🌞 Good Morning, Folks!

Everyone’s obsessing over the next Fed move, Nvidia’s next AI chip, and whether oil hits $90. But beneath all that noise, something subtle just happened — Deckers quietly became one of the best-performing consumer stocks of the last five years. And barely anyone’s paying attention.

The company — yes, the one behind UGG boots and HOKA shoes — has defied the macro slowdown, retail softness, and margin compression narratives. It’s grown revenue, expanded margins, and turned a niche running shoe into a cult brand. But now, with earnings around the corner and the stock near all-time highs, the expectations are loaded and the risk is quietly rising.

This week, I’m unpacking what’s really at stake for Deckers — and why this earnings report could either validate a rare breakout growth story or trigger a brutal repricing. Most investors think they understand this stock. I don’t think they do.

If you’re serious about spotting the cracks before they show up in the headlines, this one’s for you. Let’s go deeper.

🌐 From Around the Web

🔻 How Much Have 4 Years of Tariffs Cost the U.S.?

Since 2018, U.S. companies have paid $316 billion in tariffs — and the cost keeps compounding. While politicians posture about “bringing jobs back,” the real price has been quietly passed to businesses and consumers. If you're bullish on industrials or retail, you'd better be tracking the drag this creates.

💎 5 Monster Stocks to Hold for the Next 25 Years

Long-term investors are hunting for stocks that won’t just survive — but compound. This list includes predictable names like Amazon and Nvidia, but also a few under-the-radar giants flying just below the hype radar. It’s not about being early — it’s about staying with winners long enough for the payoff to matter.

🔥 This Week Is Crucial for Nvidia and Google Stock Investors

Both stocks are nearing inflection points — not just technically, but fundamentally. With earnings approaching and AI expectations sky-high, the margin for disappointment is razor-thin. Watch how the market reacts — not to the numbers, but to the tone in forward guidance. That’s where the real signal hides.

TOGETHER WITH OUR PARTNER

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

🔍 This Week’s Focus: Deckers (DECK) Is Walking Into a Minefield — Will It Trip or Sprint Ahead?

Deckers (NYSE: DECK) reports earnings this week, and here’s the brutal truth: this is the moment the stock either proves it deserves its cult status — or gets slapped back to reality.

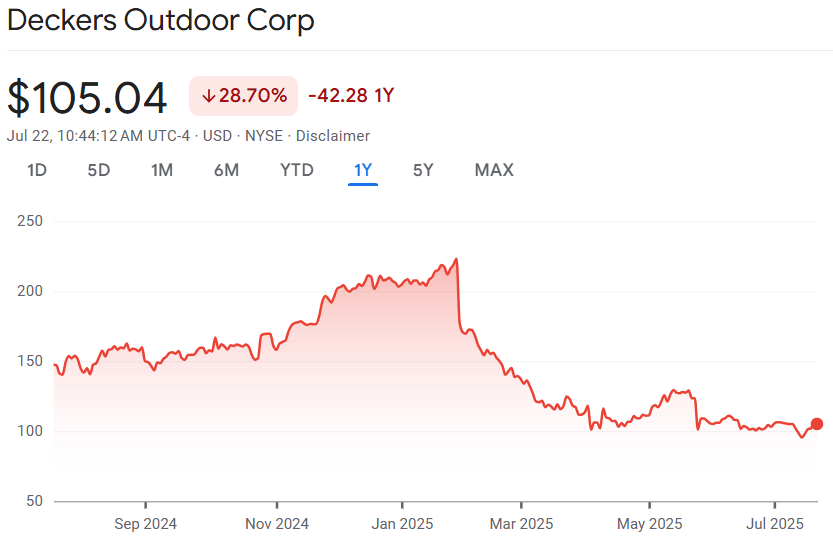

I’ve been watching this setup unfold for weeks. The chart says “strong,” the sentiment says “overloved,” and the fundamentals? About to get their biggest test yet.

This isn’t just another quarter. This is where premium multiples meet performance pressure.

🧠 Why Deckers Matters Right Now

Deckers has been on an absolute tear. The stock is up over 300% in the last 5 years, quietly outperforming big-name tech and even most of the Magnificent Seven. But it’s not just the run that intrigues me — it’s the disconnect.

The stock trades at a forward P/E of 26x — not insane for a growth name, but not cheap for a footwear company either. Wall Street expects ~20% YOY revenue growth this quarter, riding on the back of two blockbuster brands:

HOKA (explosive growth and Lululemon-tier loyalty)

UGG (surprisingly resilient despite the macro slowdown)

But here’s the catch: the bar is stupidly high.

