🌞 Good Morning, Folks!

Everyone’s celebrating the AI “winners” — but the numbers don’t quite line up. Microsoft spends $44 billion in a year building data centers, yet Nvidia pockets 76% margins selling the chips that fill them. The headlines scream AI dominance, but the math whispers something else.

This is the part the media glosses over: the company building the fortress isn’t always the one feasting inside it. The hype machine wants you to believe every dollar invested by Big Tech becomes a dollar earned. But history says otherwise — sometimes the shovel seller wins, sometimes the landlord gets squeezed.

That’s why I want to slow this week down. Strip away the buzzwords, the trillion-dollar valuations, and the glowing coverage. What matters isn’t who looks like the winner, but who actually keeps the profits when the bills land.

In today’s issue, I’ll dig into the tension around Microsoft and its AI empire — and why the story isn’t as simple as “more spend equals more dominance.” This isn’t doom, and it’s not hype. It’s about clarity: separating real moats from expensive illusions.

The section you’ll see next — This Week’s Focus — unpacks the cracks and the leverage in Microsoft’s AI bet. Not to dismiss it, but to weigh it properly. Because if you only read the headlines, you’d miss the part that actually moves your portfolio.

By the end, my goal is simple: cut through the noise, give you conviction, and leave you sharper than the crowd still chasing inevitability.

🌐 From Around the Web

🤝 Nvidia’s $100B Bet With OpenAI Ignites Global Chip Frenzy

Nvidia is investing up to $100 billion into OpenAI, securing both supply and stake in what’s arguably the epicenter of AI infrastructure build-out. The move isn’t just financial—it’s structural: expect GPU demand upside, partner gains, and spillover buying across semis. If you blink, you’ll miss how this anchors the next leg of the AI rally.

⚠️ Palantir + Meta Moves Waving $17B Alarm Bells on Wall Street

Insider activity and contract disclosures from Palantir and Meta suggest ~US$17B in potential “warning” exposure. Most investors are caught up in growth stories; the smart ones are looking at what insiders are doing and what obligations are baked into those deals. It hints at risk accumulation many haven’t priced in.

📈 U.S. Treasurys Are Quietly Getting Their Mojo Back

After months of being the funding punch-bag, U.S. Treasurys are attracting capital again, driven by rising risk aversion and concerns over overheated tech. The yield chase isn’t flashy—but it’s meaningful: it signals the margin of safety trade is reentering the menu. Miss this, and you might be over-exposed when the next risk event hits.

TOGETHER WITH OUR PARTNER

Your daily edge in private markets

Wondering what’s the latest with crypto treasury companies, Pre-IPO venture secondaries, private credit deals and real estate moves? Join 100,000+ private market investors who get smarter every day with Alternative Investing Report, the industry's leading source for investing in alternative assets.

In your inbox by 9 AM ET, AIR is chock full of the latest insights, analysis and trends that are driving alts. Readers get a weekly investment pick to consider from a notable investor, plus special offers to join top private market platforms and managers.

And the best part? It’s totally free forever.

🔍 This Week’s Focus: Microsoft’s AI Showdown - The Costs Are Huge, But So Is the Prize

If you own Microsoft stock, you’re not just buying software anymore — you’re buying the backbone of AI.

Yes, the bills are massive. Microsoft spent more than $44 billion last year building AI data centers. Yes, OpenAI is restructuring and might take a bigger slice of profits. But here’s the flip side: Microsoft is also becoming the landlord of the entire AI economy.

The fortress is expensive to build. But if it stands, it could become the toll booth for every company rushing into AI.

🍰 OpenAI’s Restructure: Less Slice, Still a Seat at the Table

When Microsoft invested billions in OpenAI, it secured exclusive hosting rights and a cut of profits. Now, OpenAI is moving toward a standard for-profit structure, which likely means Microsoft’s slice gets thinner.

