🌞 Good Morning, Pragmatic Thinkers!

This week was peak market theater. A couple of headlines moved prices like the world was ending, and a few earnings prints got treated like final verdicts instead of what they really are: data points in a longer story.

Here’s the uncomfortable truth most investors don’t want to hear: the market didn’t “discover new information” this week. It just changed what it was scared about. One day it’s inflation. Next day it’s AI spend. Next day it’s “what if growth slows.” Same movie, different villain.

And the fake drama? Everyone obsessed over the loud moves, the flashy winners, the trending takes. But what really mattered was quieter: capital allocation. Who’s investing into the next decade with a real edge, and who’s just spending because they’re afraid to be left out.

That’s why the biggest misreads this week weren’t about revenue misses. They were about narrative misses… when investors saw long-term investment and treated it like short-term failure.

So in today’s issue, I’m not here to hype. I’m here to simplify. I’m going to show you how to read the market’s reaction like a professional: what was fear, what was signal, and where the crowd might be pricing things emotionally instead of rationally.

Then in The Pragmatic Playbook, we’ll go deep on Google, the poster child for this week’s overreaction: a cash-printing machine that got punished not for failing, but for investing aggressively into AI.

Because the real edge right now isn’t prediction. It’s composure. When the market gets loud, I get specific. Levels, triggers, invalidation, and a plan that doesn’t require me to be right on Monday to win by December.

🔥 Market Pulse – What Actually Mattered

₿ Bitcoin Price Today — $70,000 in Focus

Bitcoin rallied recently and is once again testing the $70,000 level, a key psychological and technical threshold for crypto markets. Traders point to renewed institutional interest, easing macro volatility and favorable derivatives flows as catalysts behind the rebound. At the same time, volatility remains elevated — meaning short-term swings could be sharp, even as the broader trend holds within an extended cyclical uptrend.

🍏 Apple Stock Investors Just Got Fantastic News From China

Apple received a boost from stronger-than-expected iPhone sales in China, where demand outpaced forecasts and helped lift overall revenue expectations in a market that has been challenging for Western tech brands. Analysts noted not only sequential growth but also improving average selling prices, which can bolster margins for the March quarter. For long-term shareholders, this news alleviates some near-term bearish sentiment and reinforces Apple’s ability to compete even in price-sensitive regions.

📈 Broadcom’s Stock Rises on Google’s Spending Plans — But Nvidia’s Stock Extends Decline

Broadcom shares climbed as investors reacted to news that Alphabet plans significant cloud-infrastructure spending, which likely includes chips and networking silicon where Broadcom has strength. At the same time, Nvidia extended a recent decline as traders reassessed near-term earnings expectations and valuation multiples after softer guidance from some data-center end markets. The divergence suggests a potential rotation within semiconductor leadership — from pure GPU bets toward diversified infrastructure players benefiting from broader cloud hardware commitments.

TOGETHER WITH OUR PARTNER

If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, we break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

🎯 The Pragmatic Playbook: Google Got Punished For Spending, Not For Failing

Google just delivered a quarter that would make most CEOs pop champagne.

And the stock still got smacked.

That’s not because the business is suddenly broken. It’s because the market saw one thing and panicked. Not revenue. Not profit. Spending.

This is the exact setup that creates investor confusion: a great company does something strategically smart, but the stock reacts like it did something stupid.

So today I’m not doing a recap. I’m doing something more useful.

I’m going to tell you what the market really heard, why the reaction makes sense in the short term, why Google can still be a great bet long term even if AI spend doubles… and most importantly, what you can actually do with the stock from here without getting emotionally chopped up.

