🌞Good Monday Morning, Folks!

This market doesn’t reward discipline. It punishes boredom.

That’s the game right now — and most investors are getting played.

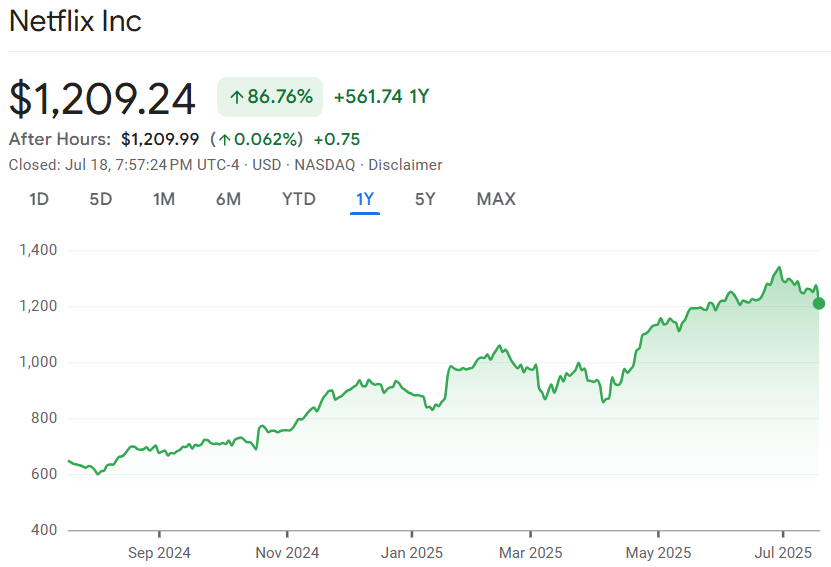

Netflix just delivered a masterclass in compounding: fat margins, rising cash flow, a breakout ad business… and the stock dropped. Not because the numbers were bad. Because they were too good. Too clean. Too efficient. And that’s not sexy enough for a market chasing the next AI pop.

But here’s the kicker — while everyone else was looking for flash, Netflix quietly cemented itself as a platform. Not just a streamer. A global monetization machine with pricing power and levers to pull for the next decade.

This week, I’m unpacking what actually happened in Netflix’s Q2 — and why the market’s tepid reaction is exactly the kind of mispricing serious investors wait for.

Because if you’re still judging this stock by subscriber growth… you’re not just late — you’re playing the wrong game.

Let’s set the record straight.

⚡ Quick Hits - What Actually Matters This Week

🟢 July Rate Cut Just Got the Green Light

The Fed’s pivot is no longer hypothetical. A top official just signaled support for a July rate cut, confirming what the bond market has been pricing in for weeks. But here’s what most investors are missing: this isn’t just a macro shift — it’s a timing signal for risk-on plays that have been waiting for liftoff. If you’re sitting in cash thinking you’ll wait for confirmation, you’ll miss the move when it starts.

💸 These Stocks Are Built for Right Now — Not Someday

Retail investors are finally waking up to stocks with pricing power, cash flow, and near-term catalysts. This breakdown from Fool isn’t just another list — it nails the shift happening under the surface: away from speculative moonshots and back toward compounders with actual earnings traction. If you’ve got $1,000 to put to work, you need to be thinking in months, not decades — because that’s how fast the market’s repricing leadership.

⚠️ Earnings Misses Will Hurt More Than Ever

We’re entering a quarter where “not bad” won’t cut it. As stocks flirt with new highs, the bar is higher — and the punishment for missing is brutal. Think Tesla, think Intel. Wall Street’s tolerance is gone, and this earnings season could be the most binary we’ve seen in years. If you're holding names with wobbly narratives, don’t wait for the report to make a decision.

TOGETHER WITH OUR PARTNER

Find out why 1M+ professionals read Superhuman AI daily.

AI won't take over the world. People who know how to use AI will.

Here's how to stay ahead with AI:

Sign up for Superhuman AI. The AI newsletter read by 1M+ pros.

Master AI tools, tutorials, and news in just 3 minutes a day.

Become 10X more productive using AI.

💡One Big Idea: Netflix Just Quietly Won the Streaming War — But Wall Street's Still Looking the Other Way

You ever watch a stock put up near-perfect numbers… and the market just shrugs?

That’s Netflix right now.

They posted one of the strongest quarters in the company’s history — and instead of a rally, the stock dipped. Not because of weak guidance. Not because of deceleration. But because investors still haven’t updated the mental model they’re using to evaluate this company.

So let me say it plainly:

Netflix is no longer a “streaming stock.”

It’s a global monetization platform with SaaS-level margins, real cash flow, and a content engine built to scale without burning capital.

And if you’re still valuing it like it’s just another entertainment name, you’re missing the entire setup.

💥 What Just Happened: Netflix’s Earnings Beat Wasn’t Just Strong — It Was Strategic

Let’s talk numbers, because they matter.

Revenue: $11.08B — beat expectations and grew ~16% YoY

EPS: $7.19 — crushed the $7.07 estimate, up 47% YoY

Net Income: $3.13B — a 46% jump

Operating Margin: 30% — Netflix raised full-year guidance to 30%, compared to 22% a year ago

Free Cash Flow: $2.1B for Q2, with a 2025 forecast of $8B+

Ad Tier Users: 94 million and growing — now up to 55% of new sign-ups in supported markets

Subscriber Growth: +8 million net adds — solid, but not even the best part

Now, I’ve seen plenty of beat-and-raise quarters. What’s rare is this level of execution paired with discipline.

