🌞 Good Morning, Folks!

Bitcoin’s $100,000 hype has everyone talking, but here’s something wild nobody’s mentioning: while everyday traders like us are throwing money at random altcoins, the big institutional pros are quietly scooping up one stock that’s the backbone of crypto. It’s odd, isn’t it? We’re stressing over late-night price drops, second-guessing every trade, and kicking ourselves for missing rallies, while the real opportunity is slipping right past us.

In this midweek’s Deep Dive, I’m diving into a setup so clear it cuts through all the crypto buzz and tariff noise. Forget chasing the latest coin or worrying about headlines—I’m showing you a move tied to the heart of crypto’s growth. It’s the kind of thing you’ll wish you’d jumped on sooner.

You know that feeling, like you’re always one step behind the market? I get it. Let’s skip the chaos and focus on the one play everyone’s overlooking. Hang with me—this could be a big one.

Receive Honest News Today

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

🔍 This Week’s Focus: Coinbase (COIN) – Grab Your Stake in Crypto’s Gold Rush

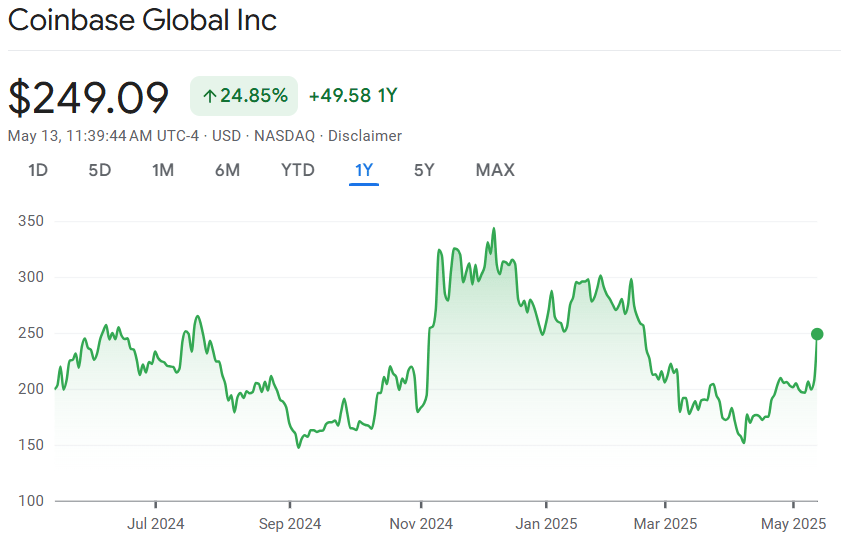

Bitcoin’s $100,000 run left you behind, and Coinbase (COIN) soared 30% since April. Hurts, doesn’t it? But here’s the truth: this rocket’s just warming up. With a US-China tariff truce igniting markets and Coinbase leading crypto’s charge, this is your shot to join the gold rush before it’s gone.

🎟️Why Coinbase Is Your Golden Ticket

Coinbase is crypto’s beating heart, and it’s pulsing with opportunity. Bitcoin’s rally past $100,000 has retail investors rushing back, and a 90-day US-China tariff pause—cutting duties from 145% to 30%—has set markets on fire. Announced Monday, this truce fueled the S&P 500’s biggest jump in a month, lifting crypto with it. Coinbase is your gateway to this frenzy, cashing in on every trade.

The company’s killing it. Q1 revenue hit $2.03 billion, up 33% year-over-year, with $304 million from stablecoins alone. Its $2.9 billion Deribit deal makes it a derivatives titan, and—huge news—Coinbase just joined the S&P 500, replacing Discover Financial. This is crypto’s big moment, and COIN’s your front-row seat.

💰Valuation & Positioning: A Bargain in Disguise

Market Cap: $53 billion, trading at $249—way below its 2021 peak of $342.

Growth Engine: Forward P/E of 85x, fueled by 23.6% EPS growth, screams upside.

Smart Money: 68.84% institutional ownership, with funds like Anatole doubling down.

Here’s the deal: COIN’s price looks like a steal compared to its 2021 highs. While retail hesitates, funds are loading up like it’s a fire sale. Don’t let this slip away again.

🔥Tariff Truce: Fuel for the Fire

The US-China tariff rollback is pure rocket fuel. Markets braced for a trade war, but the 90-day pause (US tariffs at 30%, China’s at 10%) unleashed a risk-on stampede. Bitcoin’s rock-solid above $100,000, and Coinbase’s trading volumes are about to explode as retail FOMO kicks in. Stable supply chains sweeten the deal for COIN’s tech backbone. This 90-day window is fleeting—don’t blink.

