🌞 Good Morning, Folks!

Something doesn’t add up this week.

Bitcoin just pulled off a whiplash — crashing into the $80K range before bouncing straight back toward $87K. The headlines call it “volatility,” but that’s lazy reporting. What’s really happening is a stress test of conviction. When the world’s most liquid asset suddenly gasps for air, it’s not about panic — it’s about tightening money.

While everyone’s busy blaming traders or ETFs, they’re missing the bigger signal: liquidity is quietly leaving the room. The Fed isn’t cutting yet, borrowing remains expensive, and capital is getting picky. That shift doesn’t just hit crypto — it ripples across everything from tech stocks to startup valuations.

The consensus says this is just “profit-taking.” I disagree. This feels like the market quietly adjusting to a new normal — one where cheap money is gone and speculation finally costs something again.

Midweek is when I reset my lens — clear out the noise, ignore the recycled takes, and hunt for what the market’s really telling us.

This week, that signal is clear: liquidity rules everything. When it flows, prices inflate. When it contracts, even the best assets wobble.

So in today’s focus, we’ll break down why Bitcoin’s slide isn’t panic — it’s positioning. And why this shift in liquidity could reshape how every investor — crypto or not — should be thinking right now.

🌐 From Around the Web

🚀 Amazon to Spend Up to $50 Billion on AI Services for U.S. Government

Amazon, via its cloud unit Amazon Web Services (AWS), has committed up to $50 billion to scale AI and super-computing infrastructure for U.S. federal agencies. The investment includes adding ~1.3 gigawatts of high-performance computing across Top Secret, Secret and GovCloud regions. For investors, this highlights how government demand might become a major driver of the AI infrastructure wave—meaning AWS (and Amazon) could be a structural beneficiary if execution holds.

📈 Alphabet Rally Threatens World’s Most Valuable Stock Standings

Alphabet Inc. saw its shares rally strongly (up ~6.3 %) as its newer AI model gets traction, pushing its market-cap toward the $4 trillion range. The scale of this move suggests investors are increasingly treating Alphabet as not just a search/ads business but a core AI infrastructure play. If the momentum continues, we may see standings shift among the tech giant tier—meaning the “Big Tech pecking order” could be evolving.

🧠 Billionaire Peter Thiel Just Sold Nvidia and Tesla

Peter Thiel’s hedge fund significantly reduced its holdings in NVIDIA Corporation and Tesla, Inc. during Q3 2025—reportedly dumping ~538,000 Nvidia shares and ~208,000 Tesla shares. This move adds fuel to concerns among some market participants that the AI-fueled tech rally may have stretched valuations—and that even high-profile insiders are starting to rotate. For you as an investor, this could be a signal to revisit risk assumptions around the “Magnificent Seven”-type names.

TOGETHER WITH OUR PARTNER

Run ads IRL with AdQuick

With AdQuick, you can now easily plan, deploy and measure campaigns just as easily as digital ads, making them a no-brainer to add to your team’s toolbox.

You can learn more at www.AdQuick.com

🔍 This Week’s Focus: Bitcoin’s $80K Scare — and What It Really Means

Bitcoin’s Drop Isn’t Panic — It’s Liquidity

Let’s be real — it’s been a brutal week for Bitcoin.

