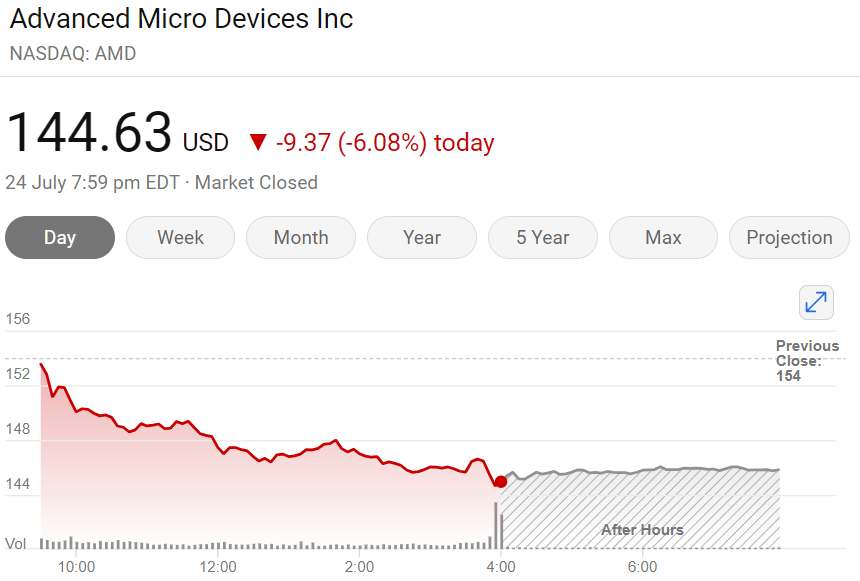

Hold onto your hats, folks! The technology-heavy Nasdaq 100 just posted its biggest weekly drop since April, triggering a market shake-up that’s left investors reeling. And guess who’s caught in the storm? AMD. The stock took a staggering 6.08% nosedive in a single day! Yes, you read that right—6.08%! The booming semiconductor sector, once the darling of Wall Street, hasn’t emerged unscathed. Nvidia might be leading the pack, but AMD isn't far behind in this dramatic plunge. So, what does this all mean? Is AMD still a worthy investment, or are we staring at the beginning of a major downturn? Buckle up as we unravel the chaos and assess whether this dip is a golden opportunity or a warning sign.

Recent Performance and Market Context

The past week has been a rollercoaster for Big Tech. Last week, the Nasdaq 100 recorded its largest weekly drop since April, falling by 4.5%. This decline was driven by a market rotation from mega-cap tech stocks to smaller-cap names, a trend known as "The Great Rotation." As a result, small-cap stocks, represented by the Russell 2000 index, climbed by 9.3% in the last one month.

The semiconductor sector, led by Nvidia's meteoric rise, wasn't spared. On July 17, the PHLX Semiconductor Index fell almost 7%, marking its largest one-day drop since 2020. This decline continued in the following days, with major chip stocks like AMD taking a significant hit. Over the past week, AMD's stock price dipped by 16.5%, closing at $144.63 on July 24.

Fed Chairman Jerome Powell's warnings on July 11 about the potential slowdown in economic growth due to high interest rates spurred this shift in investor sentiment. The July 11 Consumer Price Index (CPI) data coming in below expectations also played a crucial role in this market rotation. Investors quickly moved from Big Tech stocks to interest-rate-sensitive stocks, which are often more leveraged and financed with floating-rate debt.

Key Factors Influencing AMD's Stock

1. AI and Semiconductor Demand

AMD's role in the AI and semiconductor markets is pivotal. The company’s processors are integral to various high-demand sectors, including gaming, blockchain, and AI applications.

