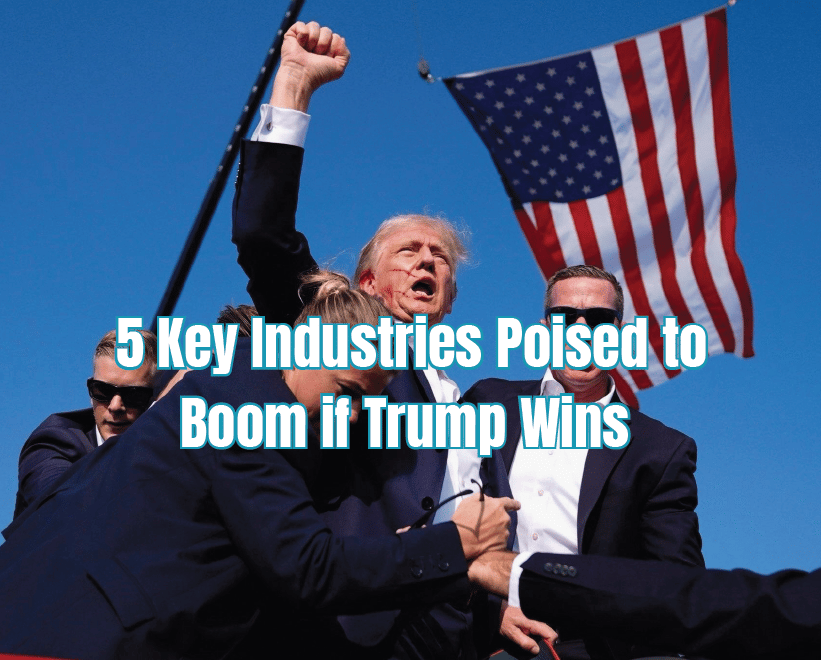

A Trump assassination attempt? Can you believe it?!

That's the shocking reality we're facing. In the ever-volatile world of politics, this recent attempt on Donald Trump’s life has thrown the upcoming election into even more chaos. We’re talking about an event that could shift the entire political landscape overnight. And let's not kid ourselves – this isn't just political theater. This is a high-stakes game that will ripple through the stock market and our economy.

In this blog post, we're diving deep into the potential fallout from this assassination attempt. What does it mean for Trump's election chances? Which industries will thrive if Trump clinches another term? We're not pulling any punches here – it's time to lay out the raw, unfiltered truth about what a Trump re-election could mean for your investments.

Election Chances: Rallying the Troops or Stirring the Pot?

The assassination attempt on Donald Trump is a seismic event that could reshape the election. On one hand, it could rally his supporters. Picture Trump, defiant and resilient, turning this into a narrative of invincibility. His base might see him as an underdog hero, fueling their enthusiasm.

But there's another side. This incident could scare undecided voters, pushing them towards a candidate who promises stability and safety. The media frenzy and rampant conspiracy theories only add to the chaos, making it harder for voters to decide.

Trump's ability to leverage this incident for political gain will be tested. He thrives on drama, and this is tailor-made for his style. His rallies could become even more charged, casting him as the last line of defense against chaos.

However, security concerns might limit his ability to hold large events, forcing a shift to virtual campaigning. Can he maintain his charismatic connection through a screen?

The assassination attempt has thrown a wrench into the electoral machinery. Whether it will rally the troops or stir the pot remains to be seen. One thing is certain: the stakes have never been higher, and the election just got a lot more unpredictable.

5 Key Industries Poised to Benefit

Let's dive into the key industries that are likely to see significant gains if Trump is re-elected. With his distinctive policy approaches, these sectors are positioned to thrive under another Trump administration.

1. Energy Sector

Trump's administration has always been a strong advocate for the fossil fuel industry. His policies favor deregulation and increased domestic production of oil and gas. A second term would likely continue these trends, boosting the fortunes of traditional energy companies.

ExxonMobil (XOM): As one of the largest oil and gas companies globally, ExxonMobil stands to benefit from policies that promote increased drilling and reduced regulatory oversight. With potential expansion in exploration and production, the company's revenue and stock prices could see substantial growth.

