🌞Good Monday Morning, Folks!

🪦 Buffett hasn’t left the stage yet — but the curtains are starting to close. And when he exits for good later this year, the era of rational investing may go with him.

The media barely blinked. No fireworks. No panic. Just a quiet heads-up at the Berkshire Hathaway annual meeting — and with it, the slow fade of the most disciplined voice in modern investing.

But this week, while Wall Street cheers another rally, I’m asking a different question: 👉 Do you still know how to invest without Buffett anchoring the narrative?

Today, we unpack what this shift really means — and spotlight a mid-cap sleeper that’s starting to look a lot like Buffett’s earliest winners.

💡One Big Idea: Buffett Is Leaving — And the Era of Rational Investing Might Be Too

There are moments when history doesn’t announce itself with fireworks — just a quiet shift in tone. That’s what we witnessed at the Berkshire Hathaway shareholder meeting this month. No bombshell deal. No grand pronouncement. Just Warren Buffett, 94 years old, sounding more like a man putting his affairs in order than the Oracle we’ve known for decades.

“I feel fine, but I know the odds,” he said with that familiar grin. But behind it? A truth the markets haven’t priced in yet:

The Buffett era is ending — and the investing world will never be the same.

Let’s be real: no one alive has had a bigger impact on modern investing. Buffett didn't just beat the market. He became the market’s conscience — a living resistance to speculation, leverage, and short-termism. He didn’t just allocate capital. He made discipline look heroic.

And now? That gravitational force — the one that steadied institutions and retail alike — is vanishing. Slowly. Quietly. But undeniably.

Of course, there’s a plan. Greg Abel, Buffett’s handpicked successor, is stepping in to lead Berkshire Hathaway. And on paper, Abel checks all the right boxes: operationally brilliant, calm under pressure, trusted inside the firm.

But here’s what most investors are missing: Abel is not Buffett. Not in style, not in strategy, and certainly not in public influence.

Buffett’s genius wasn’t just in stock picking — it was in narrative control. He could anchor markets with a sentence. Shift sentiment with a quote. Set expectations without hype. Greg Abel? Brilliant behind the scenes, but no public oracle. He’s not writing folksy, philosophically rich shareholder letters. He’s not sitting on $150 billion in cash waiting for blood in the streets. His style is quieter. More operational. More delegation, less doctrine.

That doesn’t make Abel bad. But it does make the future different. And when Berkshire changes, the market changes too.

Here’s how I’m thinking about this shift:

🧾 Berkshire’s cash deployment will tell you everything. Buffett hoarded liquidity like a wartime general. If Abel starts chasing yield or doing “big deals” to prove decisiveness, the market will notice — and so will I.

🛠️ Valuation discipline may loosen subtly. Buffett was obsessed with margin of safety. Abel, while capable, comes from a utility mindset — capital intensive, long-cycle, less alpha-driven. That matters.

📉 Narrative risk is rising. Buffett’s presence silenced critics and steadied shareholders. Without him, Berkshire becomes just another large conglomerate. And when the myth disappears, so does some of the multiple.

And this isn’t just about Berkshire.

Buffett’s departure marks a psychological pivot point for markets. A world without him will accelerate what’s already creeping in: speculative narratives, AI hype cycles, crypto fads, and momentum over fundamentals.

He held the line for decades — not just for Berkshire, but for value investors, compounders, even passive allocators who trusted that someone like Buffett was still calling BS on the noise.

When he steps down, that line goes undefended.

So no, I’m not panic selling. But I am adjusting my filters.

I’m looking for CEOs with skin in the game. Business models that compound without narrative fuel. And sectors that don’t need Buffett to remind investors why they matter.

Because the post-Buffett market won’t reward discipline the same way.

And the real question now is:

Are you building your portfolio for a world where Buffett’s not just retiring — but where Buffett-style thinking is retiring with him?

If not, you may already be positioned for a market that no longer exists.

