🌞 Good Morning, Folks!

The market’s acting like it’s solved the AI puzzle — but something doesn’t add up.

Every headline screams about Nvidia’s next breakthrough or how AI will “change everything,” yet quietly, one of the biggest winners of the boom isn’t the name on anyone’s lips. While traders are chasing the next ChatGPT headline, Broadcom has been building the roads everyone else drives on — and almost nobody’s talking about it.

It’s the kind of setup that hides in plain sight. The stock barely moves for weeks, analysts yawn, and then one catalyst — like next week’s earnings — flips the narrative. That’s the quiet power phase before conviction money moves in.

When a company like Broadcom sits near a $1.9 trillion market cap, just shy of $2 trillion, the question isn’t “Can it grow?” — it’s “How much more can the market ignore before the next leg up begins?” And that’s exactly the kind of tension that creates opportunity.

This week, I’m not here to echo the noise. I’m here to unpack what’s actually happening underneath the AI euphoria — the real story about infrastructure, pricing power, and why Broadcom may be the most underappreciated trillion-dollar stock in the market.

Because while the crowd is obsessed with headlines, disciplined investors know where the signal really hides — and that’s what we’ll dig into in This Week’s Focus.

🌐 From Around the Web

Meta Platforms (META) is often overshadowed by chip-makers or cloud-giants — but this piece argues it remains one of the most undervalued AI plays out there. The company is doubling down on AI infrastructure and investing heavily, yet its core advertising business (powered by AI-driven targeting and recommendation engines) gives it a real path to justify that expensive bet. For long-term investors, this could be a chance to buy into AI exposure outside the usual suspects — with lower headline-risk if ads and user reach hold up.

Recent commentary shows the Federal Reserve is maintaining a more unified front than expected, as global economic uncertainties and sticky inflation muddy the rate outlook going into 2026. While certainty around future rates backs some stability, investors looking for a clear “fed-cut rally” may be disappointed. That ambiguity tends to favor value, dividend and defensive sectors over speculative growth — a pattern worth watching heading into the new year.

Digital-Asset Treasury companies — publicly traded firms that hold crypto or tokens on their balance sheets — have surged in popularity. But many are now facing serious headwinds: with crypto prices down and growing regulatory scrutiny, those “treasure chests” are being marked to market — meaning paper losses could become real ones if confidence deteriorates further. For investors, any idea of DATs as easy ways to ride a crypto recovery needs rethinking — the thesis hinges heavily on broader sentiment and regulatory developments.

TOGETHER WITH OUR PARTNER

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

🔍 This Week’s Focus: AI Surge — Could Broadcom Crack $2 Trillion by 2026?

Broadcom doesn’t sell GPUs. It sells the arteries that feed them.

And that difference could be worth another trillion dollars.

While the market obsesses over flashy chipmakers and meme-driven moves, Broadcom has quietly built itself into the silent giant of the AI age — powering the data highways that every large language model runs on.

