🌞 Good Morning, Folks!

Everyone keeps talking about “AI stocks” like it’s one big trade.

But that doesn’t add up.

Because while people argue about which app wins, the real money is quietly flowing into the one thing AI can’t live without: capacity. Real factories. Real output. Real constraints.

Here’s the overlooked signal most people missed: TSMC’s latest monthly revenue print wasn’t just “good.” It was the kind of number that forces institutions to stop debating and start repositioning. When a company shows you demand is pulling forward in real time, the market doesn’t wait for your feelings to catch up.

And yet the narrative online is still weirdly split. Half the crowd says TSMC is “too expensive” because it’s ripping. The other half is treating it like a guaranteed straight line up forever. Both are lazy takes. One is fear dressed up as discipline. The other is optimism dressed up as certainty.

What’s actually happening is more interesting. TSMC is behaving less like a cyclical chip stock and more like a strategic asset, because it sits at the choke point of the AI buildout. That shift changes how the stock trades, how pullbacks behave, and what “risk” really means here.

In today’s This Week’s Focus, I’m going to break down why TSMC is surging, what the market is really paying for, and the few signals that matter if you don’t want to get sucked into FOMO or paralysis.

We’ll talk about the three drivers behind the move, the bear case that could trip it up, and the exact price zones that separate a healthy pullback from a mood swing that turns into something uglier.

And most importantly, I’ll lay out a simple playbook: what I do if I already own it, what I do if I don’t, and how I keep my decision-making clean when the stock is moving fast.

Because the goal this week isn’t to sound smart. It’s to stay sharp while everyone else is getting loud.

🌐 From Around the Web

🛢️ BP Beats Earnings Expectations in Q4 and Full Year as Energy Prices Hold Up

BP reported better-than-expected results for both its fourth quarter and full 2025, as higher oil and gas prices combined with disciplined cost control boosted profitability and free cash flow. The company’s downstream refining and chemicals units delivered solid margins, helping offset modest upstream production volumes. For energy investors, the beat underscores how major integrated oil companies can still generate strong shareholder returns even in a more volatile commodity environment.

📈 CEO Lip-Bu Tan Just Delivered Fantastic News for Investors at Cadence Design

Cadence Design Systems — an essential provider of software tools used to design semiconductors — reported stronger revenue guidance and expanding customer demand across AI and advanced processing segments. CEO Lip-Bu Tan’s leadership has positioned the company to benefit from sustained investment in chip design, especially for complex AI accelerators and next-generation nodes. For long-term investors, improved guidance suggests Cadence could continue compounding returns as semiconductor budgets grow.

💻 Microsoft’s Stock Is Cheaper Than IBM’s for the First Time in a Decade — What That Says About the AI Trade

For the first time in over a decade, Microsoft’s valuation (on a price-to-earnings basis) is now lower than IBM’s — a striking reversal that highlights how growth expectations and AI positioning have reshaped tech valuations. Microsoft’s strong recurring revenue streams and expanding footprint in cloud AI contrast with IBM’s more modest growth profile and legacy enterprise focus. This valuation inversion suggests Wall Street may be pricing in a maturing of the AI narrative — where traditional cloud leaders now appear more attractive relative to older enterprise vendors.

TOGETHER WITH OUR PARTNER

When it all clicks.

Why does business news feel like it’s written for people who already get it?

Morning Brew changes that.

It’s a free newsletter that breaks down what’s going on in business, finance, and tech — clearly, quickly, and with enough personality to keep things interesting. The result? You don’t just skim headlines. You actually understand what’s going on.

Try it yourself and join over 4 million professionals reading daily.

🔍 This Week’s Focus: TSMC Is Surging… And It’s Not A Meme Move

TSMC is ripping, and I can already hear the two predictable voices in every investor’s head.

Voice #1: “It’s too late.”

Voice #2: “I should’ve bought more.”

Both voices are useless. They’re emotional. And emotion has a talent for making you buy tops and sell bottoms while convincing you it’s “risk management.”

