🌞 Good Morning, Folks!

Something about this week’s sell-off doesn’t sit right.

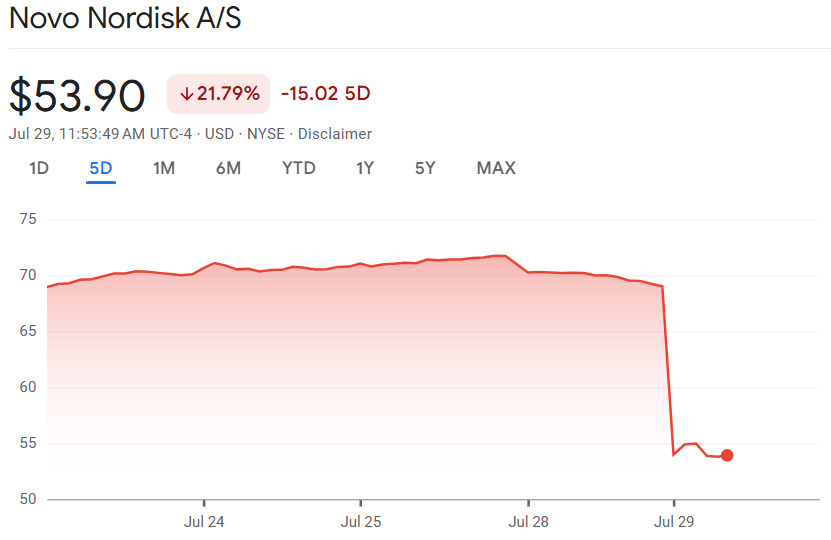

Novo Nordisk shaved a few points off its 2025 forecast — and the stock fell off a cliff. Nearly $140 billion wiped out in a day. The same company that’s been propping up European indexes and fueling the GLP-1 megatrend suddenly became toxic… over what? A revised growth range that still beats 90% of big pharma?

The market didn’t react to fundamentals. It reacted to narrative decay.

And that’s the tension I’m leaning into today — the gap between short-term panic and long-term power.

Because if you actually read the update (not just the headlines), you’d see a business still growing double digits, still generating operating profit up 29% YoY, and still leading one of the most transformative health trends of this decade. The downgrade? It wasn’t a death knell. It was a reset — and possibly a gift.

But most investors won’t see it that way. Because they’re addicted to speed. When the growth rate slows, they jump ship — even if the ship is still headed in the right direction.

In this issue, I’m breaking down what really happened with Novo — and more importantly, what it reveals about how the market prices momentum vs conviction.

This isn’t a call to chase the dip.

It’s a challenge to sharpen how you process risk, story, and price action when they’re pulling in different directions.

Let’s talk about what actually changed — and why clarity always wins in moments like this.

🌐 From Around the Web

Most people chase yield the wrong way — high-dividend traps, risky real estate, or speculative tokens.

This piece highlights dividend stocks and strategies that actually hold up in today’s rate environment — without blowing up your downside. Worth reading if you're tired of rental horror stories and want income without chaos.

Markets hate uncertainty — but they love predictability, even in chaos.

Wall Street’s reaction to Trump’s latest tariff rhetoric has been surprisingly muted. Here’s why investors might be underestimating the second-order effects of rising protectionism… and why you shouldn’t assume we’re in the clear just yet.

Think the Fed only matters for Wall Street? Think again.

This breakdown shows exactly how rate policy is quietly squeezing your cash flow, credit access, and investment returns. If you’re still positioning like it’s 2021, you’re already behind.

TOGETHER WITH OUR PARTNER

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

🔍 This Week’s Focus: Novo Nordisk Just Got Punched — So Why Am I Watching It Closer Than Ever?

Twenty percent.

That’s how far Novo Nordisk’s stock tanked after they cut their full-year guidance last week.

A company that added hundreds of billions to its market cap in less than two years… just lost nearly $140 billion in a day.

It was messy. Funds trimmed. Analysts downgraded. Retail panicked.

The narrative flipped overnight from unstoppable GLP-1 machine to growth deceleration red flag.

But while the headlines screamed collapse, I kept reading.

And here’s what most investors missed: Novo isn’t broken. The story just got resized.

This week, I’m leaning in — not to buy, but to understand the edge. Because this is the kind of moment where positioning and clarity separate amateurs from professionals.

🚨 The Drop That Shook the Thesis — But Didn’t Kill It

On July 29, Novo Nordisk issued a revised 2025 sales growth forecast of 8%–14%, down from 13%–21%.

They also lowered expected operating profit growth to 10%–16%, down from 16%–24%.

The market treated this like an earnings miss.

But this wasn’t a Q2 earnings disaster. It was a forward guidance reset — and one based mostly on supply constraints and short-term U.S. compounding issues, not a crumbling demand curve.

