Steal our best value stock ideas.

PayPal, Disney, and Nike all dropped 50-80% recently from all-time highs.

Are they undervalued? Can they turn around? What’s next? You don’t have time to track every stock, but should you be forced to miss all the best opportunities?

That’s why we scour hundreds of value stock ideas for you. Whenever we find something interesting, we send it straight to your inbox.

Subscribe free to Value Investor Daily with one click so you never miss out on our research again.

As we navigate the intricate waters of 2024, inflation remains a critical gauge of economic health. As an investor, I'm here to tell you that the economic landscape is shifting, and if you're not paying attention, you might miss out on some golden opportunities.

Over the past two weeks, the Bureau of Labor Statistics has released data that shows inflation cooling more than anyone expected. This is huge news! We're talking about the kind of market movement that can make or break your investment strategy. In this post, I'm diving into the nitty-gritty of these inflation numbers, breaking down what they mean for the economy, and highlighting the stocks that are primed to soar in this new environment.

Recent Inflation Data: A Positive Surprise

On July 15, 2024, the Bureau of Labor Statistics released its Consumer Price Index (CPI) report for June. The headline inflation rate stood at 3.1% year-over-year, down from 3.7% in May. Core inflation, which excludes volatile food and energy prices, came in at 2.9%, marking a significant drop from the previous month's 3.4%. This decline indicates that the measures taken by the Federal Reserve to combat inflation are starting to bear fruit.

Key Highlights

Energy Prices: A significant reduction in energy prices contributed to the lower inflation rate, driven by increased global oil production and stabilizing geopolitical conditions. Crude oil prices have dropped by 15% year-over-year, easing the cost pressures on transportation and manufacturing sectors.

Food Prices: Food inflation moderated as supply chains continued to recover, and agricultural yields improved. The U.S. Department of Agriculture reported a 10% increase in wheat and corn production, which has helped stabilize food prices.

Housing Costs: Rent and housing prices showed signs of stabilizing, easing one of the most persistent inflationary pressures. The Housing Price Index (HPI) increased by only 2.5% in June, compared to 5% in May, indicating a cooling housing market.

Federal Reserve Implications

The lower-than-expected inflation numbers have sparked speculation about the Federal Reserve's next move. While the Fed has maintained a cautious stance, these figures increase the likelihood of a more dovish approach in upcoming meetings. The prospect of a slower pace of interest rate hikes or even potential rate cuts in the future could significantly impact various sectors and stocks.

The Fed's dual mandate focuses on promoting maximum employment and maintaining stable prices. With inflation showing signs of moderation, the Fed may shift its focus to supporting economic growth. If the trend of lower inflation continues, we could see a more accommodative monetary policy, which would be a positive development for the stock market.

Stocks Set to Gain from Lower Inflation

With the economy showing signs of stabilizing inflation, certain sectors and stocks are poised to benefit. Here are some of the top picks:

1. Apple Inc. (AAPL): The Tech Titan

Lower interest rates make future earnings more valuable, benefiting tech giants like Apple. With strong consumer demand for its innovative products and services, Apple stands to gain from increased disposable income and lower financing costs.

Recent Performance: Apple's stock has seen a 12% increase over the past twelvemonths, buoyed by strong sales of the iPhone 14 and robust growth in its services segment, which includes the App Store, Apple Music, and iCloud.

Financial Health: Apple reported a revenue of $97.3 billion in Q2 2024, up 7% year-over-year. Its net income was $23.4 billion, reflecting a healthy profit margin of 24%.

Growth Prospects: With the anticipated launch of new products, including the next-generation MacBook and augmented reality devices, Apple is well-positioned to capitalize on consumer spending trends. Additionally, Apple's expansion into financial services with Apple Pay and the Apple Card continues to drive growth.

12-Month Target: $230

2. Amazon.com, Inc. (AMZN): The E-Commerce Giant

Amazon is well-positioned to capitalize on increased consumer spending power. With its vast e-commerce platform and growing cloud services, lower inflation can drive more purchases and boost AWS growth.

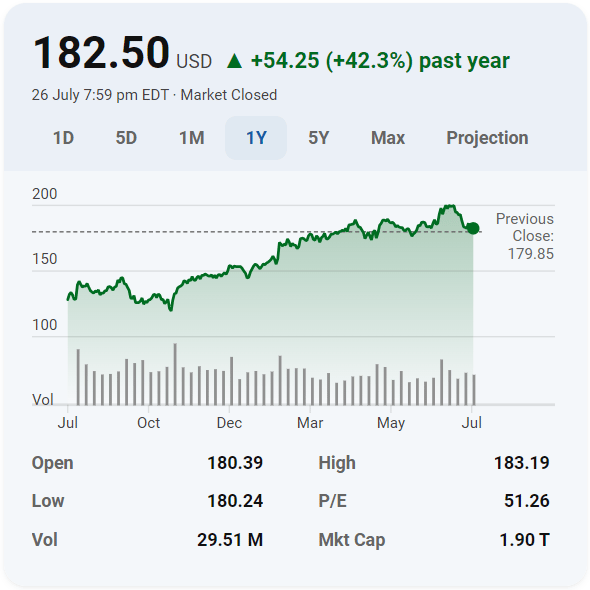

Recent Performance: Amazon's stock has rebounded by 42% in the last twelve months, driven by strong performance during Prime Day and increased AWS adoption by enterprises.

