🌞 Good Morning, Pragmatic Thinkers!

$849 billion. That’s how much the U.S. just earmarked for defense. And Wall Street barely blinked. Everyone’s searching for a pivot. But while the market clings to rate-cut daydreams, something far more permanent is taking shape — and most investors aren’t positioned for it.

Defense isn’t a headline story. It’s a cash-flow machine hiding in plain sight.

The NATO summit just raised the floor to 5% of GDP. That’s not a forecast — that’s a commitment. Meanwhile, contractors like Lockheed and RTX are sitting on record backlogs with nearly no retail interest.

This setup doesn’t need a war. Just a budget. We’re not chasing momentum. We’re front-running institutional money that hasn’t rotated yet. And while the world debates chip stocks, I’m looking at companies with guaranteed capital, long-term visibility, and Pentagon-grade durability.

This week’s Playbook is about defense — not because it’s scary, but because it’s boring, profitable, and still cheap. Let’s break it down.

🔥 Market Pulse – What Actually Mattered This Week

The market’s gotten too comfortable — again. Everyone’s waiting for a clean Fed pivot, chasing short-lived AI pops, or fretting over Elon’s latest corporate chaos. But underneath the headlines, we saw something more revealing: conviction starting to crack at the edges. When even Buffett drops a cautionary flag, and Tesla quietly fires its manufacturing lead, that’s not noise — that’s pressure. The kind that doesn’t show up in charts until it’s already too late.

⚠️ Buffett’s Warning Wasn’t for Boomers

This week, Buffett didn’t just speak — he moved. Berkshire is sitting on a record $189 billion in cash and scaled back equities while valuations climb. That’s not market timing. That’s discipline. When the Oracle’s doing less, and the retail crowd’s doing more, smart investors should pay attention. Cash isn’t bearish. It’s optionality.

🚨 Another Exec Falls at Tesla

Elon quietly ousted Omead Afshar — a top exec who oversaw Cybertruck production and the broader manufacturing org. No earnings call drama. No tweet storm. Just gone. This wasn’t about performance; it was about control. And when Tesla’s biggest product bets are tied to one man’s moods, that’s not innovation — that’s a risk premium.

📉 The Market Thinks the Fed Is Bluffing

Despite Powell’s insistence that rate cuts will come “when appropriate,” markets are already pricing in two cuts by year-end. This disconnect is massive. Either the Fed folds — or investors do. Historically, misreading the Fed’s resolve has ended portfolios, not just trades. Watch real yields, not the noise.

Trading That Deliver REAL Profits—Don’t Be the One Who Misses Out Again

Now, the Mid-Year Rush is here. No fluff, no hype—just the raw strategy that’s turning new traders into winners fast.

Here’s what you’ll unlock inside:

✅ You get real-time answers

✅ You practice with guidance

✅ You stay focused (no YouTube rabbit holes)

10 July, 8AM EDT. One shot, limited spots.

Last class sold out! Don’t wait for “someday.”

🎯 The Pragmatic Playbook: Why Defense Stocks Deserve Your Attention

There’s something I’ve noticed in 2024 — and now, halfway into 2025 — that too many investors are still ignoring:

The defense sector is quietly building one of the strongest long-term setups on the board.

Not because of politics. Not because of war headlines. But because of structural spending shifts that are backed by cold, hard math.

And after the NATO Hague Summit confirmed a new baseline of 5% GDP defense spending across key member nations, that math just got harder to ignore.

📉 What Just Happened

Earlier this week, NATO’s 32 member states agreed to boost defense spending to a floor of 5% of GDP — a jump from the previous 2% target, with the U.S. already far surpassing that.

To put this into perspective:

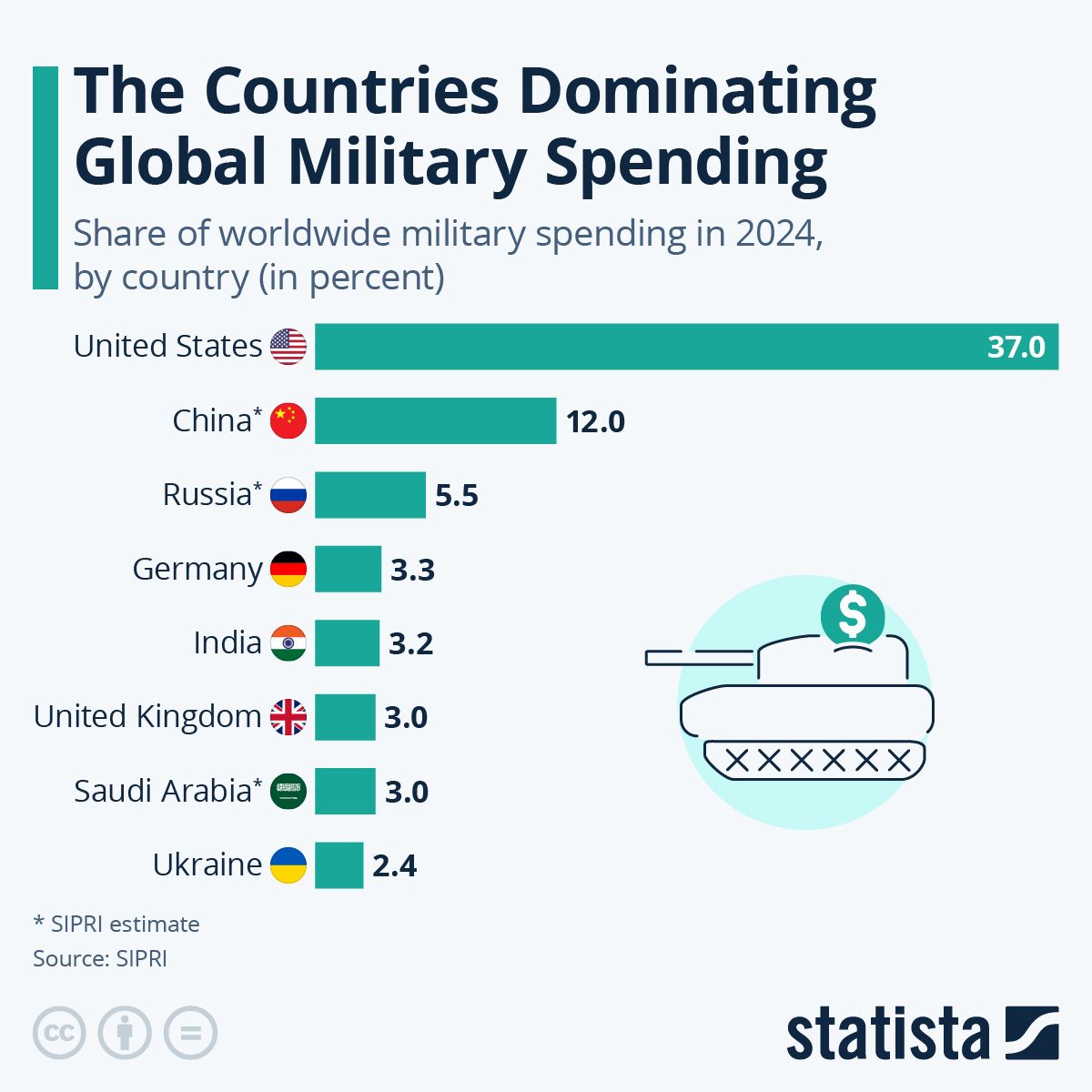

Global military spending reached $2.718 trillion in 2024, according to SIPRI — the highest ever recorded and a 9.4% YoY increase.

The U.S. Department of Defense’s FY2025 budget request is $849.8 billion, an increase from $842 billion in FY2024 — and the largest in modern history.

Defense backlogs for U.S. contractors now exceed $450 billion combined across Lockheed, RTX, and Northrop Grumman.

What caught my eye wasn’t just the headline — it was the fact that market sentiment barely flinched. No euphoric surge. No AI-level hype. Just business as usual. And that’s exactly why I’m watching it.

🧠 What It Triggered In Me

Most investors don’t know how to price defense. It’s not like tech — there’s no consumer buzz, no viral launches, and no Apple-style keynotes.

But here's what most people miss:

Wars don’t have to start for defense stocks to rise — budgets just need to swell.

And right now, the budgets are not only swelling — they’re becoming structural. This isn’t a knee-jerk wartime response. It’s a multi-decade rearmament cycle fueled by geopolitical tension, defense modernization, and military AI integration.

This reminds me of how I missed the energy setup in 2020. Everyone hated oil. ESG was dominant. But CapEx was drying up, inventories were falling, and quietly, the math was changing. By the time the crowd caught on, the easy money was gone.

That’s what defense feels like now.

📊 The Setup I’m Tracking

Let’s zoom into the U.S. names. These are the contractors and suppliers with multi-year tailwinds.

Company | Backlog/Orders | Yield / PE / Performance |

|---|---|---|

Lockheed Martin | $157–176B backlog | Trading near $458, ~17× forward, 2.7% yield |

RTX Corp | $217–218B backlog | Stock up 22% YTD |

Northrop Grumman | $92.8B backlog, +17.6% YoY | PE ~17, yield ~1.9%, $9.24 dividend |

These aren’t momentum stocks. They’re durable, high-margin machines priced like they’re still in peacetime.

And here’s the real kicker: Institutional positioning is still light. The smart money has not fully rotated here yet — but the contracts already have.

🚨 What I’ll Do — And What Would Stop Me

✓ My Move: Gradual core positioning in LMT, RTX, NOC as Q2 backlogs confirm and dividends hold steady.

✗ Stop-loss Triggers:

Margins slipping below 8%

Budget stalling post-election

Major fulfillment issues or insider selling

If funding sustains and contract pipelines grow, the risk isn’t early—it’s late.

🧭 Why This Sector Demands Clarity Now

Global military spend is now $2.7T and rising faster than at any time since the Cold War.

U.S. defense alone tops $850B and heads toward $1T by 2028—backed by bipartisan support.

Backlogs at major primes total over $450B combined, with no consumer sentiment drag, no valuation bubbles.

This isn’t speculative hype—it’s policy-anchored infrastructure investing with built-in inflation protection and bond-like reliability.

TOGETHER WITH OUR PARTNER

Finance Headlines, Translated for Humans

Every week, 1440 zooms in on one timely business or finance theme—whether it’s a sudden Fed pivot, an IPO frenzy, or the hidden economics behind AI chips—and unpacks it with crystal-clear analysis. Expect a swift read grounded in hard data: straightforward charts, context that connects the dots, and zero partisan spin. We cut through industry jargon so you gain real insight, not marketing fluff, leaving you informed, confident, and ready to talk markets like a pro—all in one concise email.

🧠 What did you think of today's newsletter?

🧘The Friday Reset

It’s easy to feel like you’re missing something right now. Defense names grinding higher without headlines. AI froth stealing the spotlight. Macro signals blaring one day and vanishing the next. This week wasn’t loud — but it was telling. The setups that matter aren’t shouting. They’re humming in the background, building quietly, while everyone’s still chasing whatever went up 5% yesterday.

I’m not here to predict. I’m here to prepare. That’s the real edge. Process beats panic, and clarity beats noise. The investors who win aren’t the fastest to react — they’re the ones who stay positioned while the rest get distracted. So if it feels like you’re behind, you’re not. You’re just early. Let them chase heat. We’ll stay with the setups that last.

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.