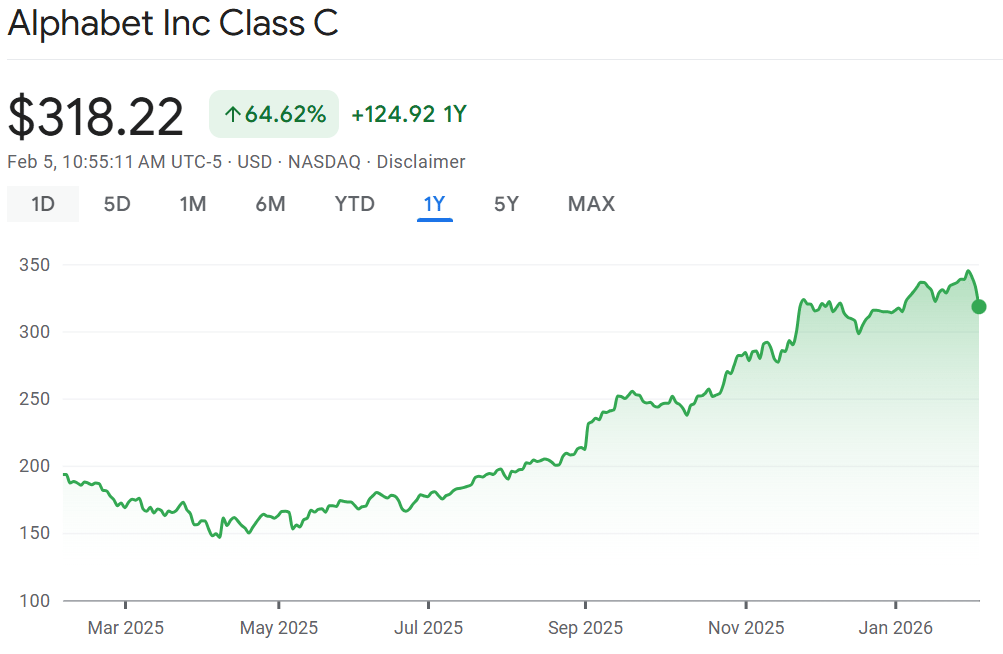

From the pre-earnings close around $333 to the post-earnings low around $307, GOOG dropped roughly 8% at the worst point before trying to stabilize.

That’s a meaningful move for a mega-cap.

And it tells you something important: this wasn’t “a normal pullback.” This was the market repricing a narrative.

The market wasn’t saying “Google’s quarter was bad.”

It was saying: “Prove the payoff on AI spending.”

😤 Why The Market Flinched

Let’s keep this simple and real. Five reasons.

Capex shock: investors hate when the bill shows up before the payoff

ROI timeline: the Street is in “show me” mode on AI monetization

Free cash flow fear: heavy spending can squeeze near-term FCF even if earnings look fine

Multiple reset: premium stocks get punished when the story gets messy

Search anxiety: if AI answers reduce clicks, ad economics become the battleground

None of this means Google is doomed.

It means the market is temporarily choosing caution over conviction.

And that’s normal.

💸 The Capex Headline That Spooked Everyone

The part that triggered the selloff wasn’t “bad business.”

It was the number.

Alphabet basically signaled an AI and infrastructure buildout that has investors thinking in terms of a much heavier spending cycle than they expected.

Here’s the part most people miss:

This isn’t a random spending spree.

This is data centers, chips, compute, and infrastructure so Google can scale AI inside Search, YouTube, and Cloud without falling behind.

Capex is not the enemy.

Capex without advantage is the enemy.

And Google actually has advantage: distribution, data, and a product ecosystem that already has billions of users.

🧱 The Overlooked Signal: Google Is Quietly Getting Stronger

This is where I get slightly contrarian.

The market is acting like “AI spend” is automatically bad.

But Google is one of the few companies on earth that can spend aggressively while still keeping the core engine alive and cash-generating.

🔍 Search + YouTube Still Print Cash

People talk like Search is fragile.

It’s not fragile. It’s still one of the most powerful cash machines ever built.

And YouTube is not just “video.” It’s attention. Distribution. Advertising gravity.

☁️ Cloud Is Becoming Too Big To Ignore

Google Cloud is no longer a side hustle.

The market still treats it like the “third-place cloud.”

But Cloud growth and contract backlog are the kinds of things that eventually force a re-rate, especially if margins keep improving.

🤖 AI Distribution Is Google’s Cheat Code

This is the key point.

Google does not need to win an “AI app contest.”

Google wins if AI becomes embedded into places people already use daily: Search, Android, Workspace, YouTube, Maps, Gmail.

That is how AI turns into a profit stream.

Not from hype. From habit.

🔥 So Is Google Still A Good Bet If AI Spending Doubles?

Here’s my honest take: yes, it can be.

Because the AI arms race isn’t just about “who has the coolest model.”

It’s about who has:

the cheapest long-term compute economics

the best distribution

the clearest monetization path

the deepest integration into daily workflow

Google is one of the few companies that can check all four boxes.

But there’s a condition:

Google doesn’t get rewarded for spending.

Google gets rewarded when spending becomes measurable monetization.

Until then, the stock can stay choppy.

🔭 What I’m Watching Next: Three Signals That Matter

If you want to stay grounded, track proof, not opinions.

✅ Signal 1: Cloud Growth + Margins Stay Strong

If Cloud keeps growing and margins hold up, the capex fear fades.

If Cloud slows while capex stays heavy, the stock can get stuck.

✅ Signal 2: Search Monetization Holds In An AI World

The real risk isn’t that AI exists.