🚨👉 Missed Friday’s Setup? Here’s What You Overlooked

Last Friday, I highlighted a stock that surged +7.6% — and it’s still climbing. This wasn’t a lucky guess; it was a calculated move based on clear signals. If you missed it, catch up now:

⚡Quick Hits: What Smart Money Is Watching This Week

1. Palantir’s Make-or-Break Moment Is Coming

💣 Palantir reports earnings on May 5, and expectations are sky-high after a 36% year-to-date surge. But with investors still unsure if PLTR is a true AI compounder or just riding hype, this quarter could tip the narrative — hard. Ignore this, and you might miss the shift from story stock to real business.

2. Big Tech’s $300B AI Bet: Boom or Bust?

💸 Microsoft, Google, Meta, and Amazon are pouring over $300 billion into AI infrastructure this year — even as rate cut hopes fade and earnings decelerate. Smart money loves the narrative, but the real question is: when will this AI spend start printing profits? The margin pressure is real.

3. OPEC+ Plays Hardball As Oil Slides 20%

🛢️ Despite Brent crude tanking 20% since April, OPEC+ just ramped up production again — signaling they care more about defending market share than stabilizing prices. For energy traders and inflation-watchers, this is a curveball you don’t want to miss.

🔒 Feeling Like the Market’s Rigged Against You?

With inflation creeping and geopolitical risks everywhere, smart money isn’t just rotating — it’s insulating. Gold IRAs from Goldco are helping investors hedge without the noise, panic, or Wall Street spin. If you’re looking for a smarter way to diversify without guessing headlines — it’s worth a closer look.

The 5 Advantages of a Gold IRA

With everything going on in the world today - inflation, tariffs, market volatility - it’s more important than ever to stay informed.

That’s why you need to get all the facts when it comes to protecting your retirement savings.

Did you know that Gold IRAs can help safeguard your money?

Request a free digital copy of The Beginner’s Guide To Gold IRAs to arm you with the facts.

In the Beginner’s Guide to Gold IRAs, you’ll get…

The Top 5 Advantages to a Gold IRA

How To Move Your 401K To Gold Penalty Free

A Simple Checklist For How to Get Started

Don’t miss this opportunity to get the facts about how a Gold IRA can help you protect and diversify your retirement savings.

*Offer valid on qualified orders of Goldco premium products only. Receive up to 10% in free silver based on purchase amount; cannot be combined with other offers. Additional terms apply—see your customer agreement or contact your representative for details.

🔍 Market Setup: The $13B Stock Hiding in Plain Sight

Nobody's watching Zebra — and that’s exactly why I am.

