🌞 Good Morning, Folks!

Something didn’t add up this week.

Markets cheered “strong earnings” in some places, punished them in others, and then pretended both reactions made perfect sense. Headlines blamed margins, guidance, sentiment — pick your excuse. But if you stepped back for a moment, the real signal was quieter and far more revealing.

The market isn’t reacting to bad news.

It’s reacting to complexity.

That’s the shift most people missed.

For months, narratives were clean. AI wins, demand accelerates, margins expand, stocks go up. Simple stories travel fast. This week, those stories started to fracture — not because the businesses failed, but because reality intruded.

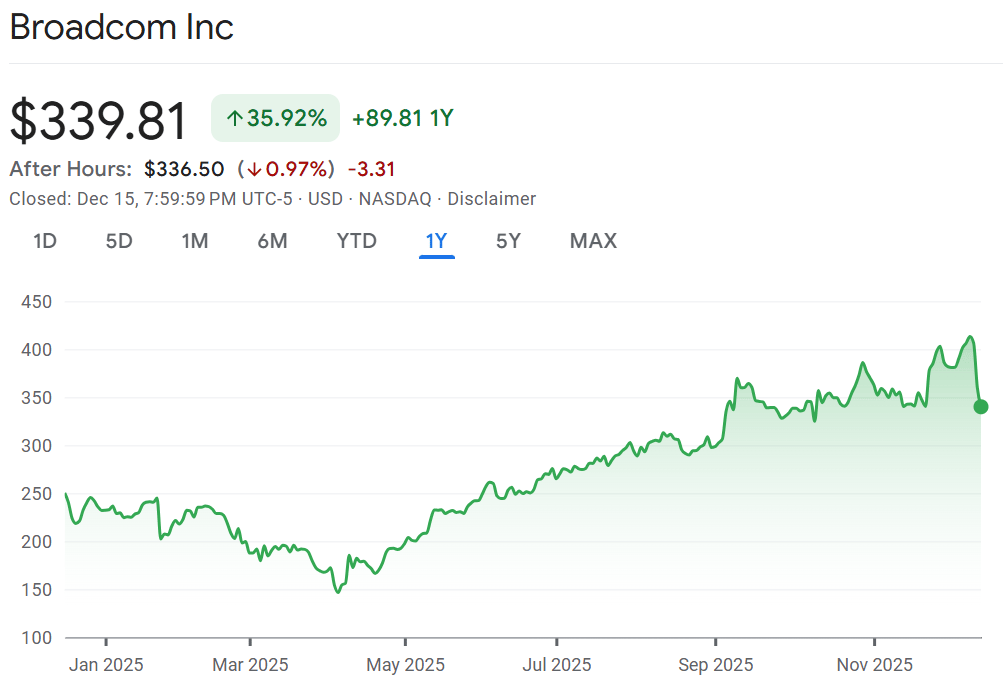

Broadcom was the clearest example. A solid quarter, strong demand commentary, and yet the stock sold off hard. Not because the numbers collapsed, but because the story got harder to tell in one sentence.

And when stories get harder, prices get jumpy.

This issue isn’t about chasing the reaction or fading it. It’s about understanding why the market suddenly feels uncomfortable — and what that discomfort is really pricing.

In This Week’s Focus, I’m unpacking Broadcom’s post-earnings move, the margin narrative everyone latched onto, and the deeper signal hiding underneath it. Not to predict what happens next, but to clarify what actually changed.

Because when consensus breaks, clarity becomes an edge.

🌐 From Around the Web

📉 Debt Worries Continue to Weigh on AI-Related Stocks

Rising debt concerns are starting to pressure parts of the AI trade, particularly companies with heavy capital-spending requirements and long payoff timelines. As borrowing costs stay elevated and balance-sheet scrutiny increases, investors are becoming more selective about which AI names deserve premium valuations. This feels less like the end of the AI story and more like a rotation toward businesses with clearer cash-flow visibility.

🔍 Should You Invest $1,000 in Alphabet Right Now?

Alphabet is being framed as a steadier AI play compared to more speculative names, thanks to its dominant advertising engine and deep integration of AI across Search, YouTube, and Cloud. The article argues that even a modest investment could benefit from long-term AI monetization without taking on extreme valuation risk. For investors seeking exposure without chasing hype, Alphabet continues to sit in the “boring but powerful” camp.