The risk is that AI answers reduce click-outs and weaken ad yield.

If Google can monetize AI Overviews and protect ad economics, it’s a huge win.

✅ Signal 3: Gemini Adoption Becomes Habit

I don’t care about one-off download spikes.

I care about retention and integration.

If Gemini becomes a default layer inside Google’s ecosystem, AI becomes recurring revenue, not a science project.

🧭 My Stance (What I Would Actually Do)

If I don’t own GOOG, I’m not chasing anything. I’m building slowly only after the stock proves it can stabilize.

If I do own GOOG, I’m holding, and I only add when price gives me confirmation that the earnings selloff has been absorbed.

The real risk isn’t missing the bounce.

The real risk is buying before the stock stops bleeding.

🛠️ Actionable Playbook: Entry, Exit, Invalidation

GOOG is a great company.

But great companies can still be bad entries.

So here’s the plan, depending on your style.

🎯 Plan A: Investor Accumulation (6–18 Months)

Goal: build a position without letting emotions set the price.

Starter zone: $315–$320 only if price stops making new lows and holds multiple closes

Add zone: $305–$310 if it tests and holds again without breaking down

Panic zone: below $300 only if fear overshoots and you see a clear reversal

Invalidation: if GOOG breaks below the post-earnings low area and stays weak for 1–2 weeks without reclaiming, I stop adding and wait.

Profit-taking mindset: this is not a “flip it next week” plan. This is a compounding plan. The goal is a good average price, not bragging rights.

⚙️ Plan B: Swing Trade (2–6 Weeks)

Goal: avoid guessing bottoms.

Bullish trigger: reclaim $330 and hold for 2–3 sessions

That’s the market saying the capex shock is being digested.

Bearish warning: lose $305 and fail to reclaim quickly

That’s the market saying sellers still control the tape.

Exit logic: if you catch a reclaim and it runs, scale partial profits into strength near obvious resistance zones instead of trying to nail the exact top. Keep the rest with a trailing stop so you don’t overthink it.

🧯 Plan C: Options (For People Who Want Guardrails)

If you want exposure without full emotional whiplash:

Cash-secured puts near levels you’d actually be happy owning, especially around the $305–$300 zone

Call spreads only after a reclaim setup (like holding above $330) so you’re not buying upside into weakness

One rule: your option structure must match your timeframe.

Short-term emotions with long-term positions is how investors blow up a good thesis.

✅ Next 2 Weeks: My Checklist (Signal Over Noise)

This is what I’ll be watching, and it’s what should guide your next move.

Does GOOG hold $305–$310 on daily closes?

Does it reclaim $330 and stay above it?

Are down days losing momentum (smaller red candles, less panic)?

Does management commentary or follow-up guidance clarify capex cadence?

Does Cloud momentum stay strong enough to justify the spend?

If these start turning positive, the selloff becomes an opportunity.

If they don’t, patience is the play.

🧊 What Would Change My Mind?

I’m not married to Google. I’m married to reality.

Here’s what would make me step back:

Cloud growth slows while spending stays elevated

Search ad economics deteriorate because AI answers cannibalize monetization

The stock keeps breaking supports and can’t reclaim them, signaling the market sees deeper issues

If those show up, this isn’t a mispricing.

It’s a reset.

🧠 My Honest Take

Google didn’t get punished for losing.

Google got punished for investing.

The market is basically saying: “Cool story. Show us the cash flow path.”

And that’s fair.

But when a cash-printing platform gets marked down because investors are scared of a spending cycle that may strengthen its moat, I pay attention.

Not to chase.

To position patiently, with structure, and let the market prove when fear is peaking and reality is taking over.

TOGETHER WITH OUR PARTNER

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

🧠 What did you think of today's newsletter?

🧘The Friday Reset

By Friday, your brain is usually cooked from all the “urgent” noise. A stock drops, everyone screams panic. A stock rips, everyone screams FOMO. And you’re left staring at your watchlist like it’s a scoreboard deciding whether you’re winning or falling behind. That fatigue is real, and it’s expensive, because it pushes you toward the two worst habits in investing: chasing moves you missed, and overreacting to moves that don’t actually change the long game.

So here’s the reset I’m taking into the weekend. If it feels like you’re behind, you’re not, you’re just early, and early only hurts when you demand instant proof. When the market slows down, real clarity speeds up, because my edge doesn’t come from guessing, it comes from preparing levels, risk, and patience before the next headline hits. I don’t need to predict Monday, I need to be ready for it. Signal over sentiment, process over drama. Hype doesn’t last. Setups do, and the calm investor usually wins because they’re the only one still thinking clearly.

Stay Sharp,

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.