🌞Good Monday Morning, Folks!

This week? A mess — but not for the reasons you think.

Everyone’s obsessing over Tesla’s $50 billion haircut or Netflix’s earnings “miss,” but here’s the truth no one wants to admit: the market isn’t broken… it’s bored. Growth stocks are doing what adults do — slowing down, tightening margins, acting responsibly — and Wall Street’s throwing a tantrum because the sugar rush is gone.

I’m not here to cheerlead or panic. I’m here to decode the tantrum. Because what’s happening right now isn’t chaos — it’s clarity. The market’s just reminding us that valuation without discipline is a house built on vibes.

In today’s issue, I’ll break down what Netflix’s post-earnings drop really means, why the “EV and streaming fatigue” headlines completely miss the point, and how smart investors can turn short-term disillusionment into long-term positioning.

If you’ve been staring at your screen wondering why every good result gets sold off — this one’s for you. Let’s talk about what’s actually happening beneath the noise, and how to use it before everyone else sobers up.

⚡ Quick Hits

The U.S. is reportedly moving to impose deeper software export controls on China—and the implications are enormous. This isn’t just another tech headwind—it signals a structural decoupling in global supply chains, and when chips and software get locked down, growth assumptions built on cheap cross-border flow start to crack. Miss this, and you’ll be behind when winners emerge in the reshuffle.

If you’re counting on a prolonged phase of “semi-retirement plus side hustle,” you might need to rethink it. New rules are set to change how retirement benefits work when you keep working and collecting, and that has big implications for retirement income, company pension planning, and wealth strategy. The market tends to ignore rules-shifts until the penalty shows up.

Massive AI-infrastructure spending is masking underlying weakness across sectors, and that’s a double-edged sword. Yes, it’s propping up growth—but if earnings don’t materialize as promised, it may become the biggest vulnerability in the system. If you assume growth is stable because “AI is saving it,” you’ll miss how quickly momentum can reverse.

TOGETHER WITH OUR PARTNER

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

💡One Big Idea: Netflix’s 17% Growth, Wall Street’s Panic - The Market Just Taught Us What Maturity Costs

Netflix just reported one of its strongest quarters in years — and the market punished it anyway.

Revenue surged 17% year-on-year to $11.51 billion, with subscriber and ad-tier growth both ticking up. The company even delivered consistent cash flow, proving its business model is solid. But none of that mattered.

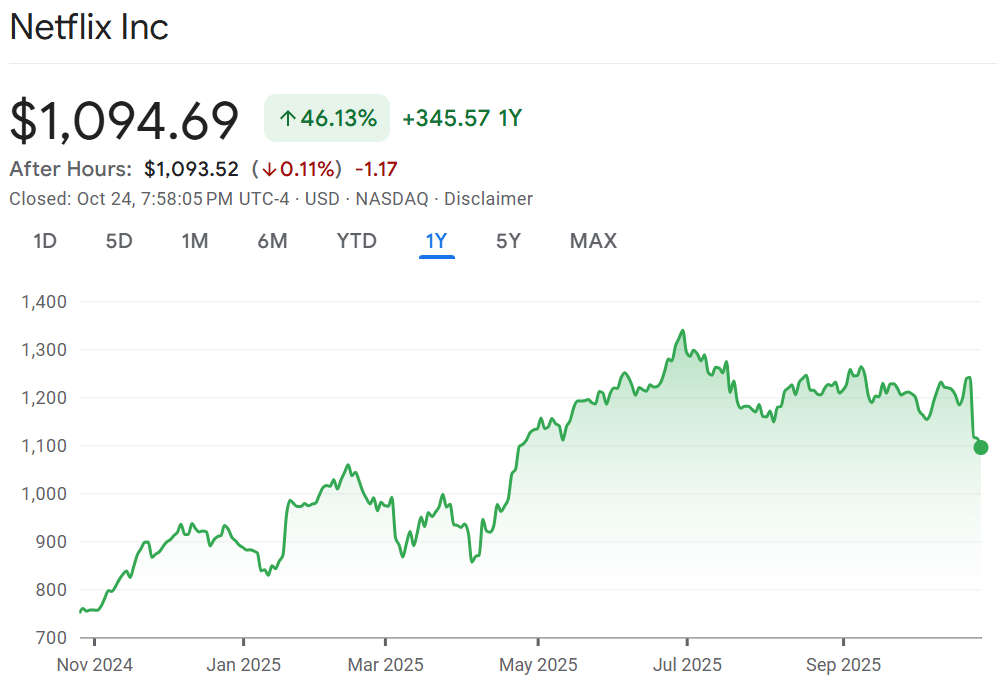

The stock dropped roughly 5.6%, closing around $1,094.69.