Institutional holders already love DECK. The float is tightly held. Shorts have been obliterated. So this earnings isn’t about surprising on EPS or revenue — it’s about narrative control.

Does management guide conservatively (which they always do), and risk triggering a sell-the-news moment?

Or do they go full throttle with bullish commentary and risk overpromising into an uncertain consumer landscape?

This is a chess match. And most investors are only looking at the scoreboard.

📉 What Just Happened

Last quarter, Deckers crushed estimates:

Revenue: $1.56B (+16% YOY)

EPS: $11.41 (vs. $9.60 est)

Gross Margin: 56.8% (record high)

But the stock barely moved.

That’s your signal right there. The market is numb to good news now. If you want a reward, you need great, not just good.

And don’t forget — last quarter was the holiday surge. This quarter? It's where demand gets real.

There’s pressure building beneath the surface:

Inventory normalization could hit wholesale channels

Consumer softness in Q2 might weigh on discretionary categories

International growth (especially in Asia) needs to accelerate to maintain top-line trajectory

This quarter will tell us exactly how sticky HOKA demand really is — and if UGG can keep reinventing itself without sliding into fashion irrelevance.

🧠 What It Triggered in Me

I’ve seen this pattern before. A company outperforms for years. Institutions pile in. The multiple expands. Everyone starts to assume durability — until one quarter slaps the whole thesis in the face.

Remember what happened to LULU this year? Great brand, cult following, strong numbers…

Then boom: guidance miss, inventory pressure, and the narrative flipped overnight.

Deckers could very well be walking into that same trap.

The difference?

LULU was already a household name. Deckers — especially HOKA — is still in the explosive growth phase. There’s still room to run, if this quarter confirms it.

That’s the tension I’m tracking.

📊 What to Watch in Earnings

Here’s what I’ll be dissecting this Thursday:

HOKA Revenue Growth

Street expects ~30% YOY. If it’s anything less than 25%, the stock gets punished.UGG Margins

A surprise rebound here could be the upside catalyst no one’s expecting.Direct-to-Consumer (DTC) Mix

If DTC exceeds 50% of total sales, it boosts margin narrative.Geographic Breakdown

Any hint of slowing in U.S. spend — especially among millennials — will rattle confidence.Guidance

This is everything. If they sandbag (as usual), market might freak. If they go bold, they better have the numbers to back it up.

💡 Pragmatic Insight

I’m not telling you to jump in or run away. That’s not what we do here.

What I am saying is this:

Deckers is approaching an inflection point.

If they deliver, they prove they deserve a premium multiple — and the stock could sprint toward $500+.

If they stumble, even slightly, expect a sharp pullback as funds lock in gains and rotate elsewhere.

Either way, this week offers something most investors never prepare for:

A test of conviction when the narrative is hanging by a thread.

So here’s what I’d be doing this week:

Watch the price action post-earnings, not just the numbers

Track options IV crush on Friday for sentiment reset clues

Start modeling out what 2026 EPS looks like if margins compress 200bps

This is how you stay ahead of the herd — not by reacting, but by anticipating where the pressure builds before it releases.

🔑 Quick Takeaways

Deckers reports earnings Thursday — expectations are sky-high

HOKA must show it’s still in hyper-growth mode

UGG could surprise, especially on gross margin

Guidance tone will dictate whether we see breakout or breakdown

Smart investing isn’t just about chasing performance. It’s about knowing when the market’s love for a stock is based on faith… and when it’s backed by facts.

Let’s see if Deckers can walk the talk.

TOGETHER WITH OUR PARTNER

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

🧠 What did you think of today's newsletter?

🧠 Final Word

It’s easy to get spun around midweek — headlines are loud, charts are messy, and everyone’s suddenly a macro expert again. This is the part of the cycle where clarity feels scarce and confidence gets replaced by second-guessing. Deckers is a perfect case study: a stock that’s done everything right, yet still sits on a knife’s edge because the market loves building pedestals just to test their foundations.

But when the noise gets louder, I narrow my focus. Not on narratives — on pressure points. I don’t need to predict the outcome of every earnings print. I just need to know when the market is setting up for an overreaction. This week is one of those setups. Whether Deckers pops or drops, the edge comes from understanding the why — not the what. That’s how you stay in control when everyone else is reacting.

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.