₿ Bitcoin Drops Toward $86,000 as Lack of Conviction Caps Crypto Prices

Bitcoin has slipped back toward the mid-$80,000 range as trading volumes thin and buyers hesitate to step in aggressively. The move reflects fading short-term momentum rather than a structural breakdown, but it does highlight how sentiment-driven crypto remains. For investors, this reinforces the idea that crypto positions need wider risk bands and patience — sharp swings are still part of the game.

TOGETHER WITH OUR PARTNER

The Future of Shopping? AI + Actual Humans.

AI has changed how consumers shop by speeding up research. But one thing hasn’t changed: shoppers still trust people more than AI.

Levanta’s new Affiliate 3.0 Consumer Report reveals a major shift in how shoppers blend AI tools with human influence. Consumers use AI to explore options, but when it comes time to buy, they still turn to creators, communities, and real experiences to validate their decisions.

The data shows:

Only 10% of shoppers buy through AI-recommended links

87% discover products through creators, blogs, or communities they trust

Human sources like reviews and creators rank higher in trust than AI recommendations

The most effective brands are combining AI discovery with authentic human influence to drive measurable conversions.

Affiliate marketing isn’t being replaced by AI, it’s being amplified by it.

🔍 This Week’s Focus: Broadcom (AVGO) - When “Great Earnings” Break the Story

Broadcom didn’t disappoint this week.

But it did something far more dangerous in today’s market.

It complicated the story.

For months, AVGO was treated as one of the “clean” AI winners. Not the flashy kind. The grown-up kind. Strong free cash flow, disciplined capital allocation, management with a history of execution, and exposure to AI without having to explain away speculation. It was the stock institutions could own comfortably and defend confidently.

Then earnings arrived.

The quarter itself was solid. Revenue was strong. Guidance came in above expectations. Management spoke with confidence about AI demand stretching well into the coming quarters. By almost every traditional metric, this was a good earnings report.

And yet, the stock sold off hard.

Not because demand collapsed.

Not because guidance missed.

But because Broadcom did something the market hates late in a narrative cycle.

It told the truth.

📊 The Earnings Were Fine. The Expectations Were Not.

Let’s get this out of the way first: Broadcom’s business did not deteriorate.

Revenue around $18 billion exceeded expectations. Forward guidance near $19 billion confirmed momentum. Management reiterated that AI-related demand, particularly in custom silicon and networking, remains strong and visible across multiple hyperscale customers.

Strip away the noise, and the company is still doing what high-quality semiconductor businesses are supposed to do: grow, generate cash, and position themselves at the center of long-term infrastructure spend.

But markets don’t trade on absolutes.

They trade on deltas.

And the delta that mattered was simple and uncomfortable: management acknowledged that margins will compress in the near term as AI becomes a larger share of the revenue mix.

That single admission reframed the entire quarter.

For a market that spent the past year telling itself that AI equals effortless margin expansion, this forced a reset. Not because it was shocking — but because it shattered a convenient assumption.

AI growth is real. But it isn’t frictionless.

Broadcom didn’t lower the bar.

The market realized the bar had been set unrealistically high.

Markets don’t punish bad businesses first.

They punish broken expectations.

🧠 Why the Stock Reaction Was So Violent

The selloff in AVGO wasn’t subtle. It was sharp, emotional, and decisive.

That kind of move doesn’t come from long-term investors calmly updating their spreadsheets. It comes from positioning being unwound.

Broadcom had quietly become a consensus “safe AI” trade. A way to participate in the AI boom without feeling reckless. That positioning works beautifully until the story introduces friction.

Margin compression is friction.

It forces questions investors don’t like answering in real time:

Is this margin pressure temporary or structural?

Does AI infrastructure generate the same returns as software?

How much pricing power exists when customers are hyperscalers with enormous leverage?

The market didn’t wait for answers.

It sold first and asked questions later.

This wasn’t a valuation tweak. It was confidence resetting.

And confidence always resets before price stabilizes.

📉 Where the Tape Is Now — And What It’s Actually Saying

AVGO is now trading roughly in the $330–$350 range. The exact price matters less than the behavior around it.

The stock is no longer trending. It’s deciding.

This wasn’t a slow drift lower that invites casual dip-buying. It was a sharp repricing followed by hesitation. That’s the signature of a stock transitioning from momentum to evaluation.

Here’s the reframe that matters:

Stocks don’t bounce because they feel cheap.

They bounce when selling pressure exhausts itself and belief quietly returns.