Chevron (CVX): Another major player in the oil industry, Chevron would similarly benefit from a pro-fossil fuel administration. Expect increased production, enhanced operational efficiencies, and potentially higher stock prices as regulatory barriers are lowered.

2. Defense and Aerospace

Trump’s administration has consistently pushed for increased defense spending. This focus on military strength and readiness means significant contracts and funding for defense contractors.

Lockheed Martin (LMT): Known for its defense systems and advanced technologies, Lockheed Martin would likely secure more contracts and see a boost in revenue. With a focus on developing next-generation defense technologies, the company could see a substantial increase in government contracts and international sales.

Raytheon Technologies (RTX): Specializing in defense and aerospace systems, Raytheon stands to gain from increased government spending on defense. Innovations in missile systems, cybersecurity, and aerospace technologies could drive growth, making Raytheon a key player in a defense-focused administration.

3. Financial Sector

Trump's deregulatory stance has been a boon for the financial sector. A second term would likely bring more of the same, reducing the regulatory burden on banks and financial institutions.

JPMorgan Chase (JPM): As one of the largest global financial services firms, JPMorgan Chase could see significant benefits from a more lenient regulatory environment. The bank could leverage this to expand its lending, investment, and wealth management services, potentially increasing profitability and market share.

Goldman Sachs (GS): A powerhouse in investment banking, Goldman Sachs would thrive with less regulatory oversight. Enhanced flexibility in trading and investment activities could lead to higher returns, making it an attractive stock for investors in a deregulatory climate.

4. Healthcare

The healthcare sector is complex, but Trump's policies often aim to reduce drug prices and alter healthcare regulations. Big pharmaceutical companies could benefit from these changes, navigating the regulatory environment to their advantage.

Pfizer (PFE): Known for its pharmaceutical innovations, Pfizer might benefit from more streamlined drug approval processes and favorable pricing regulations. Increased R&D investments and expedited market access for new drugs could drive growth and enhance shareholder value.

Johnson & Johnson (JNJ): With a diversified portfolio in healthcare, Johnson & Johnson could capitalize on regulatory shifts and changes in drug pricing policies. The company's strong presence in pharmaceuticals, medical devices, and consumer health products positions it well for sustained growth under favorable regulatory conditions.

5. Infrastructure and Construction

Trump has repeatedly promised substantial investments in infrastructure. If these promises materialize, the construction and equipment sectors would see a significant boost.

Caterpillar (CAT): As a leading manufacturer of construction and mining equipment, Caterpillar would likely see increased demand and higher sales. Government-funded infrastructure projects would drive the need for heavy machinery, boosting Caterpillar's revenues and market share.

United Rentals (URI): Specializing in equipment rentals, United Rentals would benefit from a surge in infrastructure projects, driving up its rental activity and revenue. The company's extensive fleet and strategic positioning in key markets would enable it to capitalize on increased construction activity, leading to robust financial performance.

These industries are not just poised to benefit—they're primed to explode under another Trump administration. Investors should keep a close eye on these sectors as the election unfolds, ready to capitalize on the opportunities that a Trump re-election could present. The potential for regulatory rollbacks, increased government spending, and a pro-business environment creates a fertile ground for growth in these key areas.

Conclusion

The attempt on Trump's life is more than just a headline – it's a potential game-changer for the election and the economy. Whether this event rallies his base or deters undecided voters, its impact on his election chances is undeniable. If Trump is re-elected, several key industries stand to benefit significantly. The energy sector, defense and aerospace, financial services, healthcare, and infrastructure are all poised for potential growth under his administration.

As we look to the future, consider the broader implications of this political drama. How will the market react to continued instability? Will these potential benefits outweigh the risks?

Final Thought

In these unpredictable times, staying informed and prepared is crucial. Whether you are a seasoned investor or new to the market, understanding the potential impacts of political events on your portfolio can make all the difference. Keep your eyes on the news, stay flexible in your strategies, and remember – the market favors those who are ready to adapt to change. Stay vigilant, stay informed, and stay ahead of the curve.

Found these insights valuable? Elevate your investing game by subscribing to our blog for more in-depth analysis, strategies, and market trends. Stay ahead with expert tips and refine your portfolio. Share this post with friends interested in the stock market and let's build a smarter investing community together!

Disclaimer:The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.