What’s happening to TSMC right now is simpler than people want it to be. The market is not chasing a story. It’s repricing a constraint.

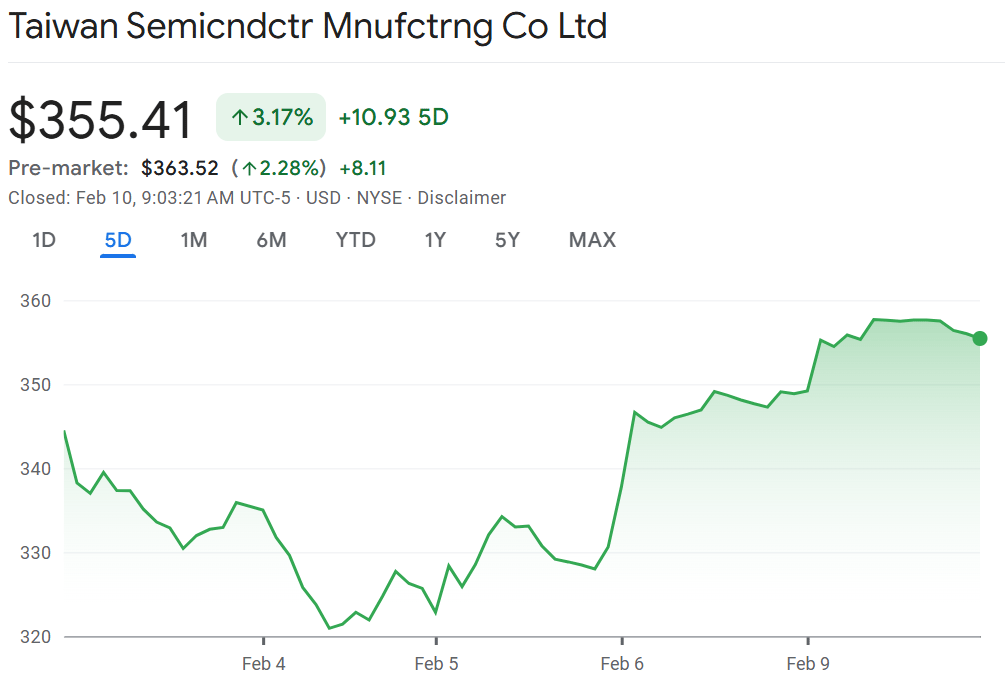

TSMC just reported January revenue of NT$401.26B, (~US$12.7B). That’s not a “maybe.” That’s a real number forcing real funds to rebalance.

This is the moment where the “AI trade” stops being a headline and starts being a supply chain reality.

🔥 Why TSMC Is Running (3 Drivers, 3 Proof Points)

1) AI Demand Is Still Loud

That January revenue number. Up ~20% month-over-month and ~37% year-over-year. When revenue accelerates like that, the market stops debating and starts buying.

2) The Real Bottleneck Isn’t Chips. It’s Capacity + Packaging

Everyone wants leading-edge nodes and advanced packaging at the same time, and there are only a few players that can deliver at scale. TSMC is not “a semiconductor company” in this phase, it’s a time machine for the world’s biggest tech budgets.

3) TSMC’s Capex Is Being Read As Moat, Not Risk

Management has been willing to spend aggressively (think $52B–$56B capex range) because demand visibility is there. The market loves disciplined spend. It really loves disciplined spend when demand is pulling the future forward.

Here’s the human version: when the biggest buyers on earth keep spending on AI infrastructure, the “factory behind the factory” becomes the asset. That’s why TSMC keeps getting paid.

⚠️ The Bear Case (What Could Break This, No Sugarcoating)

This is the part that keeps me honest, and it should keep you protected.

