🌞Good Monday Morning, Folks!

They say value investing is dead. Then Berkshire drops 10%… and everyone acts surprised.

No headlines. No scandal. Just one of the world’s most boringly powerful companies losing $120 billion in market cap like it tripped over its own shoelaces. And Wall Street? Shrugged. Meanwhile, the same investors who couldn’t stop screaming about Nvidia at $1200 are now suddenly silent when real opportunity quietly shows up wearing khakis and holding a railroad.

This market isn’t about what’s happening—it’s about what people choose to care about. AI gets headlines. Hype gets multiples. But cash flow? That gets ignored. And this week, if you’re not watching where Buffett’s empire is sitting and how investors are misreading the silence… you’re going to miss the only part of the market where the edge still exists.

Today’s One Big Idea isn’t about tech melt-ups or the next bubble—it’s about what happens when smart capital stops moving with the crowd… and starts playing the long game again.

⚡ Quick Hits

🧠 Buffett Is Quietly Repositioning — Are You Even Watching?

While the market obsesses over AI and chips, Buffett’s been trimming Apple, stacking cash, and quietly reallocating into banks, housing, and even oil again. If you think this is just "old-school value investing," you’re missing the bigger signal: capital discipline is back—and when Buffett preps for volatility, smart money listens. This isn’t about following him—it’s about understanding why he’s moving before the headlines catch up.

🤖 Zuckerberg's AI Bet Is Burning Billions — and Wall Street’s Patience

Zuck has already torched over $50 billion chasing AI—and the pressure to justify it is boiling over. Investors are finally asking if Meta is building breakthrough products… or just building burn. The AI war is narrowing from hype to real winners—and Meta’s earnings next quarter might decide if this pivot is genius or delusion. If you're exposed to Big Tech, this is a must-watch inflection.

🌏 Japan’s Rare Earths Strategy Just Made China Look Fragile

While the U.S. scrambles to secure rare earth supply chains, Japan quietly built a mineral backdoor that could shift geopolitical leverage in clean energy and defense. This isn’t just about materials—it’s about who controls the next decade of manufacturing and tech. Miss this, and you’re blind to one of the most asymmetric global power plays developing right now.

Trading That Deliver REAL Profits—Don’t Be the One Who Misses Out Again

Now, the Mid-Year Rush is here. No fluff, no hype—just the raw strategy that’s turning new traders into winners fast.

Here’s what you’ll unlock inside:

✅ You get real-time answers

✅ You practice with guidance

✅ You stay focused (no YouTube rabbit holes)

10 July, 8AM EDT. One shot, limited spots.

Last class sold out! Don’t wait for “someday.”

💡One Big Idea: Berkshire Slid 10% — Here’s Why This Isn’t a Breakdown, It’s a Buyable Stress Test