🧠Clarity Filter: My Take

I’ve seen market cycles like this in my 25 years, and Coinbase is a no-brainer. My 10-Point Stock Clarity Screen gives COIN a perfect 10/10—a rare Strong Buy. Retail’s spooked by Q1’s $2.03 billion revenue missing estimates, but they’re blind to the real story. Stablecoins, Deribit’s derivatives power, and S&P 500 status make COIN unstoppable. Funds like Anatole are all-in—68.84% institutional ownership proves it.

Here’s how Coinbase stacks up:

Criteria | Status | Why It Matters |

|---|---|---|

Understandable? | ✅ | Clear revenue from trading, stablecoins, and derivatives. |

Revenue Growth? | ✅ | $2.03B in Q1 2025, up 33% YoY, with subscriptions up 9%. |

Profitable? | ✅ | $527M adjusted net income, $930M EBITDA in Q1. |

Free Cash Flow? | ✅ | $9.9B cash reserves signal strong cash generation. |

Debt Level? | ✅ | Debt-to-equity ~0.5, a rock-solid balance sheet. |

Institutional? | ✅ | 68.84% owned by institutions—smart money’s betting big. |

Trends? | ✅ | Crypto adoption soars with Bitcoin at $100,000+. |

Leadership? | ✅ | CEO Armstrong’s vision is transforming finance. |

Moat? | ✅ | Regulatory edge, USDC, and Deribit cement dominance. |

Hold-Worthy? | ✅ | 5-year potential with crypto’s mainstream rise. |

Score: 10/10 – Strong Buy

What’s flying under the radar? Coinbase is crypto’s backbone. From stablecoins ($60 billion USDC market cap) to bank partnerships, it’s wiring the future of finance. This is your chance to own the revolution.

🥔Risks? Small Potatoes Next to the Prize

Sure, there’s noise—tariff talks could stall, and Trump’s crypto rules are unclear. COIN’s stock dipped 2% post-Q1. But Coinbase’s diversified revenue and fund backing make it a tank. The tariff truce and Bitcoin’s surge are too strong to ignore. Miss this, and you’re sidelined from crypto’s biggest moment.

👀What’s Next: The Sparks to Watch

I’m glued to three signals. First, trading volumes—Q1’s 17% consumer and 9% institutional dip could flip with this rally. Second, Deribit’s edge—if Coinbase owns derivatives, profits could skyrocket. Third, Bitcoin’s muscle—if BTC stays above $100,000, COIN’s Q2 will be a blowout. Coinbase’s engine is revving—don’t miss the ride.

🚀 Your Shot at Crypto Glory

Coinbase is crypto’s tollbooth—every trade, stablecoin, and derivative flows through it. The tariff truce is a spark, but COIN’s real power is its lock on crypto’s future. S&P 500 status and Deribit’s might make it a star, yet it’s 40% off its 2021 highs. While retail wavers, funds are charging in—this is your moment. Volatility’s part of the game, but with Bitcoin roaring and Coinbase shining, this rocket’s ready to soar. Regret stings worse than risk—don’t miss out.

👉 Missed last week's midweek deep dive?

Check out our deep dive on Palantir (PLTR), where we unpacked why Wall Street’s 8% sell-off was a misread—and how you can position for the rebound.

If you’re staring at charts for hours, hoping for a breakthrough, you’re not alone. Most traders burn out, not from losses, but from the constant grind.

That’s why Iris Yuan built a system that flips the script. It’s not about trading more — it’s about trading smarter.

Why It Works:

✅ Clarity Over Chaos — Trade with confidence, without the noise

✅ Time Freedom — 1–2 hours a day, 15–30 minute holds

✅ Focus on the Right Trades — Quality over quantity, every time

This isn’t about catching every move — it’s about catching the right ones, while still living your life.

🧠 What did you think of today's newsletter?

🧠 Final Word

Markets are buzzing with noise this week—Bitcoin’s $100,000 sprint and the US-China tariff truce have traders chasing momentum like moths to a flame. But the frenzy hides a trap: chasing headlines often burns more than it earns. Lazy narratives about “crypto moons” or “trade war relief” drown out the real signals, leaving most investors reacting, not reasoning.

I’m sticking to first principles—focus on what’s clear, not what’s loud. Coinbase’s 10/10 setup isn’t just a crypto bet; it’s a stake in a financial revolution. Patience and precision trump panic every time. Stay sharp, filter the chaos, and position for the long game. That’s how you win when others are just running.

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.