TSMC can still pull back hard even if the long-term thesis is right. Here’s what would make me stop adding and start waiting:

AI demand pauses (or customers digest inventory for a quarter or two)

Margins disappoint because the ramp costs more than the market expected

Capacity catches up faster than expected, reducing scarcity premium

A geopolitics headline shock triggers a broad de-risking, regardless of fundamentals

My tell is always the same: if the stock starts making lower lows and can’t reclaim key levels quickly, that’s not “healthy consolidation.” That’s distribution.

🧭 The Playbook (Levels, Rules, And A Plan You Can Execute)

TSM (ADR) - Stock opening at $363 as of 10 Feb

I’m going to keep this practical. No magic indicators. Just price, zones, and rules.

📍 The Zones I Care About (based on today’s range)

$360 area: recent peak / “buyers still in control” line

$350 area: first meaningful support / “trend still intact” line

$330–$335 area: deeper support zone from recent trading / “if we’re here, momentum cooled” line

✅ Confirmation Rules (this is where most people improve overnight)

I only treat $360 as support if we get 2 daily closes above it after a pullback

I only treat $370 as a breakout if it clears and then holds on a retest

If it slices through a level and can’t reclaim within a few sessions, I don’t argue. I wait.

Now the execution, depending on what kind of investor you are.

🟩 If You Don’t Own TSMC Yet (and you feel that FOMO)

Don’t chase. Don’t freeze. Split the difference and use structure.

Starter position: 25–33% of your intended size.

Plan A: Buy The Pullback (cleanest)

Enter small near $360 only after it holds (2 closes rule)

Add the next 25–33% if it reclaims $370 and holds on retest

Add the final portion only when it proves trend continuation

Risk line: If it loses $360 and can’t reclaim within a few sessions, pause.

Plan B: Buy The Breakout (for trend-followers)

Enter small only after a clean break above $370, then add on the retest hold

If there’s no retest, don’t FOMO-size it. Keep it small until it offers a proper setup.

This is the FOMO reframe that actually works: If it feels like you’re behind, you’re not. You’re just early… for the next clean entry.

🟦 If You Already Own TSMC (and you’re up big)

Your job is not to “lock profits because you’re scared.”

Your job is to avoid getting shaken out of a winner.

A simple rule that keeps you sane:

As long as it holds $360, I treat pullbacks as noise

If it breaks $360 and can’t reclaim, I tighten risk and stop adding

If it falls toward $330–$335, I reassess and only add if it stabilizes and reclaims levels

If you’re overweight, a small trim into strength is fine. But don’t do the classic move where you trim the winner and keep the laggards. That’s how portfolios die slowly.

The Bottom Line

TSMC is surging because the market is paying for something real: constrained supply meeting relentless AI demand.

But price still matters. Entries still matter. Your emotions still matter.

So I’m not here to tell you to buy because it’s “the future.” I’m here to tell you the future pays best when you stop chasing it and start executing it.

TOGETHER WITH OUR PARTNER

Go from AI overwhelmed to AI savvy professional

AI will eliminate 300 million jobs in the next 5 years.

Yours doesn't have to be one of them.

Here's how to future-proof your career:

Join the Superhuman AI newsletter - read by 1M+ professionals

Learn AI skills in 3 mins a day

Become the AI expert on your team

🧠 What did you think of today's newsletter?

🧠 Final Word

The hardest part about a stock like TSMC ripping isn’t the analysis. It’s the emotion. When price keeps climbing, your brain starts bargaining with time, replaying every moment you didn’t buy, every share you sold too early, every “I’ll wait for a pullback” that never came. That’s when the market turns into a mirror, not a scoreboard. And if you’re not careful, you stop trading the chart and start trading your regret.

So here’s the steadier truth I come back to: my edge isn’t speed, it’s structure. I don’t need to catch the first 10% of a move to win, and I don’t need to chase the last 10% to feel smart. I just need a clean setup, a clear invalidation line, and the patience to let price prove itself before I commit more capital. When the crowd gets loud, I get quieter. Because hype doesn’t last, but well-defined plans do.

Stay Sharp,

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.