🌞 Good Morning, Folks!

The market’s obsessed with the idea that AI stocks are untouchable right now. ANET just proved otherwise — not by failing, but by showing how fragile “perfection pricing” really is. When a stock explodes 17% on earnings that everyone expected to be strong, it’s not confirmation of strength. It’s a countdown clock starting the moment the applause dies down.

This week’s headlines are all about ANET’s blowout quarter and record highs, but buried in the call was the one phrase that should have made investors pause: “cadence variability.” It’s corporate-speak for “not every quarter will look like this,” and it’s the kind of overlooked signal that can turn a smooth climb into a sudden drop.

In today’s This Week’s Focus, I’m breaking down what ANET’s monster quarter really tells us about where we are in the AI trade — and why the risk now isn’t missing upside, but holding the bag when the music stops. If you’ve been feeling that something about this rally doesn’t add up, you’re not crazy.

🌐 From Around the Web

They’ve hit pause on a tariff escalation that would’ve pushed duties to 145%—but it’s just another 90-day reprieve. That gives supply chains breathing room, but with all the unresolved issues still looming, complacency now could mean panic later.

Headline CPI cooled to 2.7%, but core inflation surged to 3.1%. The Fed feels safer about cutting rates in September—but unless you’re positioned for sticker shock in services and housing, you’re missing the real threat.

One minute, Trump calls for Intel’s CEO to resign over China ties. The next, he’s praising him as a comeback “success story.” That kind of whiplash injects volatility directly into the chip sector—so don’t sleep on how quickly sentiment can shift.

TOGETHER WITH OUR PARTNER

Training cutting edge AI? Unlock the data advantage today.

If you’re building or fine-tuning generative AI models, this guide is your shortcut to smarter AI model training. Learn how Shutterstock’s multimodal datasets—grounded in measurable user behavior—can help you reduce legal risk, boost creative diversity, and improve model reliability.

Inside, you’ll uncover why scraped data and aesthetic proxies often fall short—and how to use clustering methods and semantic evaluation to refine your dataset and your outputs. Designed for AI leaders, product teams, and ML engineers, this guide walks through how to identify refinement-worthy data, align with generative preferences, and validate progress with confidence.

Whether you're optimizing alignment, output quality, or time-to-value, this playbook gives you a data advantage. Download the guide and train your models with data built for performance.

🔍 This Week’s Focus: ANET at Record Highs - The Most Dangerous Time to Get In

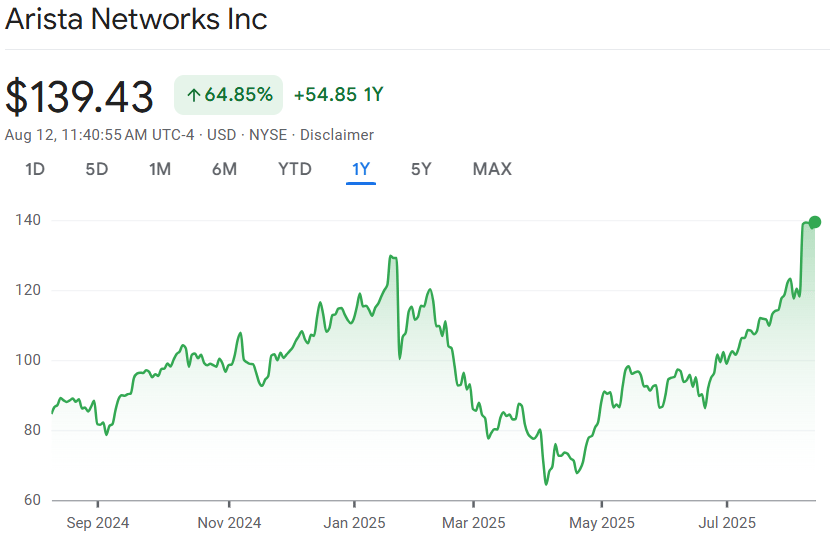

Arista Networks (ANET) is having the kind of year most stocks only dream about.

Q2 earnings crushed expectations.

Margins expanded when everyone else’s are getting squeezed.

Guidance shot higher.

The stock jumped 17% in a day and now sits at all-time highs.

And that’s exactly why I’m worried.

Because here’s the part most ANET bulls won’t tell you:

The higher the climb, the less room there is to miss a step.

One earnings miss, one shift in Big Tech spending, one wobble in margin — and the same traders cheering today will be first in line to hit sell.

Today, I’m breaking down the full picture on ANET’s monster quarter, the hidden risks most are ignoring, and how I’m positioning now — because this is the exact point in a rally where you either build conviction… or become someone else’s exit liquidity.

📊 The Earnings That Fueled the Surge

Let’s start with why the market went berserk after Q2.

Revenue: $2.205B, up 30% year-over-year, 10% quarter-over-quarter.

