Did you know that holding onto certain high-flying stocks might just be the financial equivalent of sitting on a powder keg? Yes, I’m talking about the market’s darlings—those stocks everyone raves about, that have valuations reaching dizzying heights. Tesla, NVIDIA, and Shopify might seem like they are on an unstoppable upward trajectory, but their current valuations are bordering on the absurd. If you’re clinging to these stocks, hoping for endless growth, it’s time for a reality check. Let’s dive into why you should consider selling these overvalued giants now, but keep them on your radar for potential future gains.

In this blog post, we will delve into the latest financial performances of Tesla, NVIDIA, and Shopify, discuss why these stocks are overvalued, and explore why they should remain on your watchlist for potential re-entry points in 2024. Despite their impressive growth and market leadership, their current valuations suggest that they might be teetering on the edge of a significant correction. Get ready for a deep dive into the drama of the stock market’s most hyped companies.

1. Tesla, Inc. (TSLA)

Let’s dive into Tesla, the superstar of the EV world. Elon Musk’s antics and ambitious plans have kept Tesla in the headlines, but have you checked the stock’s valuation? Tesla is trading at a P/E ratio of 65.45. While this may not seem alarmingly high for tech companies, it is significantly higher than traditional automakers. This elevated ratio reflects investor confidence in Tesla's growth prospects but also implies that Tesla must deliver flawless execution on its grand visions, which is a risky assumption.

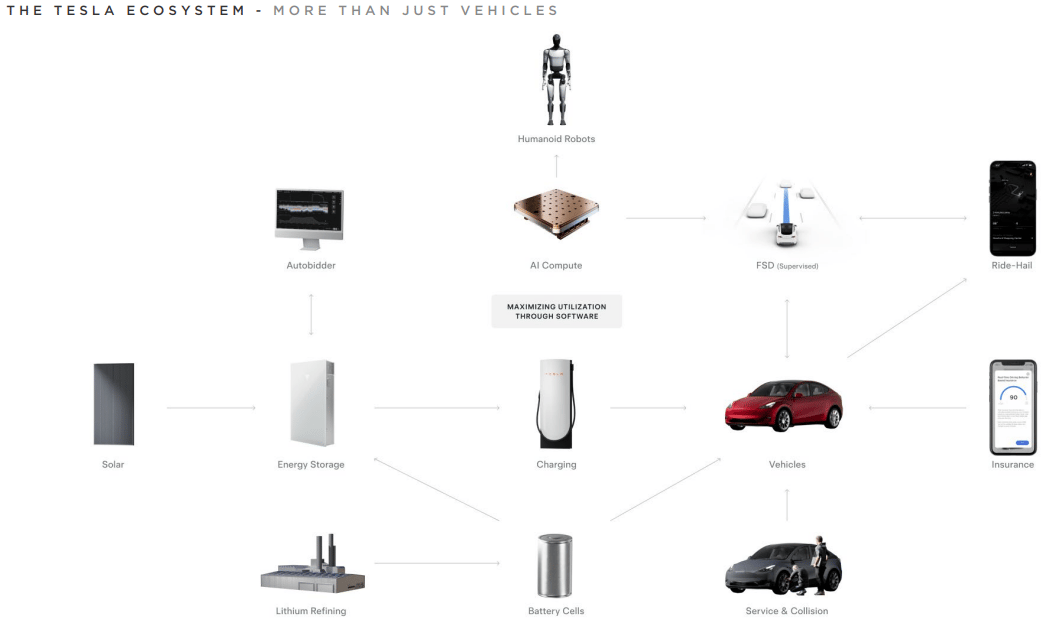

Tesla operates at the intersection of automotive and technology sectors, justifying its higher P/E ratio. Investors are betting not just on its current market position but on its future potential to revolutionize transportation and energy.

Recent Financial Performance:

Revenue: $23.33 billion in Q1 2024, reflecting a 24% increase year-over-year

Net Income: $2.51 billion, representing a 10.8% net profit margin

EPS: $1.25, compared to $0.95 in Q1 2023

Free Cash Flow: $3.11 billion, indicating strong cash generation

Operational Highlights:

Vehicle Deliveries: Tesla delivered 387,000 vehicles in Q1 2024, up from 310,000 vehicles in Q1 2023.

Energy Generation and Storage: Revenue from this segment grew by 55% year-over-year, driven by increased deployments of Megapack and Powerwall products.

Autonomous Driving: Tesla continues to make significant strides with its Full Self-Driving (FSD) software, aiming for wide release by the end of 2024.

Why Keep Watching?

Don’t get me wrong—Tesla remains a trailblazer in the electric vehicle and renewable energy sectors. The upcoming Cybertruck, continued expansion of the Model Y production, and advancements in autonomous driving technology position Tesla well for future growth. But let’s be real: the current valuation is high and leaves little room for error. If the stock corrects to more reasonable levels, it could be a golden opportunity for long-term investors. Keep Tesla on your watchlist because a more rational valuation might make this stock an attractive buy once again.

