You want drama? Let's talk about the rollercoaster that is today's stock market. Every day, we're bombarded with headlines screaming about market crashes, inflation, and economic uncertainty. Investors are left in a state of constant anxiety, clutching their portfolios and praying for some stability. But amidst all this chaos, there's a silver lining—a hidden treasure trove of undervalued dividend stocks just waiting to be discovered. These aren't just any stocks; these are the ones that offer high dividend yields and have the potential to grow significantly over the next five years. Intrigued? You should be.

In this blog post, I'll pull back the curtain on five dividend-paying stocks that are currently flying under the radar. These stocks not only provide a juicy yield but are also poised for serious growth. If you're looking to navigate this volatile market while securing a steady income stream, these are the stocks you need to know about.

1. Altria Group, Inc. (MO)

Dividend Yield: 8.2%

Payout Ratio: 78%

Years of Dividend Payments: 52 years

Historical Performance: Altria has a long history of providing consistent dividends, with a track record of increasing payouts annually.

Altria, a leading tobacco company, offers an impressive dividend yield, making it an attractive option for income-focused investors. The stock is currently undervalued due to concerns about declining cigarette sales. However, Altria's investments in alternative products like e-cigarettes and cannabis provide potential growth avenues. The company's strong brand portfolio and pricing power support its ability to maintain high dividend payouts.

Analysts remain optimistic about Altria's future. According to Morningstar, Altria's focus on reduced-risk products and strategic investments position it well for long-term growth. Analysts at Bank of America have rated the stock as a "Buy," citing its strong cash flow and attractive valuation.

Altria's strategic shift towards reduced-risk products is noteworthy. With a significant stake in Juul and an investment in Cronos Group, a cannabis company, Altria is diversifying its revenue streams. In 2023, Altria generated $20.84 billion in net revenue, demonstrating its resilience despite regulatory challenges. The company's ability to adapt and innovate in a changing landscape ensures its continued growth and ability to provide robust dividends.

2. Pfizer Inc. (PFE)

Dividend Yield: 4.1%

Payout Ratio: 54%

Years of Dividend Payments: 34 years

Historical Performance: Pfizer has a robust history of dividend payments, with a strong track record of increasing dividends over time.

Pfizer, a leading pharmaceutical company, has garnered significant attention for its COVID-19 vaccine. Despite the stock's recent run-up, it remains undervalued compared to its peers. Pfizer's diverse product portfolio and strong pipeline of new drugs provide ample growth opportunities. The company's solid financial position and commitment to returning capital to shareholders through dividends make it a compelling choice for income-seeking investors.

Analysts are bullish on Pfizer's prospects. Goldman Sachs recently upgraded Pfizer to a "Buy," highlighting the company's strong pipeline and potential for growth in oncology and rare diseases. Analysts at Citi also view Pfizer favorably, emphasizing its robust R&D efforts and consistent dividend payouts.

Pfizer's financial performance has been impressive, with 2023 revenue reaching $81.29 billion, driven by its COVID-19 vaccine and antiviral treatments. Beyond the pandemic, Pfizer's focus on oncology, rare diseases, and immunology positions it for long-term growth. The company's robust R&D pipeline, with numerous late-stage trials, underscores its potential for future innovation and revenue generation.