Right now, AVGO is testing that balance.

The $330–$340 zone matters because it’s where buyers are deciding whether the margin narrative has been sufficiently discounted. If this area holds and the stock starts forming higher intraday lows, it signals institutional support returning — quietly, methodically, without emotion.

If it fails, that doesn’t mean the business is broken.

It means the digestion phase isn’t finished.

This is likely a multi-week process, not a quick V-shaped bounce.

Time, not price, may still be doing the work.

⚠️ The Real Risk Isn’t Demand — It’s Visibility

Most commentary this week has focused on margins. That’s understandable, but it’s not the core risk.

The real risk is visibility.

Broadcom’s AI growth is driven by a relatively small number of massive customers. That’s fine when spending accelerates, but it makes sentiment fragile. When growth is concentrated, the market becomes hypersensitive to any hint of delays, re-phasing, or strategic shifts.

Even if nothing fundamentally changes, perception matters.

Right now, the market is repricing certainty.

That’s why this move feels heavier than the numbers alone justify. It’s not just about margins — it’s about how confident investors feel projecting the next few quarters.

Visibility, not demand, is what’s being debated.

🧭 Short-Term Direction: Preparation Beats Prediction

I don’t think AVGO is a screaming buy here.

I also don’t think it’s broken.

Short term, this is a stabilization and reclaim setup, not a breakout.

Here’s how I’m framing the next few weeks:

Hold above $330–$340 → digestion, not deterioration

Reclaim $360–$370 → confidence begins to return

Fail to stabilize → more time needed, not panic

My rule in situations like this is simple:

I don’t add exposure until the stock stops proving me wrong.

This is where pragmatic investors separate themselves from reactive ones.

My edge doesn’t come from guessing.

It comes from preparing.

🛠️ How I’d Think About Positioning (Without Overtrading)

Personally, I’m not rushing into AVGO here.

I want to see whether the stock can absorb selling above $330 and stop making lower lows. If it can stabilize and reclaim $360 with consistency, I’m interested. Until then, I’m watching — not because I doubt the business, but because patience is still being rewarded.

If you’re conservative, you wait. You let AVGO prove it can stabilize and reclaim lost ground before committing capital. Missing the exact bottom is not a failure. Exact bottoms are for headlines, not portfolios.

If you’re more opportunistic, you size small near support and only add if the stock confirms stability. You’re not buying “cheap.” You’re buying control.

And if you’re long-term and genuinely comfortable owning Broadcom through cycles, you treat this as an accumulation zone — not all at once, but over time. Volatility here isn’t a bug. It’s the entry cost.

The mistake would be assuming this resolves quickly. The market may need weeks — not days — to fully digest what Broadcom just told it.

🧩 The Bigger Lesson AVGO Is Teaching Right Now

Broadcom didn’t break the AI story.

It matured it.

We’re moving from a phase where AI growth was priced as frictionless to one where execution, margins, and customer dynamics actually matter. That transition is uncomfortable, and it always comes with repricing.

Short term, that hurts.

Long term, it’s healthy.

Because the best opportunities don’t appear when stories are simple and consensus is high. They appear when stories get complicated — and the market overreacts to that complexity.

AVGO is not a momentum stock right now.

It’s a thinking person’s stock again.

And that’s usually where the real edge quietly begins to form — before the crowd notices.

TOGETHER WITH OUR PARTNER

200+ AI Side Hustles to Start Right Now

AI isn't just changing business—it's creating entirely new income opportunities. The Hustle's guide features 200+ ways to make money with AI, from beginner-friendly gigs to advanced ventures. Each comes with realistic income projections and resource requirements. Join 1.5M professionals getting daily insights on emerging tech and business opportunities.

🧠 What did you think of today's newsletter?

🧠 Final Word

Markets like this are uncomfortable for a reason. The stories aren’t clean, the reactions feel disproportionate, and every move seems to invite a second guess. When stocks sell off on “good” earnings, it shakes confidence — not because the business is broken, but because expectations finally collide with reality. That friction is what creates noise, and noise is what tempts investors to abandon process in favor of reaction.

This is where patience becomes a strategic advantage. I don’t need to predict how fast the story resolves — I need to recognize when the market is repricing certainty instead of fundamentals. When narratives mature, discipline matters more than speed. Staying grounded, waiting for clarity, and letting price confirm belief isn’t passive — it’s how conviction survives cycles.

Stay Sharp,

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.