🌞 Good Morning, Pragmatic Thinkers!

he market spent the week chasing shadows. Tech headlines screamed about momentum, financials obsessed over the Fed’s next breath, and everyone tried to outguess each other on noise that will be forgotten by Monday. But while the crowd was busy trading drama, they missed the quiet signals that actually build edge.

Here’s the uncomfortable truth: what moves the needle long term isn’t what trends—it’s what compounds. A 12% pop in a hype stock steals attention. A 23% rise in profits at a company most investors dismiss as “boring” gets buried on page six. That’s how opportunity hides in plain sight.

The market wants you distracted. It thrives on the idea that conviction is built by reacting faster, louder, riskier. I’ve learned the opposite: conviction is built in stillness, by refusing to let narrative whiplash dictate your process.

This week was a perfect case study. The crowd debated the glamorous, while Copart quietly reminded us that execution matters more than noise. That’s where the edge sits—steady, patient, overlooked.

So today, in The Pragmatic Playbook, I’m pulling focus back to what matters. Not the chatter, not the hype, but the setup hiding under the surface.

Because if the week left you feeling like you missed something—you did. But not what you think. The real miss wasn’t chasing the wrong stock. It was ignoring the right one.

🔥 Market Pulse – What Actually Mattered This Week

It’s no longer a “maybe.” The shutdown is active, and the administration is beginning to pull funding and leverage cuts in essential services. When government halts and starts picking winners and losers, market complacency gets tested hard. Those exposures you think are safe? They’re not immune in a funding freeze.

After months of fighting the narrative on interest rates alone, the Fed is gaining allies — particularly around the idea that cuts should be cautious and calibrated. That’s a signal shift: markets have been pricing aggressive easing, but now the internal guardrails are coming into view. If you’re layered in leverage assuming the Fed is all-in with dovish pivots, you’ll find yourself squeezed.

While everyone’s stuck debating Nvidia’s next move, this underdog chip stock has quietly outpaced it. That’s not luck — that’s execution and structural edge. The lesson? In markets driven by narrative, the real alpha often lies in the forsaken tangent. Miss the tangent, and you’ll forever feel like you arrived late.

TOGETHER WITH OUR PARTNER

Earn your PE certificate online. Build an MBA-style network.

The Wharton Online + Wall Street Prep Private Equity Certificate Program gives you the knowledge and tools top professionals use to analyze investment opportunities.

Learn from senior leaders at top firms like Carlyle, Blackstone, and KKR.

Get direct access to Wharton faculty in live office hours where concepts become clear, practical, and immediately applicable.

Study on your schedule with a flexible online format

Plus, join an active network of 5,000+ graduates from all over the world.

Enroll today and save $300 with code SAVE300 + $200 with early enrollment by January 12.

Program begins February 9.

🎯 The Pragmatic Playbook: Copart Deserves a Second Look

Wall Street yawns when Copart reports. And that’s the tell. Because boring stocks don’t just survive—they sneak up and compound while the crowd is chasing fireworks.

Copart just posted Q4 revenue of $1.1B, up 5.2% YoY, and net income that surged 23%. That’s not a fluke—it’s operating leverage at work. And it’s happening in a flat auto cycle when peers are treading water.

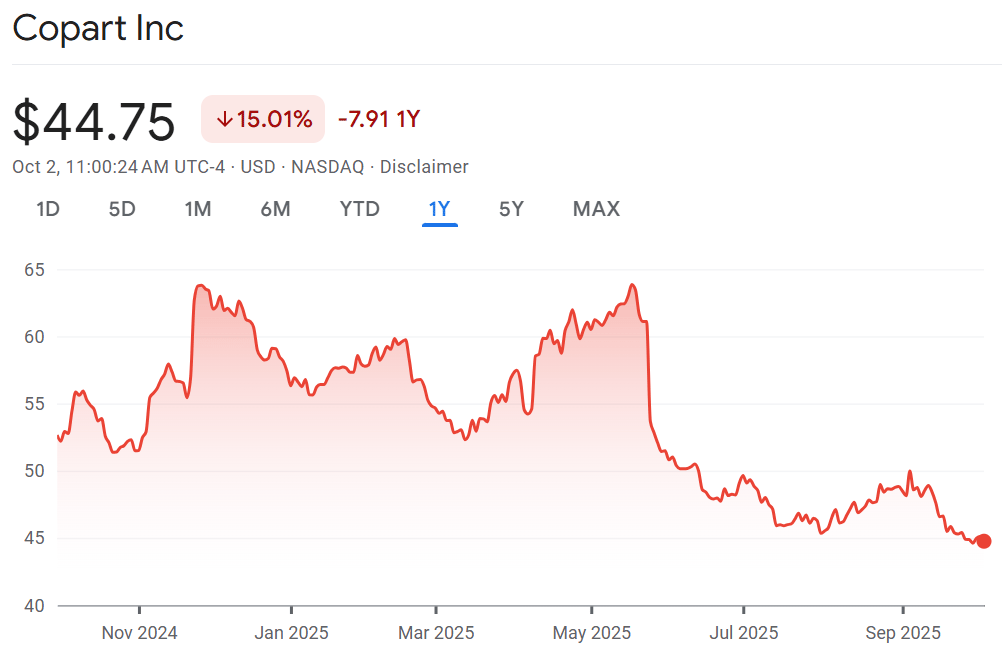

Yet the stock slid into the mid-$40s, creating confusion. Stephens cut its target to $46 on “competitive concerns.” At the same time, HSBC raised theirs to $62. A Copart director sold ~$10M in shares, feeding the fear. This is the part of the cycle most investors run from.

