🌞 Good Morning, Pragmatic Thinkers!

Wall Street got loud again this week — Nvidia rallied, inflation cooled, and suddenly everyone forgot they were bearish two weeks ago. That’s the market’s favorite party trick: turn on the optimism when it’s safe, and pretend the doubt never existed. But here’s what most investors missed while chasing headlines — the AI rally didn’t start this week. It got institutional validation weeks ago. This was just the crowd showing up late.

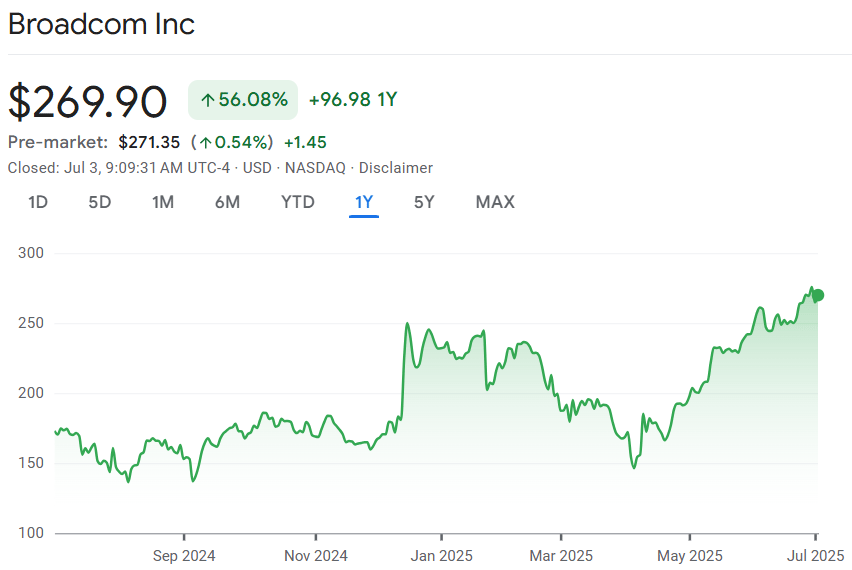

Meanwhile, everyone’s still treating Broadcom like a side character. The stock’s up nearly 50% in two months, crushed earnings, and is guiding for another 20% revenue jump next quarter. And yet? Most traders still think it’s a chip play. AVGO isn’t catching up — it’s being reclassified. But the window to buy early conviction is closing fast.

This wasn’t a week to be clever. It was a week to be clear. Hype rotated, noise spiked, and setups kept unfolding beneath the surface. If you were paying attention, the market told you exactly where the real money’s heading next.

So let’s block out the noise and get into it — this week’s Pragmatic Playbook is about Broadcom, the setup that still feels “too high” to buy — and why that’s exactly where the edge is.

🔥 Market Pulse – What Actually Mattered This Week

The S&P 500 just hit all-time highs — and no one’s scared. That should make you pause. When records fall without resistance, and bullish headlines drown out macro friction, it’s a sign the crowd has stopped asking what could go wrong. This wasn’t a week of momentum — it was a week of complacency dressed up as confidence. Under the surface, the signals were way messier than CNBC let on.

📈 S&P 500 Hits Record High — But What Happens Next?

The S&P 500 surged to another record this week, driven by Big Tech and soft inflation data. The rally looks clean — but here’s the truth: breadth is thinning and earnings season is the next reality check. Stocks hitting highs while the Fed stays vague is not bullish confirmation. It’s a setup for disappointment if results don’t deliver perfection.

🌐 Major Trade Deals Face Deadline Chaos

While everyone was busy buying the dip, Washington quietly fumbled two major trade deals — one with the EU, the other with South Korea. The risk isn’t just tariffs. It’s global uncertainty returning to the boardroom just as supply chains were finally stabilizing. Investors betting on smooth international growth in Q3 may be leaning on a broken crutch.

🧯 Billionaire Investor Bessent Slams Fed Clarity

Scott Bessent didn’t mince words: the Fed is flying blind. With sticky inflation under the surface and a market priced for three cuts, his warning was clear — policy credibility is cracking, and investors aren’t hedging for it. If he's right, the soft landing isn’t the base case — it’s the bait.

TOGETHER WITH OUR PARTNER

Marketing ideas for marketers who hate boring

The best marketing ideas come from marketers who live it.

That’s what this newsletter delivers.

The Marketing Millennials is a look inside what’s working right now for other marketers. No theory. No fluff. Just real insights and ideas you can actually use—from marketers who’ve been there, done that, and are sharing the playbook.

Every newsletter is written by Daniel Murray, a marketer obsessed with what goes into great marketing. Expect fresh takes, hot topics, and the kind of stuff you’ll want to steal for your next campaign.

Because marketing shouldn’t feel like guesswork. And you shouldn’t have to dig for the good stuff.

🎯 The Pragmatic Playbook: Why I’m Watching AVGO’s Parabolic Surge — and What It’s Actually Signaling

I almost closed my AVGO tab this week — not because the setup looked weak, but because it looked too good.

That’s when I knew I had to dig in deeper.

See, there’s a weird kind of fear that shows up when a stock runs exactly like the playbook says it would. The technicals line up. The macro winds support it. The narrative clicks.

And your gut still whispers: “This can’t be real.”

That voice? That’s not caution — it’s doubt dressed up as discipline.

And if you let it dictate your next move, you’re not investing anymore — you’re just protecting your ego.

AVGO is on a tear. But what it’s really exposing is how uncomfortable conviction can feel when it’s finally validated.

📉 What Just Happened

Let’s walk through the most recent price action and unpack the layers:

AVGO is trading near $270, marking fresh, all-time highs. It’s not just a breakout — it's a clear redefinition of valuation.