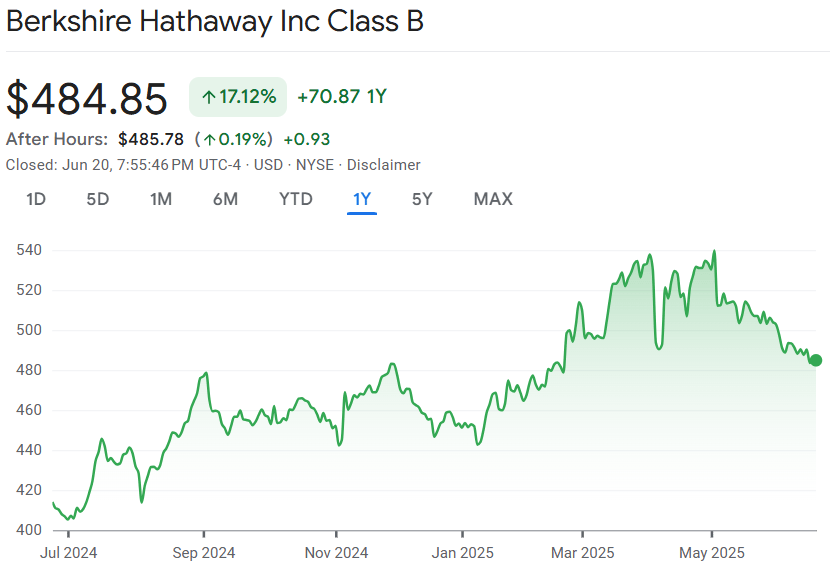

Everyone’s talking about Nvidia’s next moonshot. Meanwhile, Berkshire Hathaway slipped 10.5% from its May 2 high, landing at $485 today—and most investors just turned the page. But if you think that slide signals breakdown, you’re not thinking like an investor. You’re thinking like a trader chasing headlines. Here’s my premise: In a hype-driven market, quiet weakness in quality firms like Berkshire is often the exact contrarian setup serious capital should hunt.

📉 From $542 to $485 — Why the Panic Is More Perceived Than Real

Let me walk you through the move:

May 2: BRK.B peaks at $542—a record high.

May 3: A sharp 6–7% drop when Buffett confirms he’ll step down as CEO by end of 2025 and Q1 results disappoint — this was headline-driven, not fundamentals-driven.

Mid-May to Early June: A slow bleed into the $500s as the market shifts toward AI and growth.

Last Two Weeks: A manageable 2.5% dip—overblown as a crisis.

Overall, that brings it to a 10.5% retreat—but wrapped in noise, not structural failure. That matters, because perception drives emotion, and emotion drives bad decisions. Your task? Look past the chatter. Analyze the reasons. Size your opportunity.

💼 Business as Usual — And That’s the Best Kind of Noise

Here’s what the Q1 data actually shows:

BNSF Railway: Operating income rose 6% YoY to $1.21 B—volume is stable, and margins are steady.

Berkshire Hathaway Energy: Operating income surged 53% to $1.1 B—post-litigation tailwinds and utility demand remain solid.

GEICO: Underwriting profits increased 13%—insurance has its swings, but the trend is intact.

Operating earnings dropped 14% due to wildfire claims and FX losses—not a sign of broken business.

Translation? Nothing in the core business is collapsing. These are "boring machines"—predictable, cash-generating engines quietly working behind the scenes. They don’t dazzle headlines—but they pay the bills.

🧓 Succession & Sentiment — Why One Announcement Shifted The Narrative

There’s a psychological weight to Buffett’s succession announcement that goes beyond the facts.

Public reaction: Buffeted by fear, some investors asked, “Can Berkshire still perform without Warren?”

Reality check: Greg Abel has been a teammate for years—he’s stewarded many of Berkshire’s non-insurance operations since 2018.

What this means: Leadership moved from headline risk to operational continuity. If fundamentals remain unchanged, why the rout? Because emotion-driven markets tend to sell first, ask questions later.

💰 Cash Hoard — Not Dead Money, But Strategic Firepower

Here’s what most people miss:

Berkshire holds $347.7 B in cash and short-term Treasuries—earning ~4% yield while the rest of Wall Street chases growth.

That’s not inaction. That’s optionality on steroids.

When markets slow, Buffett historically pounces: 2008 banks, 1974 conglomerates—this is the playbook.

Buffett froze buybacks because shares exceeded 120% of book—now that they’re closer to 110–115%, that optionality is becoming actionable again.

Don’t see that as a drag. See that as available ammunition.

🛑 Value vs. Noise — What the Market Is Telling You

Markets aren’t always rational, but they’re rarely random.

Anchoring: Investors fixate on the $542 high—see $485 as broken, not discounted.

Loss aversion: A perceived 10% decline hurts twice as much as the satisfaction from a 10% gain.

Herd bias: When headlines scream, “Buffett’s empire is crumbling,” many tune in—only to regret when it recovers.

Contrast bias: AI stocks dominate the news cycle, making anything slower look obsolete—until those fundamentals still produce real cash.