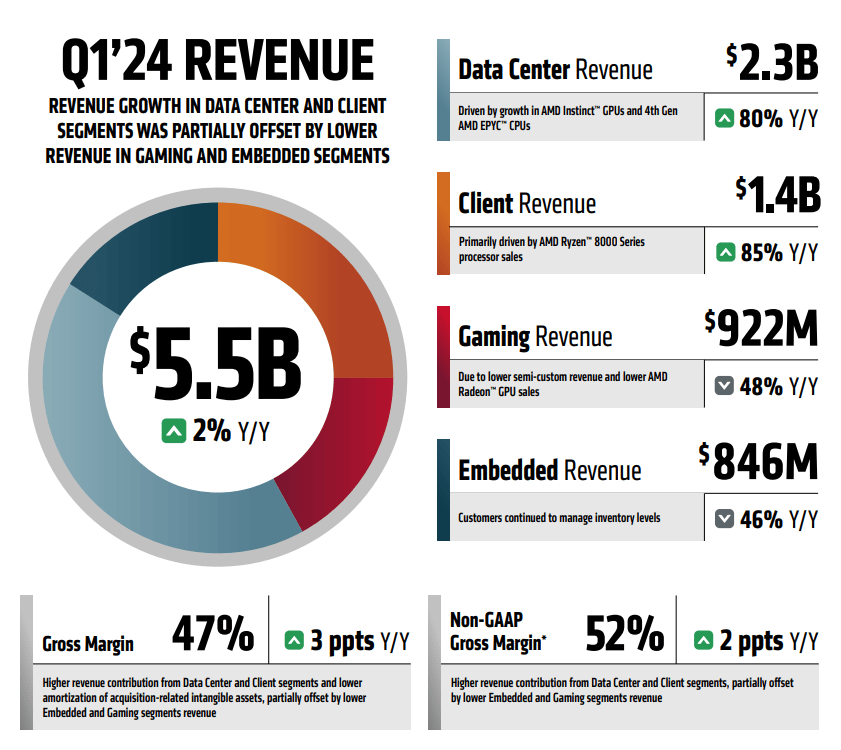

AMD, in particular, continues to show strong financial health. In Q1 2024, AMD reported revenues of $5.5 billion, a 2% increase from the previous year. The company achieved a gross margin of 47% on a GAAP basis and 52% on a non-GAAP basis. Operating income was $36 million, and net income reached $123 million. On a non-GAAP basis, operating income was $1.1 billion, and net income was $1.0 billion, with diluted earnings per share of $0.62. With AI technology driving demand for significantly more computing power, AMD’s strategic position in this market is a substantial growth driver.

The semiconductor industry itself is expected to grow, fueled by the increasing need for advanced chips. According to SEMI, the global semiconductor equipment market is projected to hit $100 billion by 2025, with AI and 5G technologies being major catalysts. AMD's innovations, such as the recently announced "Zen 5" Ryzen processors and expanded EPYC CPU portfolio, position it well to capitalize on these trends.

2. Competition with Nvidia

Nvidia is a formidable competitor, often leading market trends in the semiconductor space. However, AMD has carved out its niche with competitive pricing and innovative technologies. The rivalry has spurred both companies to push the boundaries of chip performance and efficiency.

AMD's MI300 chip, forecasted to generate over $4 billion in sales this year, exemplifies its competitive edge. Additionally, AMD's strategic acquisition of Xilinx has expanded its capabilities in adaptive computing, bolstering its position against Nvidia. Analysts like Harsh Kumar from Piper Sandler highlight AMD as a preferred large-cap semiconductor for the latter half of the year, emphasizing the company's robust product lineup and growth potential.

3. Investor Sentiment and Market Trends

The recent drop in AMD’s stock is largely a reflection of broader market trends rather than company-specific issues. The "Great Rotation" has seen investors pivot from Big Tech to smaller-cap, interest-rate-sensitive stocks. Despite this, the long-term fundamentals of the tech sector remain strong.

FactSet projects a 15% yearly increase in profit growth for the tech segment of the S&P 500 over the next two years. This growth is underpinned by rising AI and tech needs, which are areas where AMD is heavily invested. Chris Harvey of Wells Fargo asserts that the fundamentals do not support a sustained rotation away from tech, reinforcing the view that the recent sell-off may be temporary.

Active fund managers also show strong interest in AMD, ranking it as the third most held stock in the semiconductor industry. This reflects confidence in AMD’s long-term prospects, despite the current market volatility. With a consensus average 12-month price target of $194.97, indicating a 34% potential rise, investor sentiment towards AMD remains bullish.

Conclusion: Buy, Hold, or Sell?

AMD has experienced significant volatility recently, but this doesn't necessarily spell trouble. The company's strong financial health, innovative product lineup, and strategic market positioning make it a compelling consideration for investors.

As an experienced investor, I see the recent dip in AMD's stock as a potential buying opportunity. The company's role in the AI and semiconductor markets is crucial, with its processors being integral to high-demand sectors like gaming, blockchain, and AI applications. AMD’s financial performance has been robust, with Q1 2024 revenues reaching $5.5 billion and impressive gross margins. The MI300 chip, expected to generate over $4 billion in sales this year, showcases AMD's competitive edge.

Despite short-term market volatility, the long-term fundamentals of AMD are strong. The semiconductor industry is poised for growth, driven by increasing demand for advanced technologies. AMD's strategic acquisitions, such as Xilinx, further bolster its capabilities and market position.

For those with a long-term investment horizon, AMD's potential for significant returns is promising. Analysts have set optimistic price targets, reflecting confidence in the company's future growth. Holding AMD through the current market turbulence could prove beneficial as the company continues to innovate and capture market share.

In my view, AMD remains a strong contender for any investment portfolio. The company’s strategic initiatives and market positioning provide a solid foundation for future growth, making it a buy for long-term investors looking to capitalize on the evolving tech landscape.

Found these insights valuable? Elevate your investing game by subscribing to our blog for more in-depth analysis, strategies, and market trends. Stay ahead with expert tips and refine your portfolio. Share this post with friends interested in the stock market and let's build a smarter investing community together!

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.