while others consolidate, and powering AI’s ascent from the shadows.

The 40% revenue pop.

The booked-out fabs.

The rising institutional bets.

It’s not noise — it’s a siren. And it’s getting louder.

I’m not married to the trade. If tariffs rise or Chinese chips gain ground, I’ll pivot. Fast.

But right now, this is one of the clearest setups on my radar — and most investors are asleep on it.

So I’ll leave you with this:

The crowd is hypnotized by Nvidia’s glow. But TSMC is the power line behind the spotlight.

Are you ready to stop watching trains leave the station? Or will this be the one you finally catch?

🟢 Missed Another Entry? You're Not Alone — But Here's the Fix

We’ve all been there.

You blink. The stock surges. You're left chart-staring, plotting indicators, and wondering where the next move is coming from.

But the pros?

They don't chase. They prepare — with watchlists so dialed in, they can scan the market in 5 minutes and lock in sniper trades.

Iris Yuan is one of those pros.

She made $2K overnight — not by luck, but by using a method she calls the 5-Min Stock Scanning Formula.

Now, she’s breaking it all down in a FREE live masterclass.

Here’s what you’ll learn:

✅ How to scan for winning setups in 5–10 minutes

✅ How to trade outside of traditional hours (great for side hustlers)

✅ How to build the confidence to execute your trades — calmly and clearly

✅ How to avoid bad entries by locking in optimal entry + exit zones

🧠 Even if you're not experienced, this masterclass is practical, simple, and actionable.

Iris went from blowing up accounts to becoming a consistent sniper. Her system works — and she’s sharing it for free.

🧠 What did you think of today's newsletter?

🧘The Friday Reset

It’s easy to feel like you’re missing something when headlines scream Nvidia, Tesla, and now TSMC. The crowd rushes toward anything shiny, as if urgency itself is a signal. But clarity rarely lives in noise. This week, I found myself catching that old edge of FOMO — the fear that if I don’t act now, I’ll be left behind again. That’s the emotional tax we pay for past mistakes. But the truth? The best trades never feel urgent. They feel inevitable in hindsight because they were built on conviction, not impulse.

If it feels like you’re behind, you’re not. You’re just early — and early only works when you’re prepared. The edge isn’t in guessing the next breakout; it’s in showing up with your checklist when the breakout happens. Markets don’t reward speed. They reward clarity, patience, and readiness. Don’t let sentiment trick you into thinking momentum is a plan. This weekend, reset your filter. Zoom out. Re-anchor. Great setups wait for those who are watching the right things.

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.