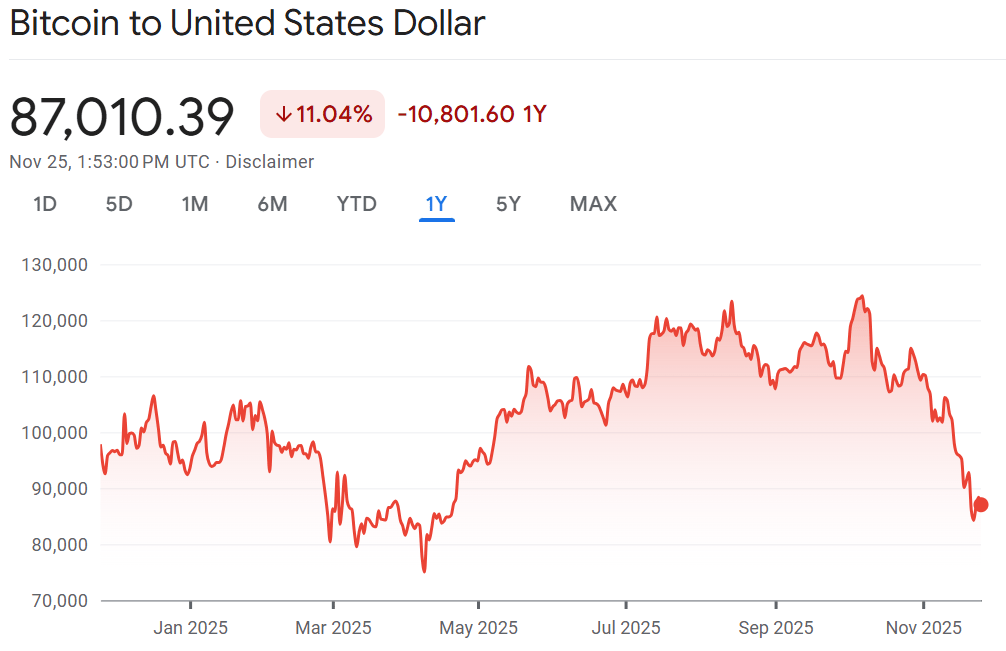

After months of climbing higher, the world’s biggest cryptocurrency suddenly tumbled into the $80K range — its lowest level in months. Billions in value vanished, and for a brief moment, it felt like the bull run was cracking apart.

If you’ve been in the markets long enough, though, you know this feeling. The crowd calls it panic. I call it liquidity in disguise.

After peaking above $120K earlier this year, Bitcoin’s sudden slide into the $80K zone — and its rebound to $87K — wasn’t about fear. It was about money flow. The oxygen that fuels risk-taking just got thinner.

🧠 The Fed Just Sucked the Oxygen Out

Every bull market eventually runs into the same problem — the Federal Reserve.

Liquidity is oxygen. When the Fed pulls it out of the system, even the strongest markets start gasping.

Interest rates remain high. Borrowing is expensive. The easy money that powered risk assets through 2023 and early 2024 has dried up. Investors aren’t deploying capital recklessly anymore; they’re hoarding cash, waiting for clarity.

And that’s what we’re seeing now — a global recalibration. Bitcoin isn’t crashing because of bad news. It’s recalibrating to a tighter financial reality.

When liquidity shrinks, markets have to choose. They pick quality and dump speculation. Bitcoin just happened to be the first domino.

💸 The Profit-Taking Avalanche

Let’s not forget — Bitcoin had a monster run this year. From $60K to $120K in less than twelve months. ETF inflows were booming. Wall Street embraced the “digital gold” narrative. Everyone wanted in.

But markets have a cruel sense of timing.

When everyone’s already in, there’s no one left to buy.

The rally stretched too far, too fast. So when inflows slowed and a few institutions took profits, the market cracked open. A trickle of selling turned into a cascade as traders rushed to protect gains.

ETF outflows piled on, leverage got flushed, and suddenly the same narrative that lifted Bitcoin — institutional adoption — started working in reverse.

This wasn’t manipulation. It was mechanics.

Liquidity came in. Liquidity went out. Price followed.

🧊 Long-Term Holders Stayed Frozen

Here’s the part that tells you where we really are in the cycle: long-term holders didn’t flinch.

On-chain data showed that wallets holding Bitcoin for more than a year barely moved. These are the battle-tested investors who lived through $3K, $30K, $60K. To them, this isn’t chaos — it’s routine.

They understand something most traders forget: bull markets aren’t destroyed by corrections. They’re built by them.

Every time volatility spikes, leverage gets purged and weak hands get flushed. That’s the price of conviction.

So while short-term traders panicked, long-term holders stayed calm. They’ve seen this movie before.

⚡ The Violent $87K Rebound

Markets always overreact — first on the way down, then on the way up.

As Bitcoin fell into the $80K zone, value buyers quietly stepped in. Maybe it was funds defending positions. Maybe it was algorithmic rebalancing. Maybe just the reflex of a market that fell too far, too fast.