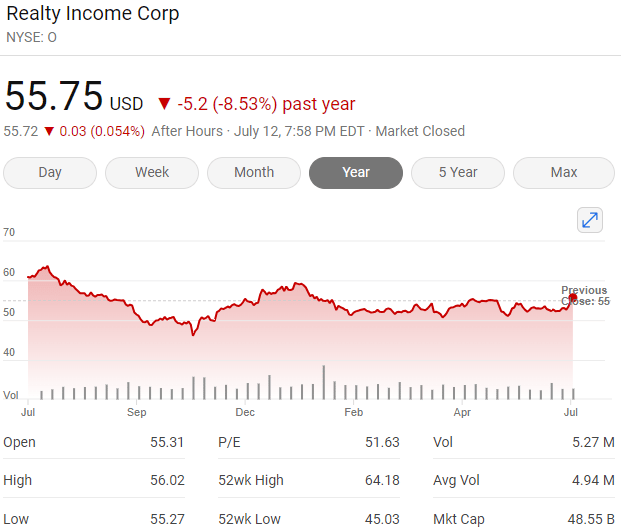

3. Realty Income Corporation (O)

Dividend Yield: 4.6%

Payout Ratio: 85%

Years of Dividend Payments: 30 years

Historical Performance: Known as "The Monthly Dividend Company," Realty Income has a long history of providing monthly dividends and has increased its dividend 110 times since its public listing in 1994.

Realty Income, a real estate investment trust (REIT), focuses on high-quality commercial properties with long-term leases. The stock is currently trading at an attractive valuation due to concerns about the impact of e-commerce on retail properties. However, Realty Income's diversified portfolio, strong tenant base, and prudent management mitigate these risks. The company's consistent cash flow and commitment to monthly dividend payments make it an excellent choice for dividend investors.

Analysts have a positive outlook on Realty Income. JP Morgan analysts rate the stock as "Overweight," citing its resilient business model and strong cash flow. Analysts at Raymond James also recommend Realty Income, noting its solid tenant base and consistent dividend increases.

In 2023, Realty Income's revenue totaled $3.22 billion, reflecting its resilient business model. The company's portfolio includes over 11,000 properties across 49 states, leased to tenants in industries ranging from retail to healthcare. Realty Income's conservative balance sheet, with a debt-to-equity ratio of 0.6, ensures financial stability and the ability to sustain its dividend payments.

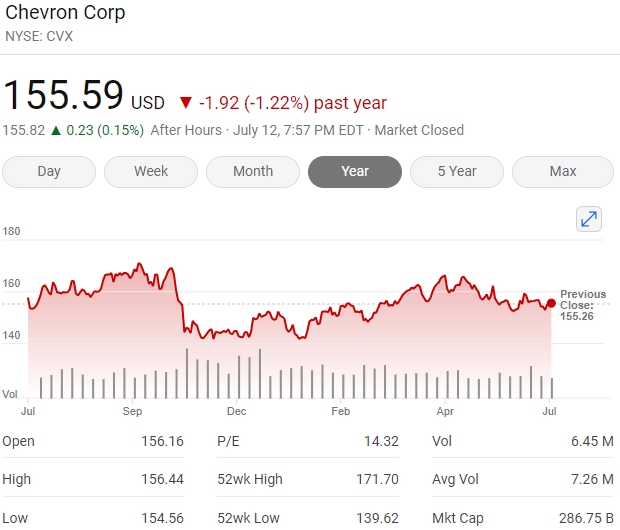

4. Chevron Corporation (CVX)

Dividend Yield: 4.9%

Payout Ratio: 61%

Years of Dividend Payments: 109 years

Historical Performance: Chevron has consistently paid dividends for decades and is known for its robust financial health and operational efficiency.

Chevron, a leading global energy company, has been undervalued due to market fluctuations in oil prices. However, Chevron's commitment to capital discipline, cost reduction, and investments in renewable energy position it well for future growth. The company's strong dividend yield and solid financials make it an attractive choice for dividend investors looking for stability and growth in the energy sector.

Analysts are optimistic about Chevron's future. Morgan Stanley analysts have an "Overweight" rating on Chevron, pointing to its strong balance sheet and strategic investments in renewable energy. Analysts at Barclays also favor Chevron, highlighting its operational efficiency and dividend reliability.

In 2023, Chevron reported revenue of $162.47 billion, benefiting from a recovery in oil prices and increased demand. The company's focus on operational efficiency and cost management has strengthened its balance sheet, with $35 billion in cash and cash equivalents. Chevron's investments in renewable energy, including hydrogen and carbon capture, demonstrate its commitment to a sustainable future and long-term growth.