Financial Health: In Q2 2024, Amazon reported revenue of $134.4 billion, a 9% increase year-over-year, with AWS contributing $23.2 billion. The company's net income stood at $5.8 billion, highlighting its robust profitability.

Growth Prospects: Amazon continues to expand its logistics network, enhancing delivery capabilities and efficiency. Its investment in artificial intelligence and machine learning for AWS is expected to drive further growth, as more companies migrate to the cloud.

12-Month Target: $220

3. Prologis, Inc. (PLD): The Real Estate Leader

As a leader in logistics real estate, Prologis benefits from lower financing costs and increased e-commerce demand. The stabilization of rent prices also supports its robust growth outlook.

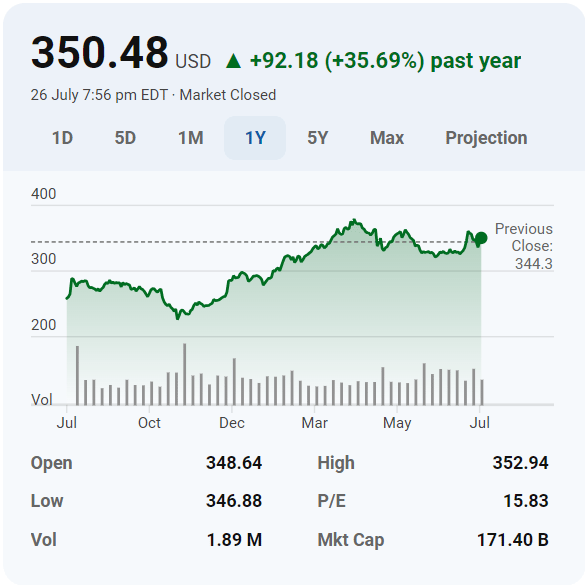

Recent Performance: Prologis has experienced a 10% stock price increase over the past quarter, reflecting investor confidence in its business model and growth prospects.

Financial Health: Prologis reported revenue of $1.6 billion in Q2 2024, up 8% year-over-year, with a net income of $850 million. The company's funds from operations (FFO), a key metric for real estate investment trusts, increased by 11%.

Growth Prospects: The continued growth of e-commerce and the need for modern logistics facilities position Prologis for sustained expansion. The company's strategic acquisitions and development projects in key markets further enhance its competitive edge.

12-Month Target: $129

4. Caterpillar Inc. (CAT): The Industrial Powerhouse

Lower inflation reduces input costs for Caterpillar, a leading manufacturer of construction and mining equipment. The potential for increased infrastructure spending further supports its growth trajectory.

Recent Performance: Caterpillar's stock has climbed 8% in the last two months, driven by strong demand for construction equipment and positive market sentiment around infrastructure investments.

Financial Health: In Q2 2024, Caterpillar reported revenue of $16.5 billion, up 10% year-over-year. Its net income was $2.2 billion, reflecting a solid profit margin of 13.3%.

Growth Prospects: The global push for infrastructure development, especially in emerging markets, is expected to drive demand for Caterpillar's products. The company's focus on sustainable and efficient machinery also aligns with growing environmental regulations.

12-Month Target: $250

5. Honeywell International Inc. (HON): The Diversified Innovator

Honeywell's diversified industrial portfolio positions it to benefit from a more favorable economic environment. Lower inflation can improve margins and support its innovative initiatives in automation and aerospace.

Recent Performance: Honeywell's stock has appreciated by 7% over the past three months, reflecting strong earnings and positive market sentiment.

Financial Health: In Q2 2024, Honeywell reported revenue of $10.3 billion, up 6% year-over-year. The company's net income was $1.8 billion, with a profit margin of 17.5%.

Growth Prospects: Honeywell's investments in advanced technologies, such as quantum computing and industrial automation, position it for long-term growth. The company's aerospace division, which provides avionics and engines, is set to benefit from the recovery in air travel.

12-Month Target: $224

Conclusion

The latest inflation report brings promising news of cooling inflation rates, which could signal a shift in Federal Reserve policy and present new investment opportunities. Key takeaways include the positive impact of lower energy and food prices, the potential stabilization of housing costs, and the broader implications for various sectors like technology, consumer discretionary, real estate, and industrials. As the economy adapts to these changes, investors should stay informed and agile, ready to adjust their portfolios accordingly.

The future remains uncertain, but the current trends offer a glimmer of hope for economic stability and growth. Will this downward trend in inflation continue, and how will it shape the market landscape in the coming months? Only time will tell.

Final Thought

As we navigate these changing economic conditions, it's crucial to remain proactive and informed. Keep a close eye on economic indicators and be ready to adapt your investment strategy to capitalize on emerging opportunities. Remember, in the world of investing, staying ahead of the curve can make all the difference. Stay curious, stay engaged, and let's see where this journey takes us.

Found these insights valuable? Elevate your investing game by subscribing to our blog for more in-depth analysis, strategies, and market trends. Stay ahead with expert tips and refine your portfolio. Share this post with friends interested in the stock market and let's build a smarter investing community together!

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.