Whatever the reason, the bounce to $87K was fast and fierce — the kind of move that traps both sides and reminds everyone how emotional this market still is.

But let’s not romanticize the rebound. It’s a reflex, not a recovery.

The tone of this market has changed. We’re no longer in the euphoria phase where “number go up” was a valid thesis. We’re entering a phase where fundamentals matter again — where liquidity and discipline replace hype and hope.

🔍 The Real Lesson: Liquidity Rules Everything

This entire episode — from the rally to the crash to the rebound — tells the same story: liquidity drives markets more than sentiment ever will.

When the system is flooded with cash, anything can go up. When that tide pulls back, only assets with real staying power survive.

That’s not just a crypto truth — it’s a market truth.

High-valuation tech stocks, AI leaders, speculative growth plays — they’re all tied to the same invisible thread. When the cost of money rises, the value of future promises falls.

So no, Bitcoin didn’t break. It just reminded us that liquidity isn’t infinite.

And that’s exactly when investors need to wake up.

📉 From Easy Money to Hard Choices

Back in 2021, corrections were easy to ignore. The Fed was printing, yields were zero, and stimulus checks were flying. You could “buy the dip” blindfolded and make money.

But 2025 is different.

Money has a cost again. Treasury bills pay 5%. Cash isn’t trash anymore. That means every dollar you invest now has to earn its keep.

And when that happens, markets get selective.

You see it everywhere — from Bitcoin to Nvidia to the smallest speculative altcoin. The flow of capital is getting smarter, faster, and far less forgiving.

Investors who rely on momentum alone are finding out how fast that game ends.

That’s why this pullback isn’t a crash — it’s a filter.

The market is sorting out who’s playing with conviction… and who’s just playing.

🧭 How I’m Positioning Right Now

Here’s how I’m approaching this new phase — not as a trader chasing every tick, but as an investor protecting conviction.

I’m keeping roughly 70% of my Bitcoin exposure untouched — cold storage, long-term, no leverage. That’s my conviction capital. It doesn’t move because of headlines or volatility.

The other 30%? It’s dry powder. Sitting in stablecoins, waiting for ETF inflows to turn positive again. When institutional money starts flowing back in, I’ll scale up slowly — not before.

In equities, my focus has shifted toward companies that generate real free cash flow — businesses that thrive when liquidity tightens. Think balance-sheet strength, not hype.

I’m staying underweight on speculative growth. If the cost of money stays high, those valuations still have room to fall.

Above all, I’m keeping risk flexible. Smaller position sizes. Tighter stops. More patience.

In markets like this, discipline is your edge.

🧩 This Isn’t a Crash — It’s a Filter

Bitcoin didn’t fall because something broke. It fell because the market needed to breathe.

Every bull trend hides one defining reset — that painful, cleansing moment that shakes out leverage, tests conviction, and redefines what “strong hands” really means.

That’s what we just lived through.

The $80K drop wasn’t the end of the bull cycle — it was a mid-cycle reset. The rebound to $87K wasn’t luck — it was resilience.

The real story isn’t about Bitcoin’s price. It’s about survival.

Because every time liquidity tightens, the impatient sell, and the disciplined stay.

You don’t lose money when Bitcoin drops — you lose it when you lose conviction.

And right now, conviction is the most undervalued asset on the market.

So hold your ground. Watch liquidity. Ignore the noise.

Because this isn’t a crash — it’s a filter.

And those who stay patient through the noise will own the next wave when liquidity returns.

TOGETHER WITH OUR PARTNER

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

🧠 What did you think of today's newsletter?

🧠 Final Word

Markets feel noisy again — everyone’s trying to decode every tick, every headline, every whisper from the Fed. I’ve seen this movie too many times. When volatility spikes, confidence disappears first and logic disappears second. The crowd starts mistaking movement for meaning. But not every drop is danger, and not every rebound is recovery. Most of the time, it’s just liquidity changing direction.

That’s why I don’t chase the noise — I wait for the signal. My edge isn’t in predicting what happens next week, but in staying calm when everyone else is reacting. This phase isn’t about timing the bottom; it’s about protecting conviction until the next real trend emerges. Patience isn’t passive — it’s a position.

Stay Sharp,

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.