That’s the paradox of this market: when a company stops being a “growth story” and starts being a “real business,” investors shift the goalposts overnight. Netflix didn’t fail — it matured. And Wall Street doesn’t reward maturity.

⚙️ What Really Happened

On the surface, the results looked great. Revenue up 17%. Engagement healthy. Subscriber base still expanding.

But the earnings per share came in at $5.87, missing estimates by over a dollar — thanks to a one-time $619 million tax charge from a dispute in Brazil. Operating margins dropped from the low 30s to roughly 28%.

That tax hit isn’t structural. But perception moves faster than fundamentals.

And perception said: “Netflix missed.”

That’s how fragile investor psychology is right now. Markets don’t care about long-term execution — they care about instant precision. One imperfect quarter, and conviction evaporates.

But when I look past the headlines, the story isn’t broken — it’s just misunderstood.

📉 Why The Market Reacted

This sell-off wasn’t fear — it was fatigue.

Netflix is no longer the hungry disruptor it once was. It’s now the incumbent. The bar is higher, the patience thinner, and the reward-to-risk trade-off smaller.

When a company reaches scale, investors stop rewarding ambition. They demand efficiency.

That’s why the market reacted so sharply. Investors weren’t dumping Netflix because it underperformed — they were dumping it because it’s transitioning.

Here’s the uncomfortable truth:

The stock didn’t drop because growth slowed. It dropped because growth finally matured.

That’s what happens when expectations are built on endless acceleration — the moment you stabilize, the market gets bored.

🧭 The Pragmatic Playbook

Here’s how I’m approaching Netflix from both a trader’s lens and a long-term investor’s perspective.

💡 If/Then Framework for Action:

If Netflix holds above $1,050, the post-earnings dip is likely a sentiment flush, not a trend reversal.

If it breaks and closes below $1,050, brace for a retest near $1,000 — the next logical support zone.

If it rebounds and closes above $1,150, momentum traders can target $1,220–1,250 as a short-term upside zone.

That’s the tactical setup. But here’s how I think about it strategically 👇

Short-Term (Next 3 Months)

This isn’t the time to chase rebounds. Let the stock settle around $1,050–1,100. I’ll add only if the next earnings guide reaffirms margin recovery toward the mid-30% range and shows ad-tier ARPU expansion.

Mid-Term (6–12 Months)

If Netflix delivers steady ad-tier growth (10–15% ARPU increase) and keeps churn low, I expect a re-rating toward $1,300–1,350. I’ll accumulate slowly under $1,100, trimming near pre-earnings highs if the narrative doesn’t strengthen.

Long-Term (3–5 Years)

If Netflix succeeds in scaling its hybrid model — ads, live content, gaming, and licensing — I see a pathway to $1,400–1,500 by 2027. That assumes margin stability and monetization efficiency. Otherwise, the story pauses — not ends.

This is the patience trade. The setup that rewards waiting for clarity, not chasing noise.

🧠 The Investor’s Mindset

Every growth story hits its mirror moment — when it stops being judged by dreams and starts being judged by discipline.

Netflix is there now.

Wall Street calls it a slowdown. I call it a shift — from speed to structure. From hype to harvest.

Most investors will miss this turn because they’re addicted to momentum. They’ll chase the next “AI story” while Netflix quietly builds recurring revenue streams under their nose.

That’s fine. Their impatience is your edge.

If you’re a long-term holder, this is the phase to observe, not overreact. Let the structure rebuild, let the narrative reset, and when everyone stops talking about Netflix — that’s when you’ll want to start buying again.

Because real compounding doesn’t start when the story is exciting. It starts when no one’s paying attention.

TOGETHER WITH OUR PARTNER

An espresso shot for your brain

The problem with most business news? It’s too long, too boring, and way too complicated.

Morning Brew fixes all three. In five minutes or less, you’ll catch up on the business, finance, and tech stories that actually matter—written with clarity and just enough humor to keep things interesting.

It’s quick. It’s free. And it’s how over 4 million professionals start their day. Signing up takes less than 15 seconds—and if you’d rather stick with dense, jargon-packed business news, you can always unsubscribe.

🧠 Final Thought

If this week’s sell-off rattled you, remember this: markets aren’t judging Netflix — they’re testing you.

Netflix didn’t fail. It evolved. The crowd just hasn’t caught up yet.

When prices wobble, I remind myself: stillness is a position.

You don’t need to trade every move to profit from the direction.

Clarity doesn’t come from predicting every tick. It comes from trusting the process long enough to see conviction turn into compounding.

The real takeaway this week isn’t about Netflix’s quarter — it’s about learning how the market punishes transition stories.

That’s where the best investors make their money — not by avoiding the mess, but by understanding it before everyone else.

🧠 What did you think of today's newsletter?

Stay Sharp,

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.