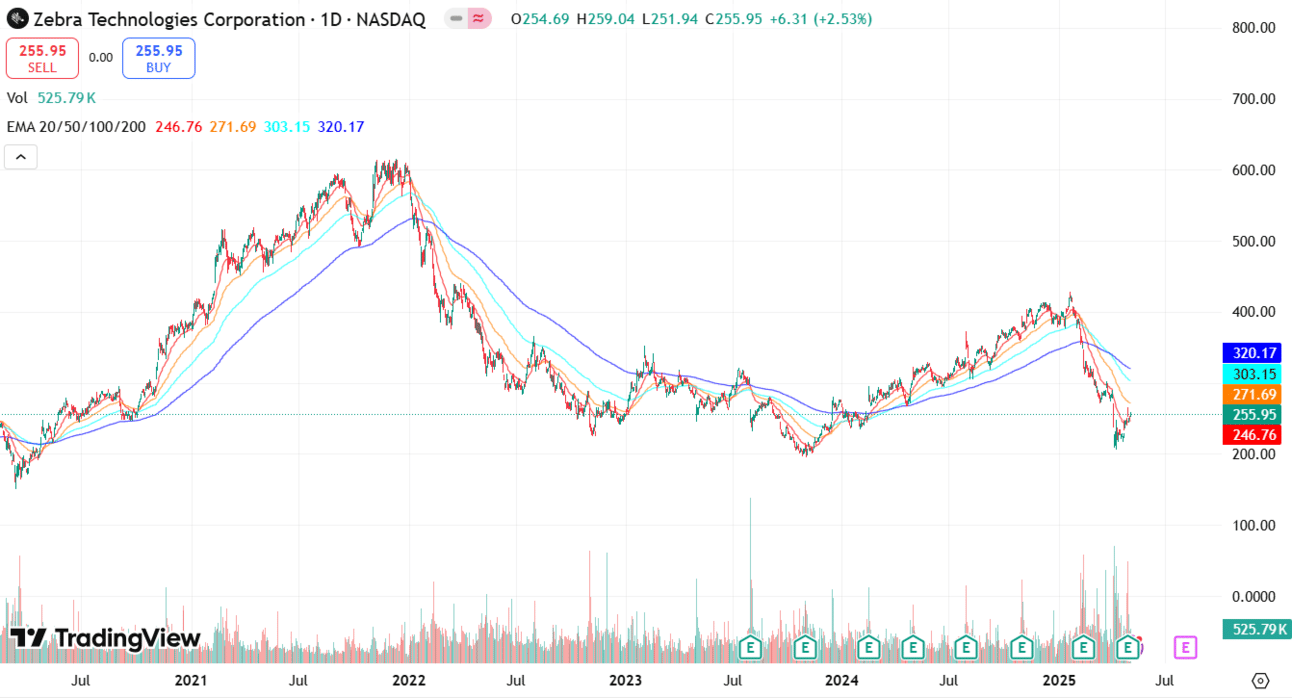

While the market is hypnotized by AI and semis, Zebra Technologies (NASDAQ: ZBRA) — a company powering real-world logistics, inventory, and industrial automation — is quietly setting up for something big. This isn't a buzzy name. It’s not riding headlines. But it is trading at a steep discount to its own fundamentals — and that’s where the edge lives.

Zebra’s core business? Making the tracking tech that keeps warehouses, hospitals, and supply chains humming. Think barcode scanners, RFID systems, and real-time analytics. Not sexy. But brutally necessary. EPS was $9.17 last year, and even with economic drag, this company is still posting strong double-digit margins, with a forward P/E under 18 — well below its five-year average.

The stock has dropped more than 30% from its 2021 highs, and it still hasn’t reclaimed its 200-day moving average — but that’s why I’m watching. Because when the technicals are weak but the business is strong, and the crowd isn’t looking… that’s often the launchpad.

📌 Here’s what’s on my radar this week:

Institutional flows have quietly started creeping in over the last 30 days

Q1 earnings drop May 7, and expectations are muted — which I love

If it holds $250 and gets any beat, this could rip through resistance faster than you think

Most traders won’t touch this because it’s not flashy. But I don’t need flash. I need mispricing, margin of safety, and a catalyst — and Zebra’s giving me all three.

🧠 This isn’t a meme stock. It’s a sleep trade with a sharp edge. And if the tape confirms what I’m seeing — I’ll be the one on the other side of the crowd when it moves.

🧠 1 Hour Could Change Your Trading Forever

I’m not here to pitch some overnight millionaire scheme.

But I am here to recommend a free 1-hour webinar that’s helped thousands of investors sharpen their execution — including me.

📌 Meet Iris Yuan — a trader who used to blow up accounts… until she built a sniper trading system that now lets her make $10K/month with just a few precise trades a week.

She’s teaching her exact framework in this no-fluff, highly tactical webinar — and it’s 100% free.

What You’ll Learn in 1 Hour:

✅ Her signature “Sniper Setup” with up to 90% win rate

✅ The 3-step system she uses to trade calmly, not constantly

✅ How to focus on only high-probability trades (2–3 a week)

✅ Why trading less = earning more (and sleeping better)

🚨 Seats fill up fast — and replays aren’t always guaranteed.

🧠 Final Thought

The market doesn’t reward nostalgia — it punishes indecision. Buffett’s coming exit isn’t just the end of an era — it’s a mirror. A reminder that no edge, no empire, no investor is untouchable forever. Most people cling to what worked yesterday, hoping it will somehow survive tomorrow. But investing isn’t about preserving myths. It’s about adapting faster than the story changes.

That’s why I’m watching the setups the crowd ignores. Because in every major market shift, there’s always a short window where clarity outperforms confidence. Whether it’s Zebra quietly compressing for a rerate, or Berkshire recalibrating for a post-Buffett reality — the smart money isn’t waiting for perfect conditions. It’s positioning into mispriced fear and uncomfortable change. This week is exactly the kind of environment where those who hesitate get priced out — and those who move early write the next chapter.

🧠 What did you think of today's newsletter?

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.