But thinner doesn’t mean irrelevant. Microsoft still powers OpenAI through Azure, and that traffic alone cements Azure as the default home for advanced AI. Even if OpenAI keeps more upside, Microsoft gets something just as valuable: volume, stickiness, and enterprise credibility.

⚡ The $44 Billion AI Power Bill

In 2024, Microsoft’s capex surged nearly 80% to $44 billion. That’s not waste — it’s a moat.

Every hyperscale data center Microsoft builds isn’t just a cost; it’s a gate. A single ChatGPT query burns 10x the power of a Google search. Few companies on earth can afford to build the infrastructure to handle that at scale. Microsoft can.

Yes, margins get pressured in the short term. But the payoff is owning the rails of AI — the highways that everyone else has to drive on.

🔄 The Double Bind — Or Double Leverage?

It’s true: Microsoft is paying on both sides.

It funds OpenAI.

It builds the data centers.

It carries the energy bills.

But this isn’t just a bind — it’s leverage. By bankrolling OpenAI and hosting it, Microsoft ensures that the most advanced AI workloads flow through Azure. Even if OpenAI captures more profits, Microsoft captures the demand that powers its cloud.

That demand strengthens Office, Teams, GitHub, and every product Copilot touches. AI becomes a growth engine across the portfolio.

🧩 The Strategic Bet

Microsoft isn’t betting on one path. It’s hedging brilliantly:

OpenAI keeps it at the center of the conversation.

Anthropic integration diversifies risk.

Custom AI chips reduce Nvidia dependence.

Enterprise AI tools (Copilot) monetize demand directly.

That’s not just playing defense. That’s building an ecosystem. And ecosystems scale.

📊 The Investor Lens

Area | Opportunity | What to Watch |

|---|---|---|

💵 Margins | Pressure now, but long-term moat | Azure margins & capex trends |

📈 Cloud Demand | More AI = more Azure traffic | Azure growth % in earnings |

🌍 ESG Positioning | Green data centers = regulatory edge | Renewable matching & disclosures |

🏗️ Competition | Rivals building, but Microsoft leads in integration | Enterprise adoption of Copilot |

Compare this: Nvidia has ~76% gross margins selling chips. Microsoft’s margins may compress today — but if it locks in enterprise AI demand across Azure + Office + Dynamics, the recurring revenue could dwarf chip sales.

Investors feel FOMO, see social proof, and believe Microsoft’s scale = guaranteed profits. That’s risky.

But here’s the positive angle: sometimes FOMO is justified. Microsoft does own unique positioning. No one else combines cloud dominance, enterprise lock-in, and direct AI monetization at this scale.

The hype isn’t always empty. Sometimes the crowd is right — the key is price and timing.

✅ What I’m Watching (And You Should Too)

Here are the four signals I track to know whether Microsoft’s AI bet is creating wealth or bleeding it:

Capex vs. Cloud Growth

If capex (currently $44B+) grows faster than Azure revenue, that’s a red flag.

Sweet spot: Azure growth above 25% YoY while capex growth slows — proof the infrastructure is paying off.

Gross Margins in Intelligent Cloud

Margins slipping = energy and infrastructure costs biting.

Margins stabilizing or rising = AI demand translating into profit.

Copilot Adoption Metrics

Enterprise rollout is the clearest revenue unlock.

Look for broad deployment across Microsoft 365 — recurring revenue gold.

OpenAI Equity & Exclusivity

Does Microsoft keep meaningful ownership after restructuring?

If exclusivity fades, watch how fast Microsoft pivots to Anthropic or in-house models.

🚀 Actionable Moves

Long-term holders: Stay put, but watch Azure margins closely. Microsoft is a compounder if AI monetization sticks.

Risk hedgers: Add Nvidia (NVDA), utilities like NextEra Energy (NEE), or infrastructure ETFs like Global X Data Center REITs ETF (VPN). They profit whether Microsoft margins expand or compress.