Non-GAAP Gross Margin: 65.6% — not just holding, but improving.

Non-GAAP Operating Income: $1B+ for the first time in company history.

EPS: $0.73 vs. $0.53 a year ago.

Full-Year Guidance: Raised from 17% to 25% revenue growth.

That’s not “good” — that’s elite execution.

The real story here? ANET isn’t just selling into hype. They’re selling into the biggest infrastructure upgrade cycle since cloud computing became a thing. AI data centers, hyperscale networking, next-gen campus networks — Arista’s kit is in the middle of it all.

Microsoft, Meta, and other cloud giants are throwing billions into AI infrastructure. That’s oxygen for Arista’s revenue engine.

And unlike a lot of “AI plays,” they’re not burning cash to do it — they’re expanding margins while growing fast.

But here’s the dangerous part: the market already knows this.

At ~50x forward earnings, investors aren’t just paying for what ANET is today — they’re paying for the next 12–18 months to go perfectly.

🕵️♂️ The Hidden Risk Most Are Ignoring

The obvious bear case is valuation — but that’s lazy analysis.

The real risk is in gross margins and hyperscale capex cadence.

Margins north of 64–65% tell me two things:

Arista has pricing power.

Their products are sticky enough that hyperscalers aren’t hammering them for discounts.

If that number slips to 61–62%, Wall Street won’t wait for the “why.” They’ll assume the hyperscalers are tightening budgets, and the multiple will compress fast.

And hyperscale AI buildouts? They’re lumpy by nature. Microsoft or Meta could easily front-load spending into 2024–2025 and slow the pace later.

Management even hinted at this on the call — buried in Q&A, they noted AI deployments could see “cadence variability.” That’s code for: “Not every quarter will look like this.”

In other words — the quarter was pristine, but the forward curve isn’t guaranteed to be a straight line.

🧭 My Playbook

Owning ANET here is about understanding the script you’re buying.

That script says:

Big Tech keeps spending heavily on AI infra.

Arista keeps expanding into enterprise and security without margin drag.

New product launches (Wi-Fi 7, SD-WAN, security) execute flawlessly.

Change one line of that script, and sentiment flips.

That’s why my playbook is simple:

If you own from lower: Trim 20–30% into strength. Keep a core position in case this is only the middle of the run.

If you’re new: Start with a starter position. Build on pullbacks to the 50-day moving average or if gross margins hold firm in the next quarter.

What I’m tracking: Cloud capex guidance from MSFT/META, gross margins staying >64%, enterprise deal traction.

What makes me bail: Margin erosion, spending slowdown, or competitive share loss to Cisco in enterprise.

Here’s the edge for subscribers:

I’m watching two other names showing the same earnings + chart setup ANET had before its 100% run. They’re not priced for perfection yet — which means upside without the all-time-high risk.

Those will be in Friday’s note.

🎯 The Bold Takeaway

ANET is one of the best-run companies in tech right now.

The AI infrastructure story is real.

Margins are elite.

Execution is textbook.

But here’s the truth I’ve learned from years of chasing breakouts:

When a stock is priced for perfection, you’re no longer trading the business — you’re trading the crowd’s expectations.

If those expectations hold, ANET could grind higher for months.

If they crack, the drop will be fast, ugly, and indiscriminate.

Patience here isn’t about being cautious — it’s about letting the market offer you a better risk/reward entry.

Because the only thing worse than missing the next 10% upside… is being the liquidity for someone else’s sell-off.

TOGETHER WITH OUR PARTNER

The Vitamin C Serum That Sold Out Twice!

Get visibly brighter, smoother skin and daily antioxidant defense with Medik8's C-Tetra™ Advanced Gel-Serum. Its non-greasy formula combines potent 20% Vitamin C with Phyto Exosomes proven to deliver visibly brighter skin in 1 week*.

*Proven via independent clinical study conducted over 4 weeks on 32 participants.

🧠 What did you think of today's newsletter?

🧠 Final Word

The market’s mood right now feels a lot like the air at the top of a mountain — clear, thin, and deceptively calm. ANET’s rally is being celebrated as a sign the AI trade still has legs, but in reality, it’s a reminder of how quickly momentum can turn when perfection is already priced in. The same optimism that fuels these highs is what makes them fragile. It’s easy to feel like sitting out means missing out, but in this part of the climb, speed and altitude aren’t the same thing as safety.

What matters now isn’t guessing the next tick — it’s knowing the difference between a great company and a great entry point. ANET’s story is strong, but strength doesn’t erase risk, it only hides it until the next catalyst. Strategic patience isn’t hesitation; it’s control. Sometimes the smartest move is to stand still long enough to see if the ground you’re on is solid — and right now, that’s the edge most people will ignore.

Stay Sharp,

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.