But I lean in. Because tension like this is where real setups form.

🧠 What It Triggered In Me

I’ve been here before. In the early 2000s, I ignored O’Reilly Automotive because it was “just auto parts.” It tripled while I chased sexier names that fizzled. That scar tissue doesn’t fade—it shapes how I read companies like Copart today.

Copart doesn’t sell dreams. It runs the plumbing of the auto ecosystem—auctions, salvage, remarketing, global yards. Unsexy? Yes. But indispensable. When insurers need to clear wrecks, Copart is the one with the scale, the software, and the yards. That’s a moat built in steel and asphalt, not hype.

What this triggered in me is simple: don’t confuse quiet execution with stagnation. The crowd is punishing Copart for being boring, not broken. And that’s exactly where edges are born.

📊 The Setup I’m Tracking

Let’s break down what matters:

Revenue resilience: Growing mid-single digits in a flat auto cycle isn’t “meh”—it’s outperformance.

Profit acceleration: Net income up 23% shows scale advantage. When competitors stall, Copart widens margins.

Analyst divergence: Targets swing from $46 to $70. That spread screams uncertainty—and opportunity for anyone willing to see past the noise.

Insider sale: $10M spooked traders. But insiders sell for many reasons—taxes, diversification—not always because the ship is sinking. Watch patterns, not one-offs.

Global expansion: New yards in Europe and the Middle East keep widening the moat. Competitors can’t catch up without years of capex.

The bold takeaway: Copart doesn’t need to reinvent itself. It just needs to keep executing in a space only it can dominate.

🧨 Peer and Macro Context

Context sharpens conviction. While IAA and KAR fight for scraps, Copart runs the board. Scale wins in salvage—it lowers costs per auction, improves recovery rates, and makes insurers stickier.

Zoom out further: U.S. vehicles are older than ever (average age ~12.6 years). Accident rates rise as fleets age. Insurance claims grow. That’s Copart’s flywheel. More wrecks → more auctions → more fees. It’s not cyclical hype—it’s structural tailwind.

So while Wall Street obsesses over Tesla’s robotaxis, Copart is quietly monetizing the fact that cars still crash. That’s edge hiding in plain sight.

🚨 What I’ll Do — And What Would Stop Me

If this were my capital, here’s how I’d frame it:

Starter position zone: Mid-$40s is where I’d plant the flag. Not chasing, not all-in—just skin in the game.

Adds: Above $55 on high volume, I’d see that as conviction returning.

Confirms: Service margins widening, guidance pointing to steady double-digit profit growth, and institutions revising targets upward.

Stops: Insider sales accelerating into a pattern, management turning cautious on demand, or failure to reclaim $50 despite strong results.

That’s how conviction is built. Not on noise, but on filters and non-negotiables.

🧠 The Scar Tissue Lesson

The market loves to overvalue fireworks and undervalue plumbing. I’ve lived through it too many times to ignore.

In 1999, web traffic was treated like revenue. In 2017, crypto wallet downloads were treated like profit. Both burned investors who confused activity with value.

Copart is the opposite. Investors dismiss it as “just auctions” while it quietly scales margins and global reach. The pain isn’t owning too early—it’s waking up five years later and realizing you missed the compounder because it looked boring.

📈 What I’m Tracking Next

Revenue cadence: If Copart grows 5–7% while autos are flat, the market will have to re-rate it.

Profit margins: The 23% net income growth is the real number. If it holds, valuation expands.

Global yard expansion: Each new yard is a fortress. Competitors can’t just “copy-paste” this model.

Institutional flows: Funds drifting back in would validate the setup.

Sentiment reset: When analyst targets converge, you’ll know the window is closing. Right now, that divergence is the gift.

✅ Takeaway

Copart isn’t flashy. It won’t give you cocktail party bragging rights. But it will do something most investors overlook: compound quietly in a space only it can dominate.

The market is punishing it for being boring. I see that as the opening. Because boring is where wealth hides.

The nightmare isn’t buying Copart at $45. It’s explaining to yourself in 2030 why you didn’t.

And I’ve lived that regret before. I don’t intend to repeat it.

TOGETHER WITH OUR PARTNER

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

🧠 What did you think of today's newsletter?

🧘The Friday Reset

Weeks like this tempt you to chase the stories that shout the loudest. The market is busy debating whether companies like Copart are too boring to matter or too essential to ignore. That back-and-forth wears people down. It makes investors forget that fatigue itself is a signal—when everyone else is distracted by flashier names, the real workhorses quietly keep building. I’ve learned that the harder it feels to pay attention to the “boring,” the more likely it is that something important is hiding there.

The reset is simple: clarity comes from resisting the pull of noise and returning to process. My conviction isn’t built on predicting which stock makes the front page tomorrow—it’s built on spotting patterns that repeat over years. Companies that quietly execute while sentiment swings are where wealth compounds. That’s why I ground myself in setups like the one we just walked through. Hype fades. Stillness endures. And the edge lies in holding steady when others look away.

Stay Sharp,

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.