In fact:

Novo reported H1 revenue growth of 18%

Operating profit for the first half? Up 29%

So let’s be clear: the business didn’t implode. It just told investors to slow their roll on the second half.

But when your stock is priced for perfection — trading at 45x forward earnings — even a slight dent in narrative can trigger a violent rerating.

And that’s exactly what happened.

📈 Why the Market Flinched So Hard

Here’s why this drop felt louder than the numbers justify:

1. The GLP-1 Bubble Mentality Popped (Temporarily)

Everyone — and I mean everyone — had bid up the weight-loss drug space to “infinite TAM” levels.

When Novo admitted that scaling Wegovy and Ozempic might take longer due to production limitations and compounded competition in the U.S., the market yanked the emergency brake.

2. Lilly Is Getting Aggressive

Eli Lilly’s Mounjaro and Zepbound are growing faster in U.S. prescription volumes.

They’re executing hard on U.S. obesity, pulling ahead in launch cadence, and leaning into advertising. That spooked Novo bulls.

3. Valuation Compressed Fast

With those updated numbers, investors are finally redoing the math.

If sales growth slows to the low teens and margins face pressure, a 45x multiple feels rich — so we’re watching a classic “expectations come down faster than fundamentals” moment.

But here’s what didn’t change:

The GLP-1 class remains the most effective metabolic treatment ever approved

Novo still owns the science, the patents, and the R&D tailwind

Demand is still insane, both in the U.S. and globally — they just can’t fill it fast enough yet

This wasn’t a demand miss. It was a capacity and channel control reset.

And that matters — because transitory execution problems aren’t the same as a structural narrative break.

Why I’m Not Looking Away

When a mega-cap name drops 20% on guidance, the natural instinct is to stay away until the dust settles.

But I’ve learned something from two decades of doing this:

Sometimes the clearest signals come during the loudest exits.

Here’s what I’m watching right now — not as a buyer, but as a strategist:

How fast can Novo regain control of the U.S. market?

Their current weakness isn’t clinical — it’s logistical. Legal action against compounders. Scaling in-house supply. Channel strategy reset. This will tell us if the margin reset is temporary or lasting.Does the H2 guidance already bake in conservative assumptions?

If they’re sandbagging, Q3 or Q4 could reaccelerate the narrative. If not, we’ll see a gradual base-building phase like Apple in 2018 or Meta in 2022.Is the pipeline still underpriced?

Most investors still see Novo as “just” Wegovy and Ozempic. But if their NASH, oral semaglutide, or even Alzheimer’s-targeted GLP-1 therapies gain traction… we’re not done with upside optionality.

🔥The Strategic Reframe Serious Investors Should Use

This isn’t about whether Novo Nordisk is a buy right now.

It’s about whether you’re training your brain to lean into moments of dislocation… instead of flinching at every red candle.

Because this is where the actual money is made:

When Amazon dropped 30% in 2014 on missed holiday sales… it was a screaming signal

When Apple got crushed in 2018 over China demand fears… conviction investors got rewarded

When Meta imploded in 2022 on margin compression… the thesis hadn’t changed — just the price tag had

Now here’s Novo, down ~20%, still growing double digits, still dominating its category…

but suddenly priced like it’s running out of gas.

Maybe this is the top of the GLP-1 hype cycle.

Or maybe… it’s the exact moment you wish you’d paid closer attention when everyone else turned their backs.

🎯 This Is Where the Edge Lives

Not in perfect timing. Not in analyst consensus.

But in the mental muscle it takes to ask:

What’s really changed?

What hasn’t?

And where does the gap between narrative and truth create future alpha?

Novo Nordisk didn’t collapse.

The forecast got trimmed.

And the price just gave every serious investor a clear moment to reset their lens.

TOGETHER WITH OUR PARTNER

News you’re not getting—until now.

Join 4M+ professionals who start their day with Morning Brew—the free newsletter that makes business news quick, clear, and actually enjoyable.

Each morning, it breaks down the biggest stories in business, tech, and finance with a touch of wit to keep things smart and interesting.

🧠 What did you think of today's newsletter?

🧠 Final Word

There’s a weird discomfort in the air this week. Not panic — just that twitchy kind of market uncertainty that shows up after a narrative breaks and no one knows what replaces it. Novo Nordisk dropped hard, and suddenly everyone’s questioning whether the GLP-1 boom was hype all along. The same analysts who couldn’t raise their targets fast enough two months ago are now quietly stepping back. And retail? Already gone — because most didn’t understand the business to begin with.

But that’s where opportunity hides. In the gray zone — when the story gets complicated and the crowd gets spooked. I don’t need Novo to be perfect. I need it to be real, and I need to understand what actually changed versus what just got repriced emotionally. A thesis doesn’t die because a forecast shifts by a few percentage points. What matters is whether the core growth engine is still running — and whether everyone else is too scared to look under the hood. In that gap, strategy lives. So I stay steady, keep watching, and let the market flinch first.

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.