With Tesla’s innovative edge and market leadership, it’s a stock to keep in sight, even if it’s time to cash out for now.

2. NVIDIA Corporation (NVDA)

NVIDIA has been riding high on the wave of AI and gaming innovation, capturing the market’s imagination. But let’s hit the brakes for a moment. NVIDIA's P/E ratio currently stands at 73.04. This elevated valuation reflects the market's optimism about NVIDIA's growth prospects but also suggests that the stock is priced for perfection, leaving little room for any missteps.

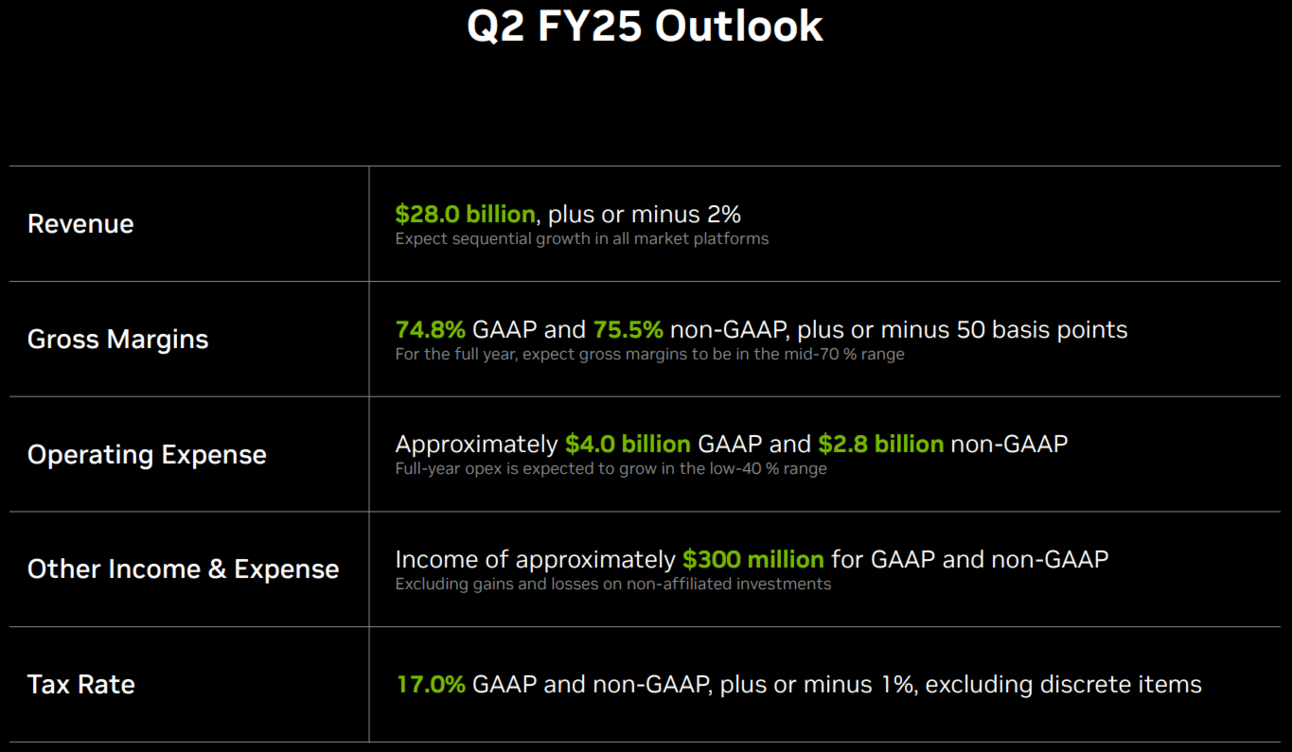

Recent Financial Performance:

Revenue: $26.04 billion in Q1 2025, a significant increase of 18% from Q4 2024 and a remarkable 262% increase year-over-year

Net Income: $14.88 billion, reflecting a robust net profit margin of 57.1%

EPS: $5.98, compared to $0.82 in Q1 2024

Free Cash Flow: NVIDIA generated substantial free cash flow, showcasing its strong cash generation capabilities

Operational Highlights:

Data Center Revenue: Record revenue of $22.6 billion, up 23% from Q4 2024 and 427% year-over-year, driven by high demand for AI and cloud computing solutions.

Gaming Revenue: $2.6 billion, down 8% from the previous quarter but up 18% year-over-year, bolstered by the launch of new GeForce RTX GPUs and AI gaming technologies.

Professional Visualization: Revenue of $427 million, down 8% from Q4 2024 but up 45% year-over-year, indicating growth in AI-enhanced workflows and new GPU launches.

Automotive Revenue: $329 million, up 17% from the previous quarter and 11% year-over-year, driven by increased adoption of NVIDIA DRIVE platforms in new vehicle models.