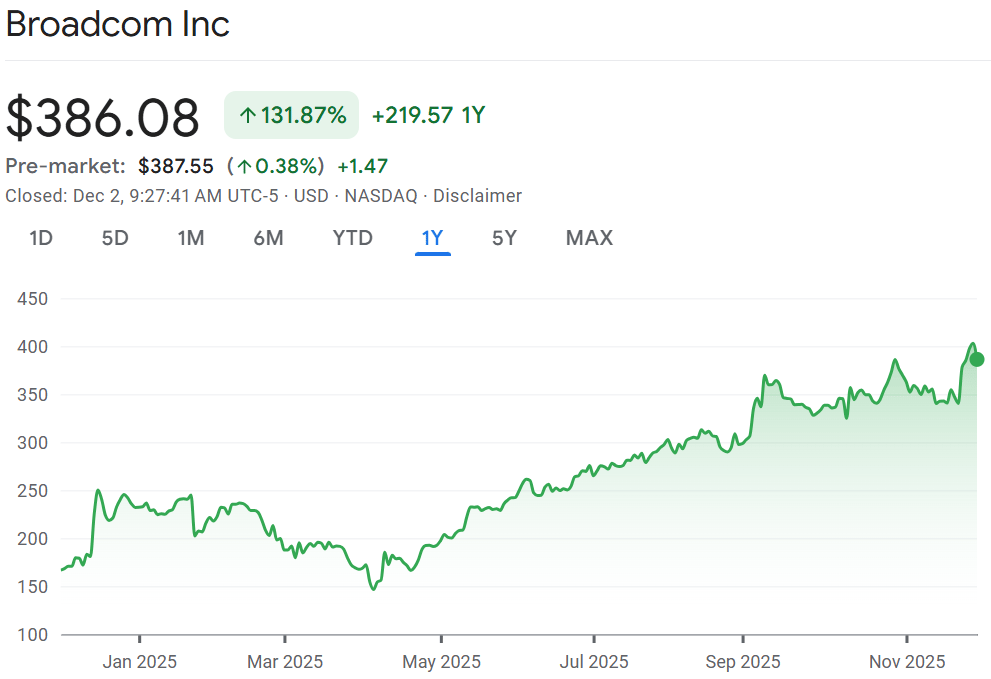

With shares trading around $398–$400 and a market cap near $1.88 trillion, Broadcom now sits inches away from one of the most exclusive clubs in markets: the $2 trillion tier. That’s just a 6–8% move — but the implications are massive.

Because a $2 trillion Broadcom wouldn’t just signal another hot tech rally.

It would confirm something bigger: that infrastructure — not hype — is where the real AI money compounds.

So this week, let’s dig into what’s actually happening beneath the surface.

🚀 AI Tailwind: Still Blowing Hard

In its latest quarter, Broadcom reported $15.95 billion in revenue, up 22% year over year — its strongest growth in years.

AI-related semiconductor sales jumped 63%, hitting $5.2 billion. That’s not hype. That’s hardware turning into habit.

But what’s more impressive is how Broadcom is executing while staying boring. It’s not trying to be Nvidia 2.0. It’s doubling down on what Nvidia needs — networking, interconnects, and custom silicon that make the AI supply chain actually work.

The result?

Broadcom has quietly positioned itself as the backbone of hyperscaler infrastructure — supplying chips and software to Amazon, Google, Meta, and Apple. It doesn’t dominate headlines. It dominates invoices.

And while everyone’s chasing “AI breakthroughs,” Broadcom is doing something more powerful: cashing steady, high-margin checks from the companies building the future.

🧩 The Real Story — Diversification and Discipline

Broadcom isn’t a one-trick chipmaker. It’s become an ecosystem.

After integrating VMware, it now has two growth engines:

1️⃣ Semiconductors – The physical layer of AI and data infrastructure.

2️⃣ Software – A high-margin, recurring revenue stream that smooths the hardware cycles.

This dual structure makes Broadcom less vulnerable to the boom-bust rhythms that plague most semiconductor names. While others swing on every product cycle, Broadcom quietly compounds.

Margins remain near 60%, free cash flow strong, and balance sheet clean. It spends heavily on R&D, but still delivers consistency — a rare combination in tech.

That’s why institutions love it.

It’s not exciting. It’s reliable. And reliability scales faster than hype.

⚠️ The Hidden Price of Perfection

Now, the uncomfortable truth: Broadcom’s valuation already assumes a lot of success.

At roughly 30× forward earnings, it’s priced higher than Marvell (~25×) but slightly below Nvidia’s 35×. That’s elite territory — and elite valuations don’t forgive mistakes.

If AI order momentum slows, or hyperscalers pause spending, the pullback could be sharp.

Miss one earnings beat, and this stock can erase three months of gains overnight.

The VMware integration also adds complexity. Culture clashes, customer retention, and margin blending are still unfolding. Software diversification helps stability — but also brings execution risk.

And competition is heating up.