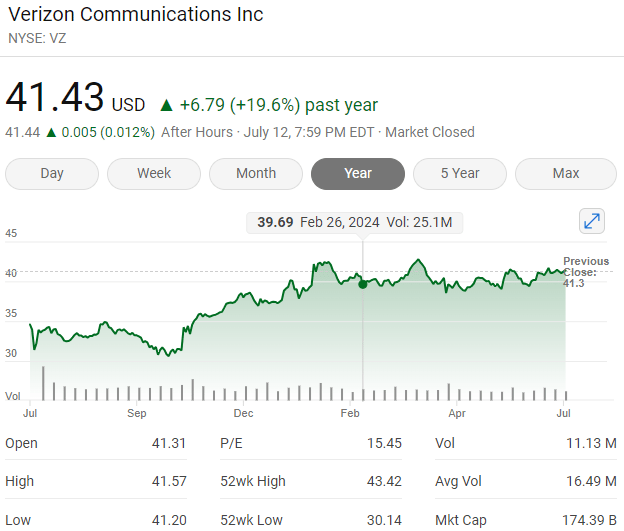

5. Verizon Communications Inc. (VZ)

Dividend Yield: 7.2%

Payout Ratio: 52%

Years of Dividend Payments: 37 years

Historical Performance: Verizon has a strong track record of paying dividends, with consistent increases over the past several years.

Verizon, a leading telecommunications company, is currently undervalued due to competitive pressures and concerns about debt levels. However, Verizon's strong cash flow, expansive 5G network, and strategic investments in digital and broadband services provide significant growth potential. The company's robust dividend yield and commitment to returning capital to shareholders make it a solid choice for income-seeking investors.

Analysts have a positive view of Verizon's prospects. Analysts at Wells Fargo rate Verizon as "Overweight," citing its leadership in 5G and strong cash flow. Analysts at Deutsche Bank also recommend Verizon, noting its robust dividend yield and growth potential in broadband services.

In 2023, Verizon generated revenue of $134.33 billion, driven by its leadership in the 5G space and strong performance in wireless services. The company's investments in expanding its 5G network and fiber broadband infrastructure are expected to drive future growth. Verizon's financial stability, with a free cash flow of $23 billion, supports its ability to maintain and grow its dividend payments.

Summary Table

Stock | Dividend Yield | Payout Ratio | Years of Dividend Payments |

|---|---|---|---|

Altria Group, Inc. (MO) | 8.2% | 78% | 52 |

Pfizer Inc. (PFE) | 4.1% | 54% | 34 |

Realty Income Corporation (O) | 4.6% | 85% | 30 |

Chevron Corporation (CVX) | 4.9% | 61% | 109 |

Verizon Communications Inc. (VZ) | 7.2% | 52% | 37 |

Conclusion

Investing in undervalued dividend stocks can provide a dual benefit of capital appreciation and steady income. The five stocks highlighted above offer high dividend yields and have strong growth potential over the next five years. By carefully selecting dividend-paying stocks that are currently undervalued, investors can build a resilient portfolio that generates income and appreciates in value over time.

Investing in undervalued dividend stocks can offer both capital appreciation and steady income, especially in a volatile market. The five stocks highlighted above—Altria Group, Pfizer, Realty Income, Chevron, and Verizon—present high dividend yields and strong growth potential over the next five years. By carefully selecting these dividend-paying stocks, investors can build a resilient portfolio that generates income and appreciates in value.

Final Thought

As we navigate through market uncertainties, remember that opportunities often lie in the overlooked and undervalued. These high-yield dividend stocks offer a chance to balance growth and income in your portfolio. Take a closer look, stay informed, and make strategic choices to secure your financial future. What other hidden gems might you uncover in your investment journey?

Found these insights valuable? Elevate your investing game by subscribing to our blog for more in-depth analysis, strategies, and market trends. Stay ahead with expert tips and refine your portfolio. Share this post with friends interested in the stock market and let's build a smarter investing community together!

Disclaimer: The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.