Most streaming players are still bleeding. Disney’s cutting costs. Paramount’s figuring out how to merge. Warner Bros is spinning in circles. But Netflix?

They’re printing cash — and buying back stock.

This is the kind of shift that usually takes Wall Street months (sometimes years) to properly price in. That’s the edge.

😮💨 The Market Still Doesn’t Get It

The stock ran up into earnings. Then dipped about 5% afterward. Not because the report was bad — but because people saw a “perfect quarter” and thought… that’s as good as it gets.

But here’s what they missed: this isn’t peak Netflix. This is the start of the compounder phase.

We’re now looking at:

High-30% EPS growth

FCF machine-mode (>$8B forecasted this year)

Ad business inflection point

Price increases sticking

Operating margin expansion — with room to go

And yet… the stock is still trading under its all-time high from 2021. Back when it had lower margins, less diversified revenue, and zero ad monetization.

That’s not efficient pricing. That’s a lagging narrative.

🧠 What This Triggered in Me

Look, I’ve been burned by Netflix before.

Back in 2022, when they announced the password crackdown, I thought it would backfire. I thought it’d create churn, not growth.

I was wrong.

It added millions of net new subscribers. And more importantly, it showed me something I didn’t fully appreciate: people don’t just use Netflix — they rely on it.

It’s the default.

That kind of brand gravity is rare. Combine it with improving monetization and you’ve got something most of the market hasn’t modeled correctly yet: durable, high-margin growth.

This isn’t about chasing a quarterly beat. It’s about recognizing a pivot in business DNA.

🧨 Where the Mispricing Lives

Here’s what most investors are still getting wrong:

They’re still using subscriber growth as the main KPI.

That was true in 2018. It’s outdated in 2025. Revenue per member, ad-tier ARPU, margin expansion — those are the new levers.They think content is still a black hole.

It’s not. Netflix has cracked the code on global scalable hits. A Korean drama can do 200M hours. A $50M budget docuseries can beat a $200M Hollywood bomb. Their content engine isn’t just creative — it’s capital-efficient.They’re ignoring the optionality.

Gaming. Live sports (think Formula 1 docuseries model). Event-style drops. Netflix is quietly testing multiple levers that don’t show up in GAAP revenue yet… but will reshape the next 5 years.They underestimate pricing power.

We live in a world where every household has 5–7 subscriptions. Netflix is the one most people won’t cancel. That’s sticky, pricing-power gold.

⚡ The Emotional Blind Spot

Let’s be honest: some investors just don’t want to believe in Netflix anymore.

They think it’s “fully priced.”

They think the growth story is over.

They missed the 2023–2024 recovery, and now they’d rather ignore it than buy back in at new highs.

That’s the psychological trap. Loss aversion. Ego. Anchoring.

But if you strip that away and look at the business?

It’s one of the most well-run monetization engines in the world right now.

And the market still hasn’t fully caught on.

🔎 What I’m Watching

I’m not saying go all-in here. This isn’t a trade idea. It’s a signal.

What I’m watching now is narrative rotation.

If we start seeing Netflix mentioned in the same breath as “platform compounders” — alongside Apple, Meta, Microsoft — the re-rating could happen faster than most expect.

Because that’s what it is.

Not an entertainment company.

Not a “streaming stock.”

But a global digital platform with multi-revenue stream scaling, fat margins, pricing power, and behavioral moat.

If this were a SaaS company, trading at ~45x forward earnings with this kind of cash generation and margin profile… you’d hear nothing but bullishness on CNBC.

But it’s Netflix — so everyone’s cautious.

That’s where FOMO starts to creep in.

✅ The Pragmatic Insight

Here’s what I’d consider if I were managing a long-term portfolio today:

Track how fast ad-tier monetization is ramping — 94M users is no joke.

Focus less on total subs, more on monetization per sub and margin trend.

Pay attention to how analysts and funds talk about Netflix over the next 1–2 quarters — once it gets the “compounder” label, it’s game over for value buyers.

Smart money doesn’t chase pop stocks.

It positions for businesses that are just starting to inflect — structurally, not sentimentally.

That’s what Netflix just showed us.

And most of the market is still behind the curve.

Ultimately, smart investing isn’t about following the crowd or buying a chart breakout. It’s about seeing a business change before the narrative does — and positioning before the herd catches on.

Netflix is showing us the signals.

If you’re paying attention, it’s hard to ignore.

📉 Missed Friday’s Breakdown?

I doubled down on AMD — not because I’m chasing hype, but because I saw something in the data everyone else is ignoring.

👉 If you’ve been on the fence about chip stocks, this is the one read you can’t afford to skip

🧠 Final Thought

What struck me most after digging into Netflix’s latest quarter wasn’t the revenue or the earnings. It was the discipline. The restraint. The quiet shift from chasing scale to compounding it — not with flash, but with focus. In a market addicted to catalysts and story stocks, Netflix is playing a longer, smarter game. And still, most investors can’t see it because they’re too busy looking for fireworks.

That’s the trap: mistaking excitement for durability. But real edge comes from learning to recognize strength before the crowd rewards it. High-margin growth, behavioral moats, cash flow discipline — these are not temporary traits. They’re the quiet signals of a business that’s stopped trying to prove itself and started pulling away. And if you’re only scanning headlines, you’ll miss the fact that this is how outperformance starts: not in the noise, but in the conviction to see what’s becoming obvious — before it is.

🧠 What did you think of today's newsletter?

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.