Marvell, AMD, and even internal hyperscaler chip teams (like Amazon’s Graviton or Google’s TPU) are developing solutions that could eat into Broadcom’s future orders.

That’s the shadow under every perfect setup: when expectations leave no room for breath.

🔭 What I’m Watching — And How I’d Play It

When everyone’s excited about “AI plays,” I focus on signals that actually matter.

Here’s my checklist for the next few weeks:

1️⃣ Q4 Earnings — December 11, 2025

→ Watch AI semiconductor revenue growth, new custom-silicon orders, and forward guidance. If growth remains above 50% YoY, that’s a green light.

2️⃣ Institutional Activity

→ A breakout above $405–$410 with high volume signals conviction buying. Weak volume post-earnings? That’s hesitation.

3️⃣ Software Segment Margins

→ The VMware integration must deliver. Flat or rising margins = execution. Declines = distraction.

4️⃣ Macro Capex Trends

→ If cloud giants confirm higher AI spending in 2026 budgets, Broadcom’s demand pipeline is safe.

My playbook is simple:

Starter Position near current levels, about 25% of normal allocation.

Add only if volume and guidance confirm the uptrend.

Cut if earnings miss or guidance turns cautious — no ego, just structure.

Conviction doesn’t mean guessing.

It means preparation.

⚖️ The $2 Trillion Filter

Forget the headlines. Here’s what really needs to happen for Broadcom to break $2 trillion and stay there:

Condition | Signal to Watch |

|---|---|

AI revenue > $6 B per quarter | Sustained 50%+ YoY growth |

VMware integration strengthens margins | Recurring software revenue up 10–15% |

Stronger hyperscaler partnerships | Public contract renewals / backlog data |

Institutional accumulation | Volume confirmation above $410 |

Free cash flow expansion | Positive revisions from analysts |

If these stay intact, that $2 T number isn’t fantasy — it’s just math.

But if AI growth plateaus, or software margins compress, Broadcom could retrace to the $360–$370 range before finding support.

That’s not fear. That’s physics.

🧠 The Bigger Picture

We’re entering the “infrastructure phase” of AI.

The models are built. Now comes the buildout — and that’s where Broadcom thrives.

It’s not selling excitement. It’s selling capacity.

And in every gold rush, the capacity builders win longest.

While the crowd debates who’s training the smartest AI, Broadcom is quietly selling the picks, shovels, and server racks that power them all.

That’s the difference between trading noise and investing in structure.

🔚 Final Take: Pragmatism Over Prediction

Broadcom won’t trend on social media. It won’t deliver instant dopamine hits.

But that’s exactly why it matters.

It represents the kind of stock serious investors hold through noise — because they understand the architecture of growth.

If execution holds, $2 trillion will come quietly — one invoice, one data-center order, one infrastructure buildout at a time.

If not, it’ll reset. And that’s fine. The story isn’t broken until the structure is.

Markets run on emotion.

Wealth compounds on discipline.

And discipline is what you came here for.

TOGETHER WITH OUR PARTNER

Want to take advantage of the current bull run?

If you want to take advantage of the current bull market but are hesitant about investing, online stock brokers could help take the intimidation out of the process. These platforms offer a simpler, user-friendly way to buy and sell stocks, options and ETFs from the comfort of your home. Check out Money’s list of the Best Online Stock Brokers and start putting your money to work!

🧠 What did you think of today's newsletter?

🧠 Final Word

Every market cycle tempts us to chase noise dressed as opportunity. Right now, everyone wants to own the next AI rocket ship — but few want to own the steel, silicon, and sweat that keep it running. The screens flash green, then red, and the headlines swing between euphoria and doom. It’s exhausting, and that’s exactly how short-term traders lose their compass.

I’ve learned to stay where conviction meets clarity. The big money isn’t made guessing who wins the next hype wave — it’s made owning the infrastructure behind every wave. Broadcom is a reminder that patience, not prediction, builds wealth. In a world obsessed with speed, calm focus is the real edge.

Stay Sharp,

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.