Why Keep Watching?

Source: Nvidia Investor Presentation Q1 FY25

NVIDIA’s dominance in AI, machine learning, and gaming graphics ensures it remains a pivotal player in the tech sector. Their cutting-edge Hopper GPU architecture and strategic partnerships position NVIDIA for continued success. However, the current valuation leaves no room for error, making it a risky hold at best.

However, if the market corrects, NVIDIA could transform from an overpriced stock into a golden investment opportunity. Its technological edge and market leadership are undeniable, making it a stock to keep on your watchlist. When the valuation aligns more closely with its earnings, NVIDIA could be a fantastic buy for long-term growth.

Stay alert for any significant pullbacks in NVIDIA’s stock price, as these might present ideal entry points to capitalize on its promising future.

3. Shopify Inc. (SHOP)

Shopify has been a transformative force in the e-commerce space, enabling millions of businesses worldwide. However, its valuation remains steep. As of the latest data, Shopify's P/E ratio stands at 73.04. This elevated valuation, similar to other high-growth tech companies, implies that the market has high expectations for Shopify’s future performance. Such a high valuation can be risky, especially if the company faces any operational setbacks.

Recent Financial Performance:

Revenue: $1.861 billion in Q1 2024, up from $1.508 billion in Q1 2023, reflecting a 23% increase year-over-year

Net Income: Shopify reported a net loss of $273 million for Q1 2024, compared to a net income of $68 million in Q1 2023. This significant swing is attributed to increased operating expenses and other non-operational losses

EPS: The company reported an EPS of -$0.21, compared to $0.05 in Q1 2023

Free Cash Flow: Shopify has maintained a double-digit free cash flow margin for three consecutive quarters, highlighting its strong cash generation capabilities

Operational Highlights:

Subscription Solutions Revenue: Increased to $511 million in Q1 2024 from $382 million in Q1 2023, driven by growth across all subscription plans.

Merchant Solutions Revenue: Increased to $1.350 billion in Q1 2024 from $1.126 billion in Q1 2023, bolstered by higher gross merchandise volume and merchant adoption of Shopify Payments and other services.

Gross Profit: Improved to $957 million in Q1 2024, up from $717 million in Q1 2023, demonstrating effective cost management and operational efficiency.

Why Keep Watching?

Shopify’s continuous innovation and expansion in e-commerce solutions make it a compelling company to watch. Despite its current high valuation, the company’s potential for future growth remains significant. Key drivers include:

Expansion of Services: Shopify continues to innovate with new features and services, such as Shopify Plus and Shopify Payments, which are gaining traction among larger enterprises and smaller merchants alike.

Global Reach: With a presence in over 175 countries, Shopify’s global reach provides a vast market for growth.

Technological Advancements: The company’s investments in AI and other advanced technologies position it well to capitalize on future trends in e-commerce.

If the stock experiences a correction and the valuation becomes more reasonable, Shopify could present an attractive investment opportunity. Its strong market position, robust financial performance, and continued innovation make it a stock to keep on your watchlist.

Conclusion

In summary, Tesla, NVIDIA, and Shopify are currently riding high on waves of innovation and investor enthusiasm, resulting in significantly elevated valuations. While their growth stories are compelling, their current stock prices leave little room for error, making them risky holdings at these levels. However, their potential for continued innovation and market leadership makes them worthy of staying on your watchlist.

Tesla: With its ambitious plans in the EV and renewable energy sectors, Tesla's future looks promising, but the high valuation means that any missteps could lead to substantial corrections.

NVIDIA: Dominating the AI and gaming industries, NVIDIA's technological edge is undeniable. Yet, its elevated P/E ratio suggests that the stock is priced for perfection.

Shopify: As a transformative force in e-commerce, Shopify’s growth potential is significant, but its steep valuation poses risks, especially if the company faces operational challenges.

Balancing these perspectives, it's crucial to recognize that while selling these stocks might be prudent now, their long-term growth prospects remain strong. A market correction could present ideal entry points for investors looking to capitalize on their innovative trajectories.

Final Thought

As investors, it's essential to stay informed and adaptable. The stock market's dynamic nature means that today's high flyers can become tomorrow's buying opportunities. Keep a close eye on Tesla, NVIDIA, and Shopify, and be ready to act when the valuations align more closely with their fundamental strengths. Remember, successful investing is not just about riding the highs but also about recognizing and seizing opportunities when the market presents them. So, are you prepared to make the most of the next market correction?

Found these insights valuable? Elevate your investing game by subscribing to our blog for more in-depth analysis, strategies, and market trends. Stay ahead with expert tips and refine your portfolio. Share this post with friends interested in the stock market and let's build a smarter investing community together!

Disclaimer:The content on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views expressed here are solely those of the author and do not represent any company or organization. Readers should conduct their own research and due diligence before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.