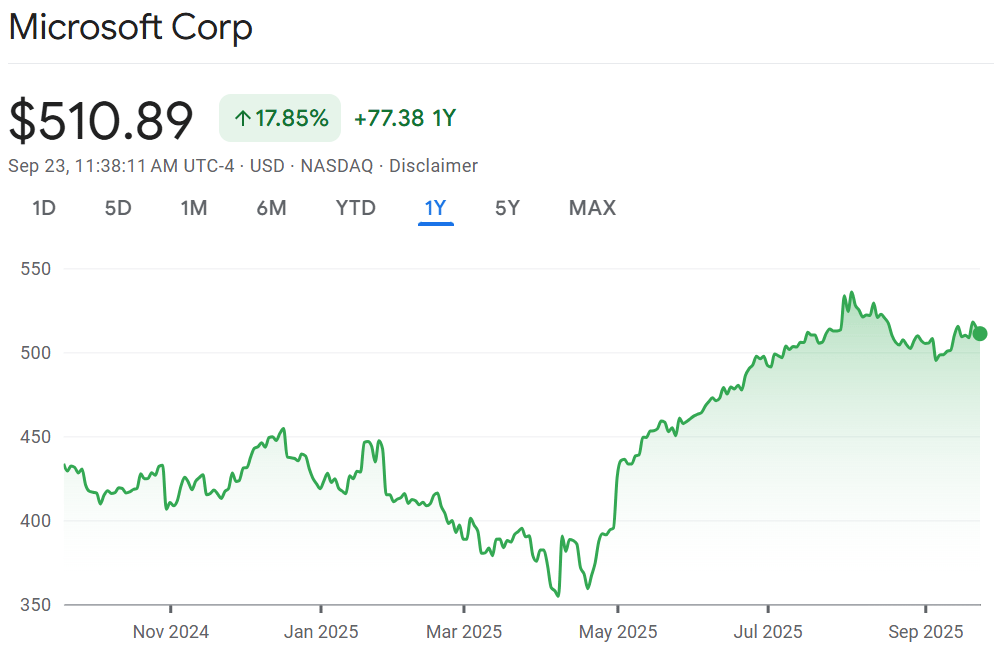

New buyers: Look for pullbacks toward support levels (see chart) before adding — better entry, less risk of paying peak hype.

🔮 Looking Ahead

Microsoft’s AI story is no longer just about headlines or hype — it’s about execution. The bills are big, the risks are visible, but so is the opportunity. Over the next 12–24 months, the real test will be whether Microsoft can turn massive infrastructure spend into sticky enterprise revenue. If it does, the fortress it’s building won’t just be another tech campus — it will be the toll road every AI competitor has to drive on.

TOGETHER WITH OUR PARTNER

Used by Execs at Google and OpenAI

Join 400,000+ professionals who rely on The AI Report to work smarter with AI.

Delivered daily, it breaks down tools, prompts, and real use cases—so you can implement AI without wasting time.

If they’re reading it, why aren’t you?

🧠 What did you think of today's newsletter?

🧠 Final Word

Markets are buzzing with every AI headline, rate-cut whisper, and chart pattern that promises destiny until it doesn’t. The noise is constant, optimism is heavy, and yet beneath it all sits an unease — a recognition that costs, margins, and reality eventually call their due. Microsoft embodies this tension perfectly: it’s spending billions to build the AI fortress, while investors debate whether it’s the king collecting rent or the peasant paying the taxes. Inevitability feels seductive, but inevitability without profitability is a trap.

Here’s where I land: Microsoft’s fortress may be expensive, but if it holds, it becomes the toll booth for the AI economy. That doesn’t mean you chase the hype blindly, nor does it mean you dismiss the risks. It means you watch the signals with discipline — margins, capex, adoption — and keep your edge by staying calm when the crowd swings manic. I don’t need to be first, I need to be right when it matters. That clarity is the edge worth keeping.

Stay Sharp,

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.