The catalyst? Strong Q2 FY2025 earnings released in early June:

Revenue reached $15 billion, up 20% year-over-year from $12.49 b in Q2 2024.

Adjusted EPS at $1.58, compared to $1.10 YoY, signaling improved net income performance.

AI semiconductor revenue surged 46% YoY to $4.4 billion, making up 40% of the AI segment. Q3 guidance projects $5.1 b — a massive sequential beat.

Tomahawk 6 switch launched, offering 102.4 Tbps, and doubled down on VMware's software traction, further solidifying AVGO’s role as an AI infrastructure leader.

Despite a ~3–4% dip in after-hours trading, that was merely calibration — analysts responded with target hikes (Jefferies $315, Mizuho $310) .

Finally, don’t forget the July 2024 stock split (10-for-1) — now trading with institutional-sized float and retail-friendly price.

🧠 What It Triggered In Me

That tightness in my gut isn’t uncertainty — it’s tension the market wants us to mislabel.

I felt it when I saw AVGO blow past $260 with no meaningful pullback. The kind of move that almost looks like a typo. But that tension? It’s not a flaw — it's a feature.

Conviction doesn’t feel comfortable. If it does, you're late.

I’ve been conditioned to fear “chasing,” yet right now, chasing may be the last irrational act.

This is an entry conditioned on tension — not trigger-induced momentum chasing. That’s why I paused to map it.

📊 The Setup I’m Tracking

Let’s break this down with modular clarity and emotional anchoring.

1. 🛠️ AI Revenue: Cemented Trajectory

Q2 AI semis at $4.4B, +46% YoY, Q3 guidance at $5.1B (+60% YoY)

CEO Hock Tan forecasts this momentum sustaining into FY2026

If estimates hold, future projections could reach $20B this fiscal year, then $30B+ FY2026

Takeaway: This isn’t a quarterly sugar rush — it’s a structural uplift in AI-driven revenue.

2. 💵 Total Revenue & Profitability

Total revenue at $15B, a 20% YoY increase

Infrastructure software (VMware) grew ~25% YoY to $6.6B, adding diversification to semiconductorcyclicality

Adjusted net income climbed: EPS at $1.58 (+44% YoY)

Takeaway: Broadcom is merging rising AI momentum with stable software growth — giving this rally structural depth.

3. ⚙️ Tech Infrastructure Innovation

Tomahawk 6 launch, delivered high-speed networking with 102.4 Tbps, critical for hyperscale AI workloads

VMware Cloud Foundation 9.0 and AI enhancements to Tanzu CloudHealth showed software integration executing at scale

Takeaway: AVGO is pivoting from hardware vendor to infrastructure pillar — and markets recognize the shift.

4. 🧩 Structural Volume & Institutional Flow

Trading volume surged in earnings aftermath, indicating institutional accumulation.

After-hours dip was short-lived; shares rebounded quickly, reinforcing investor positioning.

Analyst target hikes signal renewed confidence: Jefferies to $315, Mizuho $310, UBS/Bernstein/Truist also upgraded .

Takeaway: This isn’t retail hype — it's institutional capital moving accessibly.

🚨 What I’ll Do — And What Would Reset My Stance

I’m treating this as a structure-paced build, not a chase.

✅ Entry point: If AVGO pulls back to $260–265, aligns with the 21-day EMA and range low, I’ll scale in.

✅ Core build phase: Sustained hold above $275–280 for 2–3 weeks = consolidation into new regime → I’ll continue layering.

✅ Big data point: Q3 guidance exceeding $16B, or AI revenue hitting $6B+, pushes me from structure to conviction.

✅ Conviction cap: News flow confirming multiple hyperscaler wins, export deregulation to China, or deeper VMware integration.

But I have guardrails.

🚫 Insider sell-off — especially by Hock Tan — would kill the thesis.

🚫 Uncontrolled parabolic pump — euphoria without consolidation? I won’t chase.

🚫 AI crack in sector (e.g., NVDA/AMD show exhaustion) might drag AVGO reflexively.

📌 Core principle: trade confirmation, not impulse. Structure, not ego.

🔥 Big Takeaway: AVGO Is Building A New Identity

This isn’t a chip stock riding AI hype — AVGO is becoming AI infrastructure.

It’s an AI fabless + hyperscale switch + software stack.

And now the numbers back it:

$15B total revenue (+20% YoY)

$4.4B AI semis, projected $5.1B next quarter (+60% YoY)

$6.6B in software revenue, growing steadily

Strong analyst upgrade momentum

What makes this setup unique isn't just the numbers — it’s the re‑classification.

📣 Market thinks AVGO is mission critical.

That’s far different than “it finally popped.”

🎯 Thoughts

AVGO’s rally isn’t a flash in the pan. It’s infrastructure in motion. When conviction arrives cloaked in tension, that’s not risk. It’s entry.

I won’t chase a vertical — I’ll position on structure.

This is the kind of move we’ve trained for. It’s not about catching the bottom. It’s about sizing the truth in real time.

And right now, the truth reads like conviction disguised as discomfort.

🧠 What did you think of today's newsletter?

🧘The Friday Reset

This week, a lot of people stared at AVGO’s chart and felt like they missed the boat. I get it. When a stock runs like that, your first instinct is to start hunting for the “next AVGO.” That’s where bad trades are born — not from lack of research, but from the need to make up for what you didn’t catch. That pressure? It’s not clarity. It’s FOMO pretending to be urgency.

Here’s what I’ve learned the hard way: you don’t need to catch every breakout to win. You need to stick to setups that make sense to you, even if they’re not trending on FinTwit. If the move didn’t fit your process, it wasn’t yours. Let it go. Reset. Get back to watching names you understand, at levels you’ve mapped out. No noise. Just patience.

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.