When the noise surges, value stands still. That stillness is a feature, not a bug.

🏷 What I’m Watching — No Hype, Just Metrics

If you’re serious about treating this like a strategist, watch for:

Buyback signals

Will Berkshire resume shares repurchases if BRK.B falls below 120% of book value? Previous behavior suggests yes.

Greg Abel’s commentary

Listen for language around capital deployment, valuation, and risk in Q2 calls or shareholder remarks.

Operational trends

Q2 updates from BNSF, GEICO, and BHE—anything improving margins, volume, pricing, or risk helps the thesis.

These aren’t timing triggers; they’re situational awareness checks. If all coincide—still noise. If some skew NASA‑level discounts? That’s actionable intelligence.

🔍 Historic Precedents — When Buffett’s Calm Created Wealth

Let’s flash back:

2008: Goldman Sachs — Buffett wrote a $5 B guarantee at $115. Most investors called it reckless. A couple of years later, that stake was worth $15 B.

1974: Conglomerate downturn — Buffett picked up paper assets at rock-bottom valuations. Many missed it.

Today: The world is chasing metaverse chips. Berkshire is quietly hoarding power behind the scenes. Meanwhile, fewer people notice—or dare to believe.

Buffett’s approach hasn’t changed. The market’s collective attention has. That creates asymmetry—and it’s exactly where edge lives.

🪞 What This Says About You

Berkshire isn’t just a stock—it’s a mirror.

If you panic at a 10% dip—even in a fortress—you’re trading emotion, not strategy.

If you sit on your hands when value surfaces, you’re reacting to headlines, not analysis.

If you wait for confirmation from consensus, you’re not hiring conviction—you’re outsourcing it.

This is the test. When fundamentals stay intact, price dips, and you hesitate—you’re revealing your approach: FOMO? Herd? Or edge?

💡 What You Might Consider — Strategically Speaking

I’m not here to tell you what to do with your money. But this drop gives you a choice:

Build conviction: Watch fundamentals and edge indicators—not just price action.

Set objective thresholds: Decide in advance what drawdown you can tolerate and if you’ll scale in at 5%, 10%, or more. This preempts emotional bias.

Monitor with urgency—but don’t rush: If Berkshire resumes buybacks or Abel hints at deployment, that’s a green light to act on your rules, not his narrative.

Reflect on your investment philosophy: Are you chasing noise or harvesting value?

The best opportunities are often spelled "s-l-o-w"—but they’re profitable if you’re disciplined.

💥 Missed Last Friday’s Breakdown?

We unpacked Lululemon’s 50% drop—a move most investors called broken. I showed why, strategically, it might be the opposite.

If you skipped it, you’re already missing out.

TOGETHER WITH OUR PARTNER

Take the bite out of rising vet costs with pet insurance

Veterinarians across the country have reported pressure from corporate managers to prioritize profit. This incentivized higher patient turnover, increased testing, and upselling services. Pet insurance could help you offset some of these rising costs, with some providing up to 90% reimbursement.

🧠 Final Thought

When a stock like Berkshire drops 10%, most investors instinctively ask, “What went wrong?” But over the years, I’ve learned to ask something different: What is the market trying to make me feel—and how do I protect my judgment from it? Because sometimes, the market doesn’t whisper logic—it screams emotion. And those who chase every scream rarely find signal. Berkshire’s recent slide isn’t a flaw in the business—it’s a feature of how conviction gets tested when nothing flashy is happening.

The irony is, these quieter moments often matter more than the loud ones. Not because they demand action, but because they reveal your wiring. Are you calibrated for headlines, or for patience? Can you spot resilience without needing a catalyst? For me, the edge doesn’t come from finding the next big thing. It comes from recognizing when something enduring is momentarily misunderstood—and choosing to act with clarity, not noise.

🧠 What did you think of today's newsletter?

— AK

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.